The 10-year Treasury yield held steady at 1.19% yesterday (Aug. 4). The current rate marks the third time in recent history that the 10-year yield slipped to 1.19%, which reflects a six-month low.

Downside momentum for the benchmark rate is strengthening, based on a set of moving averages. That’s a clue for thinking that lower yields are possible, perhaps likely in the near-term future.

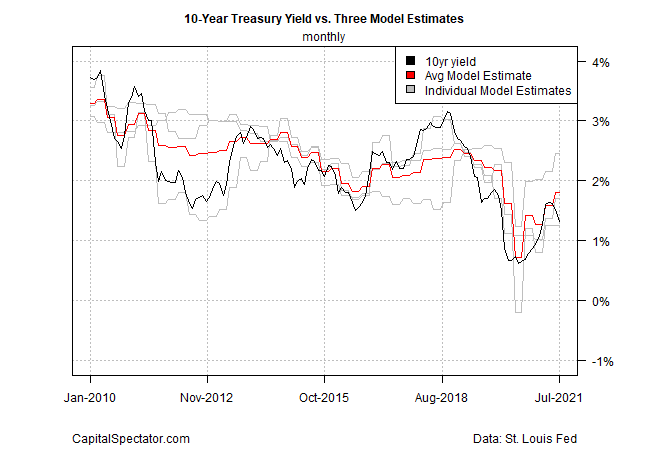

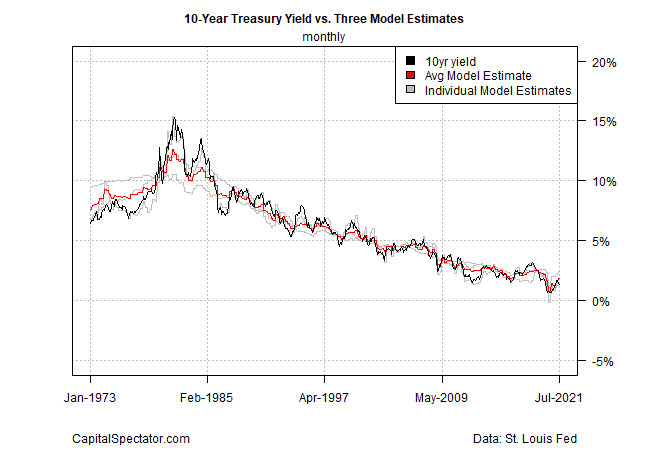

CapitalSpectator.com’s current fair-value estimate, however, suggests that downside momentum may be limited in the medium-term future. The reasoning: the average fair-value estimate via three models implies that the current rate is moderately undervalued. For details on the modeling, see this summary.

The current average fair-value estimate for July is 1.80%. That’s above the average of 1.32% for July, based on market data, as well as yesterday’s 1.19% via daily numbers published by Treasury.gov.

Although day-to-day market yields can be noisy, over longer periods of time the actual 10-year rate tends to randomly fluctuate around the average fair-value estimate. That behavior suggests that when the current 10-year rate is below fair value, there’s a relatively strong upside bias, and vice versa.

Several caveats should be considered. First, there’s a wide uncertainty band for the model estimates, based on a 95% prediction interval for each model. Even if the interaction between previous fair value estimates and the actual 10-year rate prevail, the potential for convergence remains highly uncertain on a timing basis.

In addition, economic and financial conditions can move the 10-year rate in a direction that, in the short term, appear to have little if any macro logic relative to modeling. There are also shock events to consider. In the current climate, the uncertainty linked to spread of the Delta variant of the coronavirus is a factor that may push the 10-year rate lower, perhaps more so than the market anticipates, depending on how the coronavirus spread evolves.

Ultimately, models are, at best, rough estimates of where the 10-year rate should trade, assuming that the inputs are the only factors that “explain” interest rates. That’s an idealized view of market behavior and one with limited resonance in the real world. Many factors can and do influence future changes in interest rates and models can only capture a small portion of these variables.

Nonetheless, the current average estimate offers support for thinking that the forward outlook for the 10-year rate is moderately biased to the upside. Another interpretation of the modeling: the downside bias for the 10-year yield may be limited for the medium-term outlook.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno