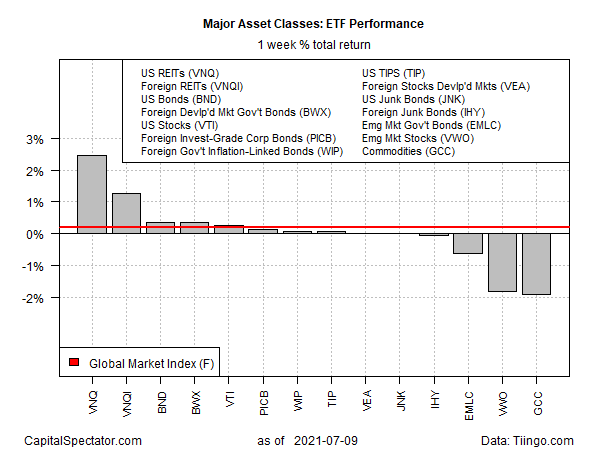

The major asset classes delivered a wide range of results in last week’s trading (through Friday, July 9), based on a set of proxy ETFs. US real estate investment trusts (REITs) led the winners while stocks in emerging markets and commodities posted sharp losses.

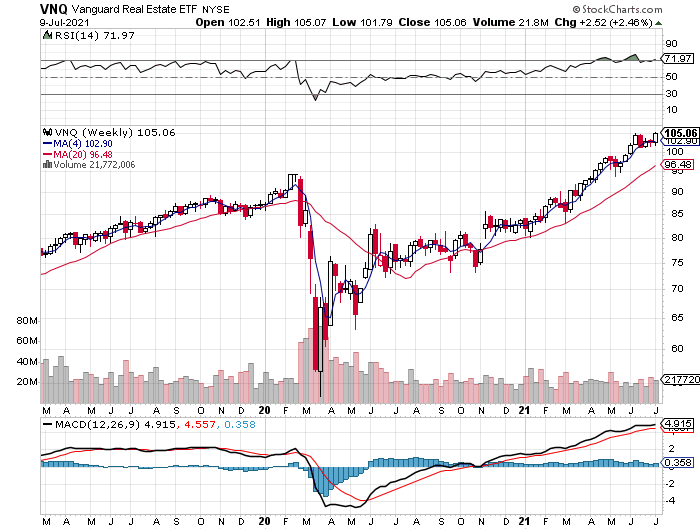

Vanguard US Real Estate (VNQ) rallied 2.5% last week, lifting the fund to a record close.

Last week’s worst performer for the major asset classes: commodities. The equal-weighted WisdomTree Continuous Commodity Index Fund (GCC) slumped 1.9%.

Concerns that the economic rebound may be weaker than expected were a factor weighing on commodities prices. Doubts about the strength and persistence of inflation are another.

Nonetheless, there’s still a raging debate about whether inflation is transitory. Joel Naroff, chief economist at Naroff Economics, prefers to label current conditions as “transitional,” telling The Wall Street Journal: “We’re in a transitional phase right now. We are transitioning to a higher period of inflation and interest rates than we’ve had over the last 20 years.”

Despite losses in several corners of the global markets last week, an ETF-based version of the Global Market Index (GMI.F) managed to edge up 0.2%. This unmanaged benchmark (maintained by CapitalSpectator.com) holds all the major asset classes (except cash) in market-value weights via ETF proxies.

For the one-year performance window, US stocks continue to lead. VTI is up 43.9% for the trailing 12-month window through Friday’s close.

On the flip side, US bonds (BND) are still in last place for the trailing one-year period, posting a 0.6% loss after factoring in distributions.

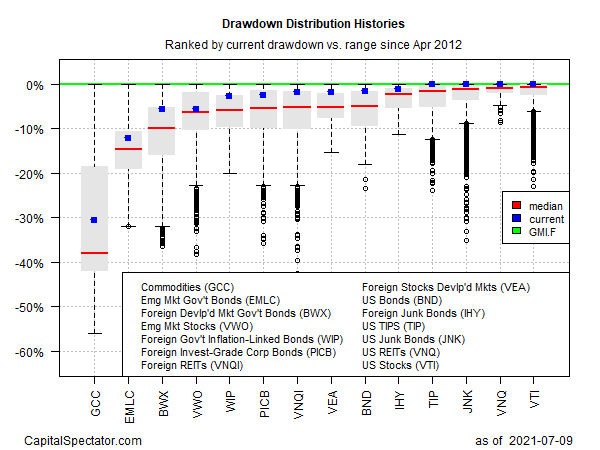

Reviewing the major asset classes via current drawdown shows that most of our proxy ETFs currently enjoy peak-to-trough declines of less than -5%. US stocks (VTI) and US REITs (VNQ) stand out as the slice of global markets that ended last week at record highs (i.e., zero drawdown). The big outlier remains commodities (GCC), which currently reflect a drawdown of -30%-plus.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno