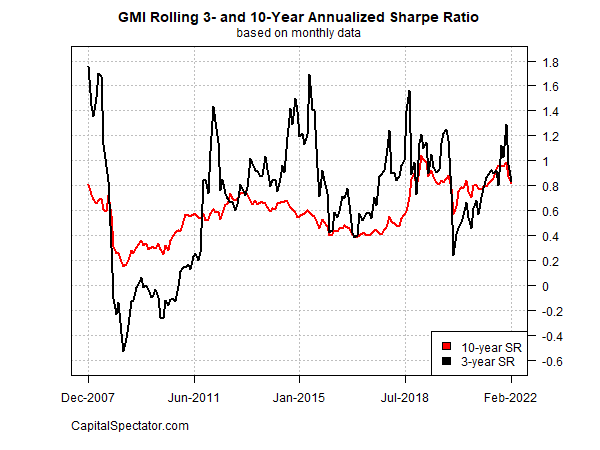

The Global Market Index’s (GMI) risk-adjusted performance continues to retreat after peaking in December, based on the trailing 3-year Sharpe ratio, a measure of return adjusted by volatility. The sharp reversal has also dragged down the 10-year rolling Sharpe ratio. Both measures fell in February to their lowest levels in nearly a year for this multi-asset-class benchmark.

As usual, there are specific factors that led to the reversal in GMI’s Sharpe ratio. But the decline isn’t unusual. Sharp spikes in risk-adjusted performance tend to reverse quickly and that playbook is alive and well in 2022.

Recall that when we reviewed the December data, the 3-year Sharpe ratio was still surging, reaching its highest level in more than four years. At the time I noted: “History suggests that upward spikes in GMI’s Sharpe ratio are quickly reversed, which implies that choppy market activity lies ahead.” That more or less describes the index’s performance so far this year.

Meanwhile, GMI’s drawdown continues to slide deeper into the red. After December’s zero reading (marking a new high), GMI’s peak-to-trough decline slumped to -6.8% last month, close to a two-year low.

GMI represents a theoretical benchmark for the “optimal” portfolio. Using standard finance theory as a guide, this portfolio is considered a preferred strategy for the average investor with an infinite time horizon. Those assumptions are, of course, unrealistic in the real world. Nonetheless, GMI is useful as a baseline to begin research on asset allocation and portfolio design. GMI’s history suggests that this benchmark’s performance is competitive with active asset-allocation strategies overall, especially after adjusting for risk, trading costs and taxes.

For additional perspective, readers can use the risk profile for GMI alongside the current monthly updates on performance and expected return for the benchmark and its components.

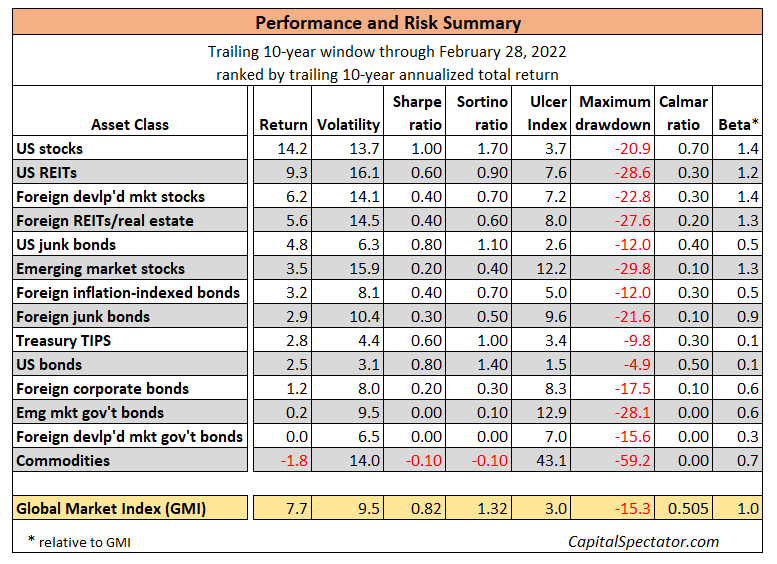

The table below presents additional risk metrics for GMI and its underlying asset classes, based on a trailing 10-year window through last month.

Here are brief definitions of each risk metric:

Volatility: annualized standard deviation of monthly return

Sharpe ratio: ratio of monthly returns/monthly volatility (risk-free rate is assumed to be zero)

Sortino ratio: excess performance of downside semivariance (assuming 0% threshold target)

Ulcer Index: duration of drawdowns by selecting negative return for each period below the previous peak or high water mark

Maximum Drawdown: the deepest peak-to-trough decline

Calmar Ratio: ratio of annualized return/maximum drawdown

Beta: measure of volatility relative to a benchmark (in this case GMI)

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno