Yesterday’s US consumer inflation data for June surprised analysts with a hotter-than-expected report. The news has convinced the market that the Federal Reserve will ramp up the pace of rate hikes to a 100-basis-point increase at the July 27 FOMC meeting. Peak inflation, it seems, remains elusive as ever. Perhaps, but there are still some hints that turning point is near. The question is how much weight to assign to these relatively encouraging hints?

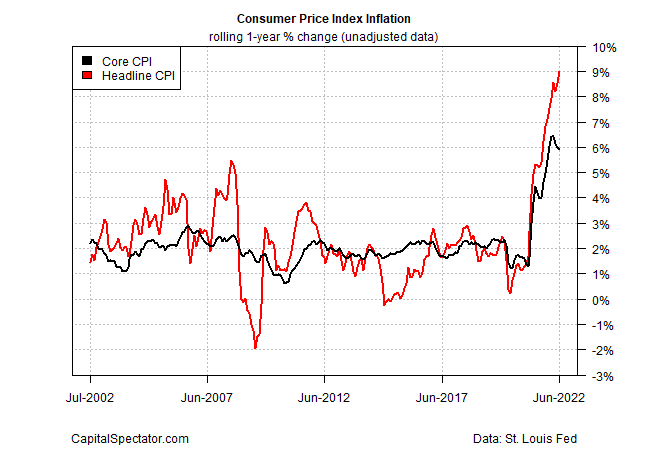

Let’s start with the latest source of angst: headline consumer prices at the headline level set a new 40-year high via a 9.1% year-over-year increase through last month. The good news, such as it is: the core reading of CPI (which strips out food and energy) eased to 5.9%, a six-month low.

Historically, core CPI has proven to be a more reliable estimate of future inflation vs. the headline measure, but there are caveats. First and foremost is the question of whether inflation has entered a new era and so the relationships of the past several decades no longer apply. Even if that proves to be false, core CPI was still a bit stronger than expected on a year-over-year basis (+5.9% vs. +5.8%). Much depends on how the next update compares. Another decline in core’s annual pace would certainly be encouraging.

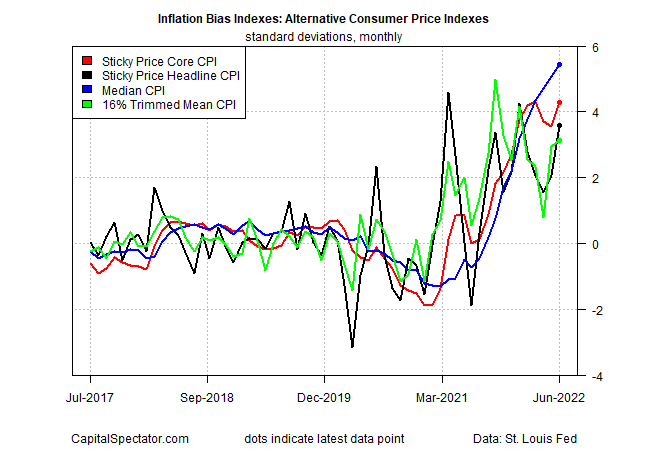

For additional perspective on how the inflation trend is evolving, let’s turn to CapitalSpectator.com’s Inflation Bias Indexes. The methodology is taking the underlying index, calculating its one-year change, taking the monthly difference and then transforming the results into standard deviations around the mean.

Running the CPI data through this filter shows that headline inflation’s bias ticked up in June for the first time since April. The rebound is modest and, for the moment, a one-month event, which may or may not turn out to be an outlier. Let’s see how or if the July report adjusts our thinking. Meanwhile, the bias for core CPI continues to drop, which suggests that the case for peak inflation isn’t dead and could be building for the second half of 2022.

The bad news is that alternative measures of inflation – measures that are arguably more robust in terms of capturing real-world inflation data – show a clear resurgence in the inflation bias. As the chart below shows, there was agreement in all four alternative CPI measures: inflation pressure rebounded in June.

The case for expecting peak inflation in the immediate future continues to look shaky, at least for the moment. The main source of optimism on this front is linked to the standard measure of core CPI. But as the alternative measures of CPI suggest, there’s still a high degree of uncertainty surrounding the veracity of the conventional measure of core CPI as a leading measure of pricing pressure.

Meanwhile, it appears that the Federal Reserve is going to err on the side of caution in its battle to tame inflation and continue raising interest rates, perhaps at a faster pace. Fed funds futures are now pricing in a roughly 85% probability for a 100-basis-point rate hike at the July 27 FOMC meeting.

The central bank appears intent on tightening policy until it’s clear that inflation has peaked. That apex still doesn’t look imminent and so rate hikes remain the likely path ahead for the foreseeable future.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report