The trend has turned ugly, at least for the usual suspects in the land of asset classes. The question is when will it be comparatively safe to start raising risk exposures? Unclear, but when the tide begins to turn we’ll likely see early clues in price trends via several ETF pairs.

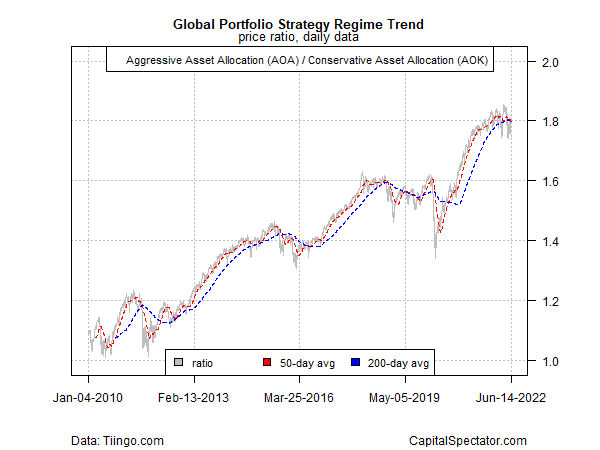

Portfolio Strategy

As a starting point, the risk-on/risk-off profile for portfolio strategy remains in a holding pattern, based on the ratio trend for an aggressive portfolio mix (AOA), the other a conservatively run allocation (AOK). It’s a bit surprising that this ratio hasn’t decisively tumbled… yet. Is that a sign that the current market correction is more light than heat? Or is this the calm before the storm?

US Stocks-US Bonds

A similar holding pattern applies to the US stock/bond ratio via SPY and BND. The explanation here is that both slices of this mix are suffering at the same time. Which side will blink first?

Inflation/Reflation

Meanwhile, the red-hot reflation/inflation trend continues to show no signs of slowing, much less reversing, via TIP/IEF.

US Treasuries

Ditto for the risk-off trend for US Treasuries, which has accelerated since CapitalSpectator.com’s previous update on this front.

Equity Risk-On/Risk-Off

One measure of US equity risk appetite confirms what’s already obvious: relative safe havens are in high demand.

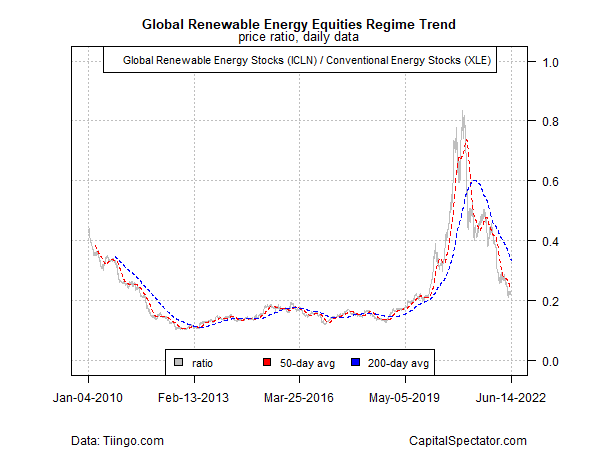

Renewable Energy Stocks

Meanwhile, the risk-off bias for renewable energy stocks persists.

Copper/Gold Ratio

Finally, the ratio for copper/gold prices – considered a leading indicator for the 10-year Treasury yield – suggests the recent run-up in rates is due to pause. That’s a contrarian view at the moment. Let’s see if this ratio continues to suggest otherwise in the weeks ahead.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno