A negative tailwind blew through most of the major asset classes, in trading last week (through Friday, Jan. 7) via a set of proxy ETFs. The main exception: commodities, which rallied in the week just passed.

WisdomTree Commodity Index (GCC) increased 1.2% last week, lifting the ETF to a level that’s close to its highest price since late-November.

A factor that’s expected to support commodities prices is recovering Asian demand for oil, predicts Platts Analytics. “Apart from China with zero-COVID policy, most countries in the region are moving toward re-opening of economies despite seeing a rise in omicron cases,” says Lim Jit Yang, advisor for Asia-Pacific oil markets at the consultancy. “Any lockdowns are likely to be localized and more targeted, with less impact on oil demand than in the past.”

The head of commodities research at Goldman Sachs sees an extended bull market brewing for raw materials overall, in part due to shortages and a global economy flooded with liquidity. “The best place to be right now, particularly given the Fed pivot [to tighter monetary policy], are commodities,” says Jeff Currie. “We think you’re going to see another year of out-performance of commodities and real assets more broadly.”

The rest of the major asset classes fell last week. The biggest decline: a sharp reversal in previously high-flying US real estate investment trusts (REITs), a property proxy. Vanguard US Real Estate (VNQ) tumbled 4.3% last week, the first weekly decline for the ETF since the end of November.

Widespread losses weighed on the Global Market Index (GMI.F), an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETF proxies. GMI.F lost 1.6% — the benchmark’s first weekly loss in the past three.

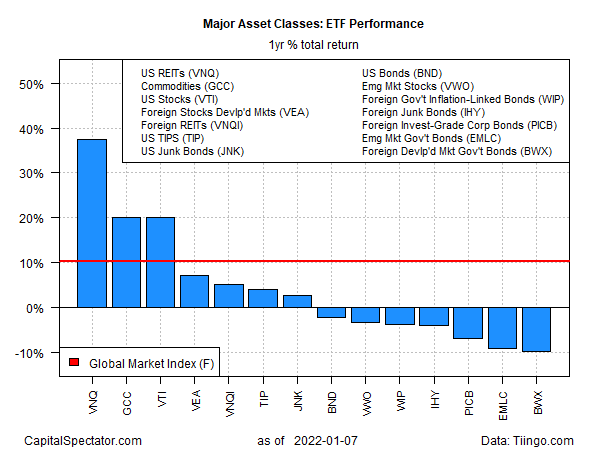

Despite the sharp setback in US REITs last week, Vanguard US Real Estate (VNQ) remains the leading performer by far for the major asset classes over the trailing one-year period. VNQ ended last week with a 37.5% total return – far above the rest of the field.

The biggest one-year loss for the major asset classes: foreign government bonds in developed markets. SPDR Bloomberg Barclays International Treasury Bond ETF (BWX) has shed 9.7% over the past 12 months.

Meanwhile, GMI.F ended last week with a strong 10.2% gain for the trailing one-year window.

Despite the latest wave of selling, most of the major asset classes continue to post relatively moderate drawdowns: no deeper than -10%.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report