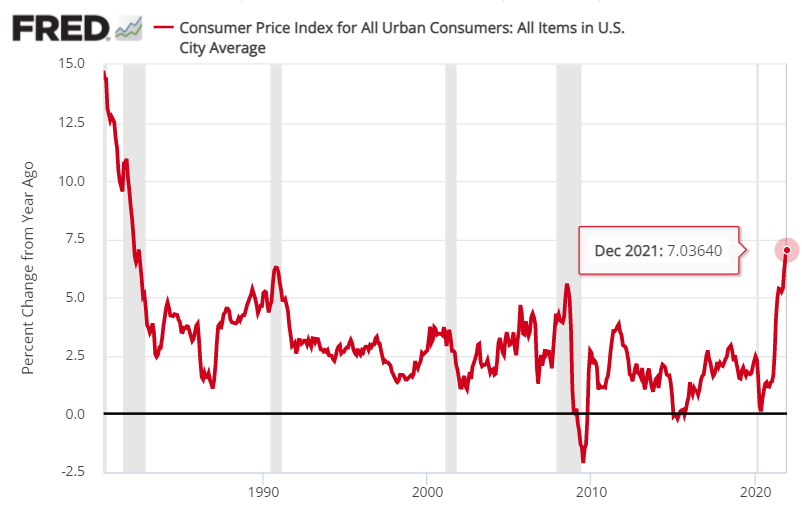

Early on in the current run of accelerating inflation there were forecasts that the increase was “transitory.” Then the outlook shifted to estimates that the peak would top out but last longer than previously expected. Now the question is whether inflation’s run higher is on track to continue?

Economists think the answer is “yes,” based on the consensus forecast for Thursday’s January report on US consumer prices (due on Feb. 10). The Consumer Price (CPI) index at the headline level is expected to edge higher in the January year-over-year estimate: 7.3% vs. 7.0% through December, based on Econoday.com’s point forecast.

Many analysts, including The Capital Spectator, have underestimated the upside persistence of pricing pressure’s run higher and a new round of misjudging the trend may be in store for Thursday. More importantly, evidence is mounting that the Federal Reserve has underestimated the shift and is now under increasing pressure to play catch-up, which comes with its own set of risks.

Mohamed El-Erian, president of Queens’ College, Cambridge, and an adviser to Allianz and Gramercy, advises that “the more the Fed in particular delays [combating inflation], the greater the risk of a summer bunching of monetary policy tightening that unduly suffocates the much needed strong, inclusive and sustainable economic recovery.”

An even bigger risk is that such policy tightening would come after inflationary expectations have been de-anchored, resulting in a twin blow — higher prices and lower income. That hits particularly hard the most vulnerable segments of the population. The damage would be amplified if pronounced market volatility spills back into the broader economy.

What is clear is that the idea that something unique to US policy is to blame is off the mark. Consider, for instance, that the Eurozone is also experiencing a run of hot inflation. Last week the currency bloc reported that inflation accelerated to an annual rate of 5.1% in January, the highest on record.

There’s fierce debate about why inflation has surged, but it’s likely that global supply-chain disruption is part of the answer, perhaps the main part. Unfortunately, relief on this front still doesn’t look imminent. As Peter Goodman reports at The New York Times, solving the Great Supply Chain Disruption:

will require investment, technology and a refashioning of the incentives at play across global business. It will take more ships, additional warehouses and an influx of truck drivers, none of which can be conjured quickly or cheaply. Many months, and perhaps years, are likely to transpire before the chaos subsides.

“It’s unlikely to happen in 2022,” said Phil Levy, chief economist at Flexport, a freight forwarding company based in San Francisco. “My crystal ball gets murky further out.”

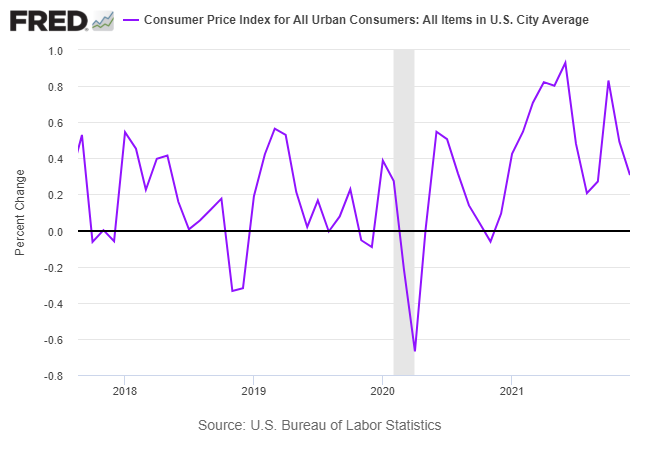

Meanwhile, there may be some econometric relief on the near-term horizon. If the monthly increases in inflation begin to ease, if only modestly, the year-over-year trend will start to peak. There are clues for thinking this may already be unfolding. Consider the headline percentage changes for CPI in recent history, which appears to be easing.

If a degree of normalization is starting to emerge, it’s reasonable that we could see a flatlining in the annual rate of inflation. The bad news: inflation running steady at or near 7% year on year is still a problem. But to the extent that the solution to inflation begins with an end to persistently higher trending behavior, such an evolution would at least be a step in the right direction.

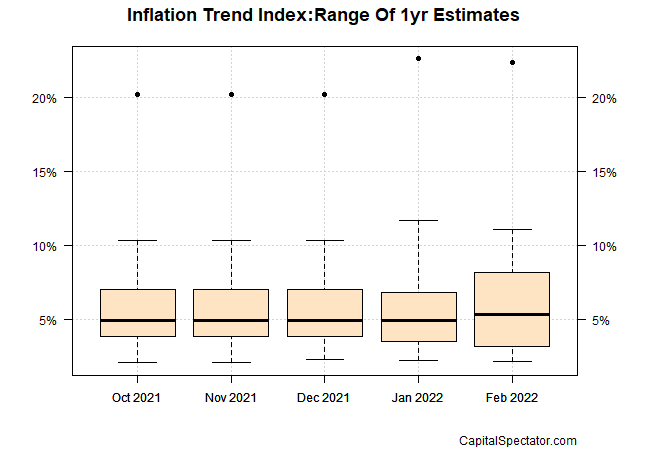

But before that happens, it appears that the trend will get hotter still. The Capital Spectator’s Inflation Trend Index is pointing to a higher median estimate for 13 indicators through this month (see this summary for details). ITI’s February median estimate edged up to 5.4% from January’s 4.9% (black line in boxes below). Note that ITI is designed as a broad measure of the pricing trend and is not intended to estimate CPI or other official inflation gauges.

Inflation’s peak may be approaching, but it still doesn’t appear imminent, but there are signs of hope for later in the year, predicts Andy Cates, senior economist at Haver Analytics. “Many of the macroeconomic drivers of asset prices in recent times are peaking and either already moving into reverse or about to move into reverse,” he said last week.

Slower US economic growth is one way to trim inflation’s sails, albeit a relatively harsh way. The question then becomes: How aggressive will Federal Reserve policy changes factor into this analysis?

Markets are pricing in a near certainty that the central bank will lift interest rates at next month’s policy meeting. The debate is whether the Fed needs to surprise the crowd with a bigger-than-expected hike, and several more later in the year.

“If I’m the Fed, I’m getting more nervous that it’s not just a few outliers” that are driving wage increases, advised Ethan Harris, Bank of America’s head of global economics research on Monday. “If I were the Fed chair … I would have raised rates early in the fall. When we get this broad-based increase and it starts making its way to wages, you’re behind the curve and you need to start moving.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report