* Powell tells Congress Fed is “strongly committed” to fighting inflation

* Powell returns to Capitol Hill today for testimony as rates stay in focus

* European leaders set to accept Ukraine as candidate to join EU

* Eurozone growth slows to 16-month low in June as demand weakens

* Germany lifts level of alarm over Russia gas disruption

* UK growth unchanged at 15-month low in June via PMI survey data

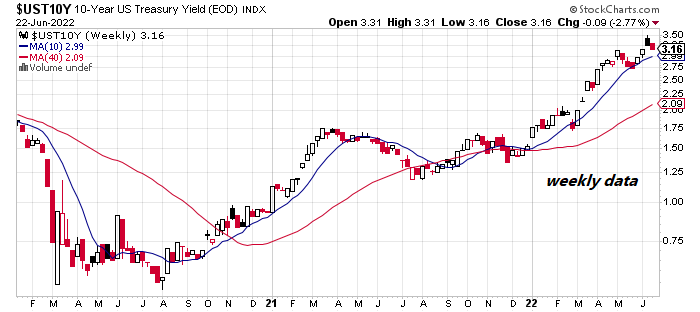

* US 10-year Treasury yield eases to 3.16%, lowest in nearly two weeks:

Economic data is becoming harder to decipher, says analyst. “There’s a lot of ambiguity right now in the economy and it’s hard to understand and parse what’s going on — never mind trying to understand what’s going to happen over the next few months,” advises Nick Bunker, economic research director at jobs website Indeed.com.

The Fed isn’t trying to trigger a recession as it combats inflation, but it’s a risk factor, says Fed Chairman Powell. “It’s not our intended outcome at all, but it’s certainly a possibility,” Mr. Powell said Wednesday during the first of two days of congressional hearings. “We are not trying to provoke and do not think we will need to provoke a recession, but we do think it’s absolutely essential” to bring down inflation, which is running at a 40-year high.

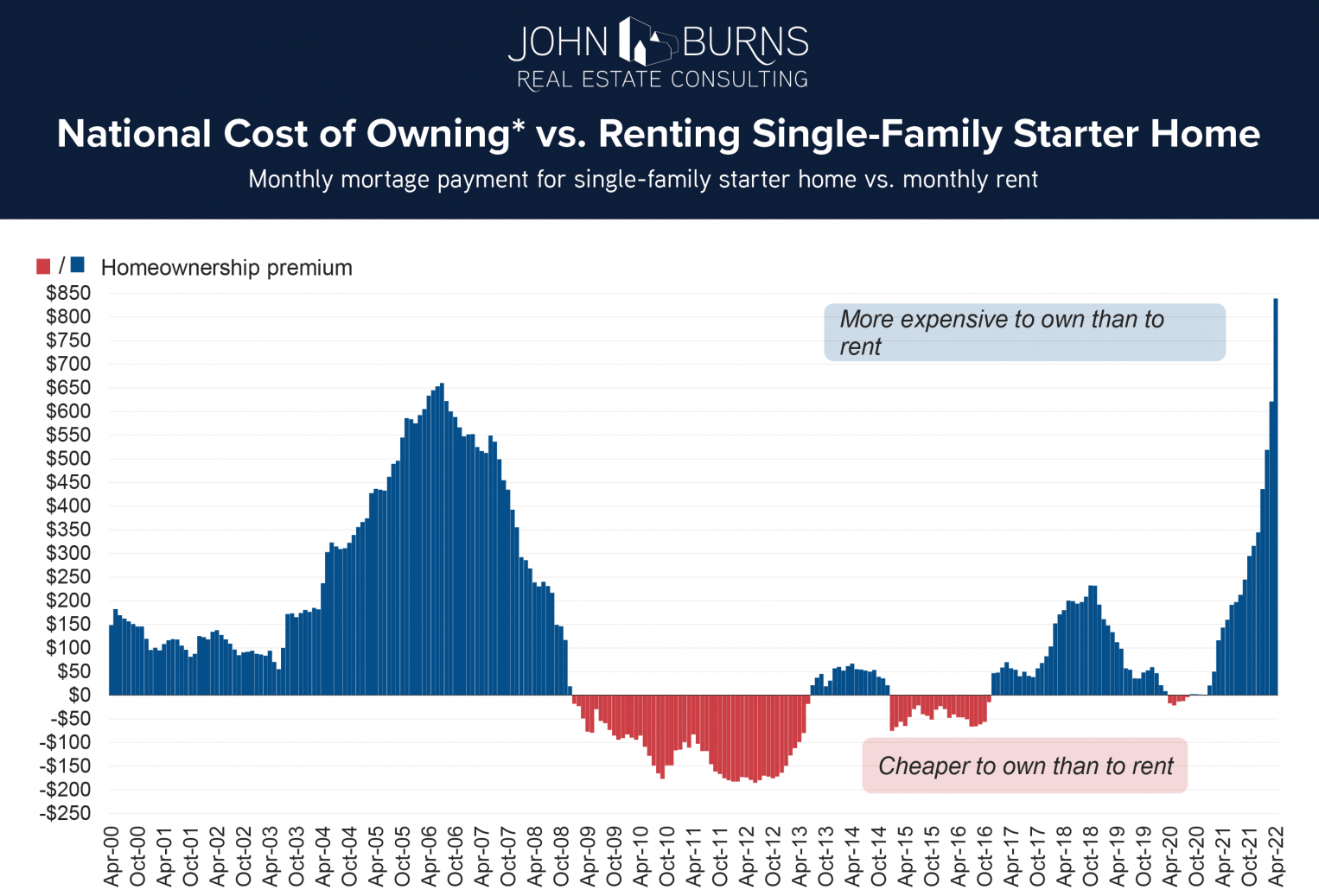

Cost of owning a home soars above price of renting, according to John Burns Real Estate Consulting. “High home prices and rapidly rising mortgage rates have created a rosy backdrop for the rental sector, with many prospective home buyers now priced out of homeownership or forced to purchase a smaller home in a less desirable area,” the firm advises in a report. “A little over a year ago, the monthly cost of owning (as we calculate it*) and renting were virtually identical. Now, owning a home costs $839 more per month than renting. This differential is almost $200 higher than at any time since the turn of the century.”

China’s housing slump shows no signs of slowing. “This is the worst property downturn on record,” says Lu Ting, chief China economist at Nomura Holdings.