October data for the labor market and the industrial sector continue to paint a bright profile of recovery in absolute and relative terms vs. previous economic expansions. Retail sales data through last month, updated earlier in the week, suggest the same for personal consumption expenditures, which will be updated for October on Nov. 24. The weak outlier is personal income and it’s unclear if this key indicator will deliver more encouraging results in the upcoming report.

The good news is that the labor market is still rebounding at the strongest pace relative to previous US expansions since 1970. It’s debatable how long this strong recovery in jobs can continue, but for the moment there’s no sign that it’s set to stumble.

Nonfarm payrolls rose 531,000 in October, well above expectations. The gain marks the tenth straight monthly advance. “If this is the sort of job growth we will see in the next several months, we are on a solid path,” observed Nick Bunker, economic research director at job placement site Indeed.

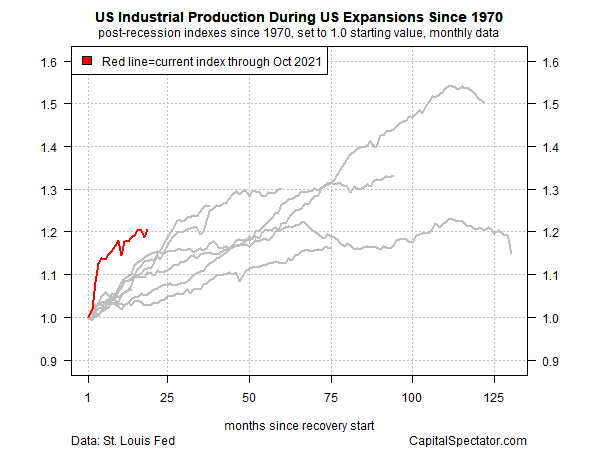

Industrial production is also rebounding at an unusually strong rate through October. Compared with previous recoveries in the industrial sector, the current bounce is far ahead of previous rebounds at this point in economic expansions.

Retail sales surged in October, which suggests that the upcoming report on personal consumption expenditures – a wider measure of consumer activity – for last month will continue to show a recovery that’s far ahead of previous expansions in the consumer sector following the end of recessions.

Personal income, by contrast, is stumbling relative to previous recoveries. Based on numbers through September, this indicator has lost ground since the economic expansion began in May 2020. That’s the worst performance by far for US recoveries for this key indicator since 1970. If the disappointing performance continues, it could become a significant risk factor for the economic outlook in 2022.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: Economic Recovery for Labor Market and Industrial Sector Continues - TradingGods.net