You can’t swing a cat without hitting a commentator discussing recession risk these days. And for good reason: there’s a growing list of potential threats to the economy. But forecasting a possible contraction in the future and monitoring events in real time are two different things and there’s always ambiguity about whether the two become one and the same. Hold that thought as we consider some of the evidence that while the potential for a new recession is lurking, the numbers published to date still indicate that the expansion is very much alive and kicking.

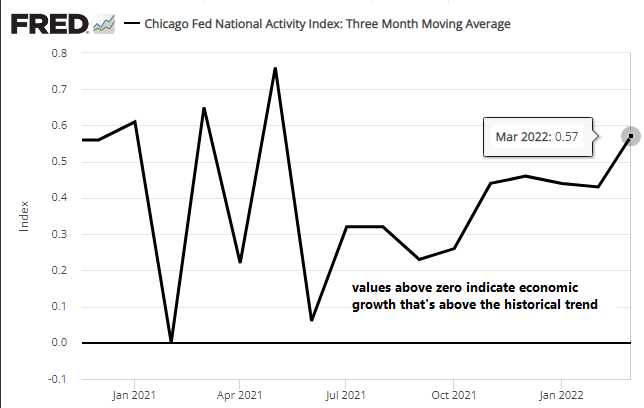

Let’s start with yesterday’s March update of the Chicago Fed National Activity Index (CFNAI), a broad measure of US economic conditions. The numbers are noisy in the short term and so there’s a case for minimizing the risk of false signals by measuring the trend on a rolling 3-month basis, which has proven to be a highly reliable proxy of the business cycle. By that standard, economic growth last month remained solid. CFNAI’s 3-month print rose to +0.57, a ten-month high. A reading above zero indicates above-average growth relative to the long-term trend. A recession reading for this indicator are values below -0.7. Translation: the risk of contraction was nil last month.

CFNAI is published with a lag and so it’s possible that economic conditions have collapsed in April to the point that the upbeat profile for March no longer applies. Maybe, but more recent indicators suggest otherwise. The New York Fed’s Weekly Economic Index (WEI) – a measure of ten indicators — through Apr. 16 continues to show a gradual slowdown in growth but at a pace that’s still far above a recession warning. Indeed, the latest WEI print equates with US GDP year-over-year growth of roughly 5% — a gain that suggests that forward momentum for the economy remains robust.

Another real-time, multi-factor business-cycle benchmark published by the Philadelphia Fed – the ADS Index — tells a similar story. Although growth has slowed over the past two months, the current rate of expansion continues to reflect above-average strength.

Every week in the US Business Cycle Risk Report I aggregate WEI and ADS for a high-frequency measure of how the broad macro trend ebbs and flow, which offers another real-time look at how the short-term economic bias is evolving. On that bias, the Macro Trend Index (MTI) still points to minimal risk for economic deterioration, based on the Apr. 16 reading of roughly zero. Only when MTI falls below -1.0 does this indicator point to elevated recession risk.

None of this should be used to dismiss the potential for a recession down the road. Indeed, the list of potential growth killers is long, including the risk of a Federal Reserve rate-hiking cycle that goes too far and ongoing blowback from the Ukraine war and higher inflation.

Meanwhile, there are many indicators to watch that may be an early warning of trouble – warnings that can precede a recession signal in the likes of CFNAI, WEI and ADS. For example, a new paper from the National Bureau of Economic Research advises that the current combination of a tight labor market and elevated inflation significantly raises the odds of a recession in the near term:

Since 1955, there has never been a quarter with price inflation above 4 percent and unemployment below 5 percent that was not followed by a recession within the next two years.

No one can dismiss such risk factors. On the other hand, a lot can happen over the next two years and so it’s short-sighted to assume that a new recession is fate in the months ahead.

The only thing we know for sure: the economy is still expanding and the odds are low that a contraction has started or is likely to start this month or in May, as detailed by revised forward estimates for the broad economic trend in the current issue of the US Business Cycle Risk Report: “Storm clouds are still gathering for the macro outlook, but US economic resilience continues to prevail.” (For a list of the indicators that comprise this analysis, see this post.)

The art and science of estimating recession risk lies in the challenge of marrying the current profile of published data with reasonable guesstimates of what may unfold in the months ahead. The main caveat: looking beyond the next couple of months is almost entirely guesswork and prone to false signals. History suggests otherwise, but don’t confuse out-of-sample analysis with the comfort and control of in-sample discovery.

That leaves us where we started: the US economy is slowing, but recession risk is still low. Yes, that can change and probably will, perhaps soon. But the main focus is still looking for reliable signals in real time for an early, reliable indication that the jig is up.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report