If you hold a diversified portfolio of world stocks and give China more than a trivial weight, you’re feeling the pinch this year. Shares in the world’s second-largest economy continue to tumble, exacerbated in recent days by the liquidity crisis in Evergrande, a large Chinese property developer with a deepening liquidity crisis that’s roiling global markets lately.

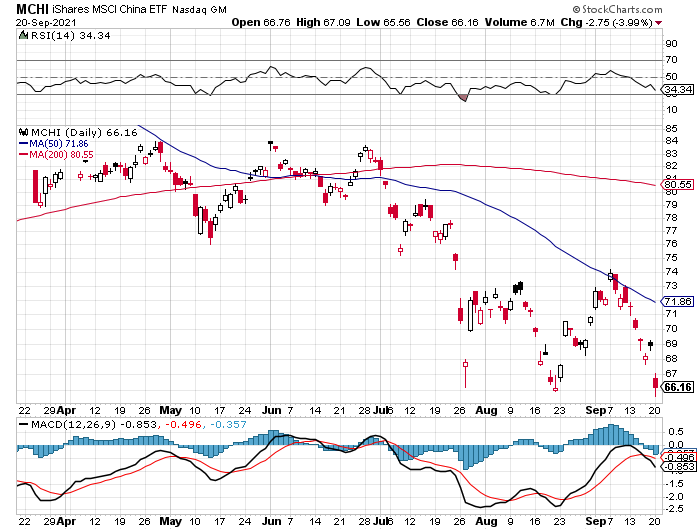

On a year-to-date basis, China shares continue to suffer the deepest loss for the world’s major equity regions, based on a set of US-listed ETFs. At yesterday’s close (Sep. 20), iShares MSCI China (MCHI) has lost 18.1% so far in 2021.

By comparison, US stocks (SPY) are up 17.2% this year. Global shares overall (VT) are ahead by 12.3%.

After yesterday’s rout in global stocks, in part triggered by worries over Evergrande, investors are keenly focused on how and when – or if — Beijing intervenes to prevent a deeper crisis. Some of the darker forecasts see this as China’s Lehman moment – a reference to the implosion of Lehman Brothers, a US investment bank, in September 2008, which is widely cited as a key trigger for the subsequent financial meltdown that followed.

A key test arrives this Thursday (Sep. 23), when Evergrande is scheduled to make an interest payment on one of its bond series. A default would likely deepen worries about the company’s woes and raise pressure on Beijing to intervene to keep the blowback from the highly indebted firm from rippling across the economy and beyond.

The risks for the company remain dire, but it’s not yet obvious that the ongoing repercussions are a wider threat. Evergrande’s shares “will continue to fall, because there’s not yet a solution that appears to be helping the company to ease its liquidity stress, and there are still so many uncertainties about what the company will do in case of a restructuring,” says Kington Lin, managing director of Asset Management Department at Canfield Securities.

There’s a growing sense that Beijing will be forced to step in to prevent a systemic financial crisis in the country. “Everyone was expecting the government would have some kind of resolution, given that Evergrande is a systemically important company,” observes Jimmy Chang, chief investment officer at Rockefeller Global Family Office. “It has $300 billion in outstanding debt. There is a contagion issue if China Evergrande is not resolved. I think it will end up having some deep-pocketed state-owned enterprises to take over.”

The main question is whether this is a Lehman moment for China? “Not even close, in our opinion,” predict analysts at Barclays. “Yes, Evergrande is a large property firm. And yes, there could (probably will) be spillover effects on China’s property sector, with economic implications. And yes, it comes at a time when China’s growth has already started to disappoint,” they advise.

But a true ‘Lehman moment’ is a crisis of a very different magnitude. One would need to see a lenders’ strike across large parts of the financial system, a sharp increase in credit distress away from the real-estate sector, and banks being unwilling to face each other in the interbank funding market.

What is clear is that heavy allocations to China stocks have turned into a significant headwind for global equity strategies this year. Consider how a pair of emerging markets ETFs — one with a China allocation (EEM) and one without (EMXC) — have performed so far in 2021. EEM’s roughly 34% weight in China has had a distinct impact via a 2.8% year-to-date decline vs. a 6.8% gain for EMXC.

The future path for that spread may lie in the hands of China’s policymakers. Even if they act, the possibility of a policy mistake can’t be ruled out. This may not be a Lehman moment for China, but whatever happens next will likely be tightly linked to political-economic decisions controlled by the government. Welcome to the Beijing moment.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: China Stocks Continue to Tumble - TradingGods.net