* Biden heads to Saudi Arabia with high-stakes agenda

* Russia and Ukraine set to negotiate restart of Ukrainian grain exports

* Global oil-supply crisis appears to be easing

* Quarter of Americans say they’ll purchase an electric vehicle

* Rising housing prices expected to keep upward pressure on inflation this year

* Eurozone industrial output posts solid gain in May

* S. Korea raises interest rates by 50 basis points to fight inflation

* US 2yr/10yr Treasury yield curve stays inverted, signaling elevated recession risk:

US economic data are sending mixed signals. “I’ve been in this business a long time, and I can’t remember any period when economic numbers were telling such different stories,” writes Paul Krugman, economics professor at City University of New York. “On the other hand, we’ve never before faced the kind of shocks we’ve gone through in the past few years: Both the pandemic-induced recession and the recovery from that recession were, to use the technical term, weird, and maybe we shouldn’t be surprised the measures we normally use to track the economy aren’t working too well. My guess about what’s really happening is that the economy is indeed slowing, but probably not into a recession, at least so far.”

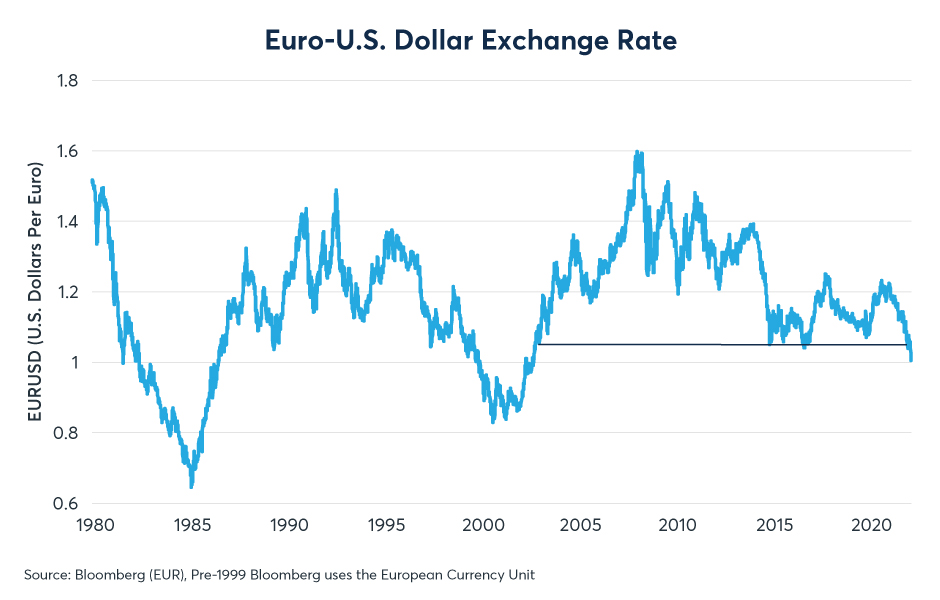

Several factors have driven the euro to a 20-year low against the US dollar, including monetary policy, writes Erik Norland at the CME Group. Trade balances, fiscal policy and “increasing tension within the eurozone debt market also appears to be weighing on the euro.”

China’s economic expansion slowed in second quarter, weakest since early 2020, according to an AFP poll of analysts. Covid lockdowns and lingering weakness in the real estate sector are cited as factors.