The US stock market is on track to end the year with a red-hot gain and a lot of the credit goes to sizzling performances in energy and real estate shares.

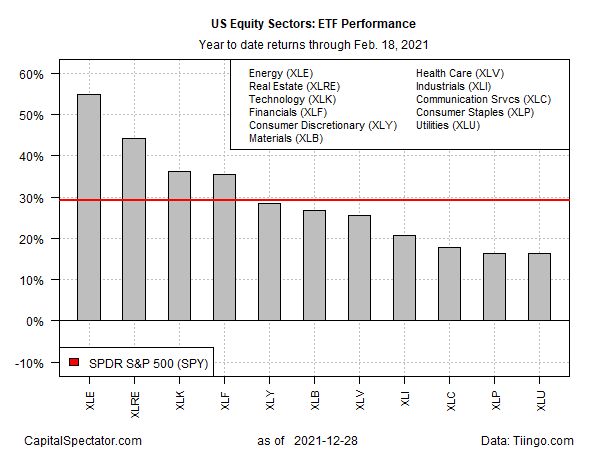

With three trading days for 2021 to go, each sector is posting strong year-to-date gains that are well above the broad market’s gain, based on a set of ETFs. Not too shabby in a year when stocks overall are set to post one of strongest calendar-year gains on record.

If genius is a bull market, there’s a glut of smart money managers this year. If you’re really impressed with a particular investor’s 2021 results, there’s a decent chance the portfolio has had a healthy dose of energy and/or real estate shares.

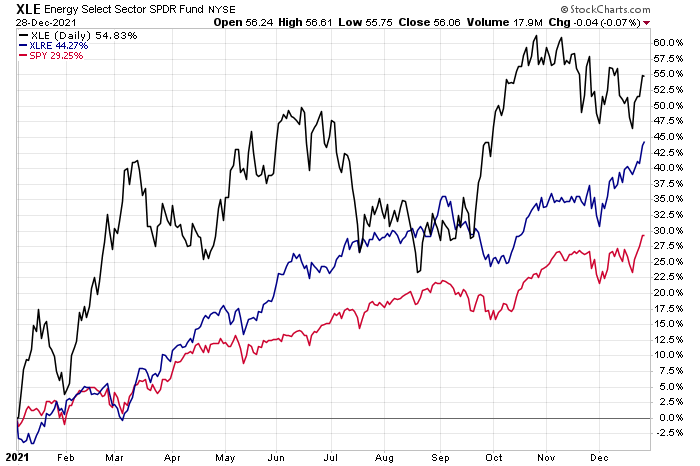

Year to date, Energy Select Sector SPDR (XLE) is the top dog with a sizzling 54.8% total return through yesterday’s close (Dec. 28). The second-best US sector performer this year: Real Estate Select Sector SPDR (XLRE), which ended Tuesday’s session with a 44.3% gain for 2021.

In both cases, year-to-date performances are well above the broad market’s bull run via SPDR S&P 500 (SPY), which has rallied 29.3% so far in 2021.

Energy is the leading sector performer this year, but by some accounts it’s been out of favor in 2021. As CNBC reports this week, “The sector remains under-owned – due to concerns around environmental, social and governance factors and the energy transition.”

“Not owning energy has been an easy thing to do,” says Les Stelmach, senior vice-president and portfolio manager at Franklin Bissett Investment Management. “For five of the last seven years, you can point and say you’ve made the right decision, but now you’re confronted with sharply higher commodity prices,” he tells Bloomberg.

Underweighting or avoiding big energy stocks has come at a price this year, but the genius of the bull market has still been a savior, at least in absolute terms. Indeed, every US sector is currently posting a gain this year. The weakest performers are well behind the broad market and energy and real estate shares, but there’s still a decent upside gain to report.

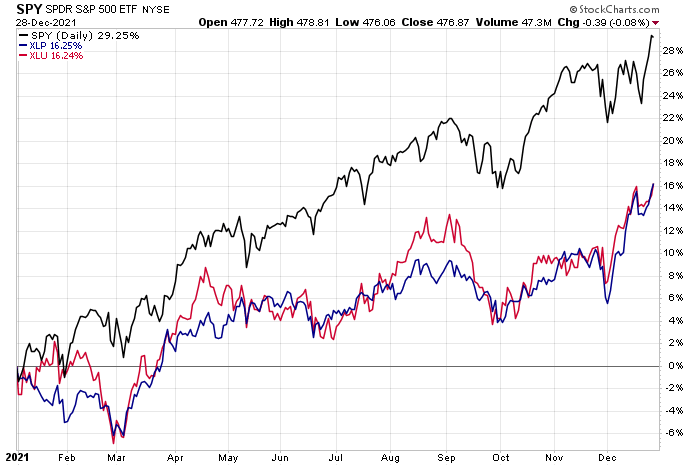

Utilities Select Sector SPDR (XLU) is last in this year’s sector horse race, but investors in the fund are hardly starving with a 16%-plus gain in 2021. Consumer Staples Select Sector SPDR (XLP), the second-worst sector performer, is similarly positioned with a virtually identical increase.

As Tom Petty reminds, Even the losers get lucky some time.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno