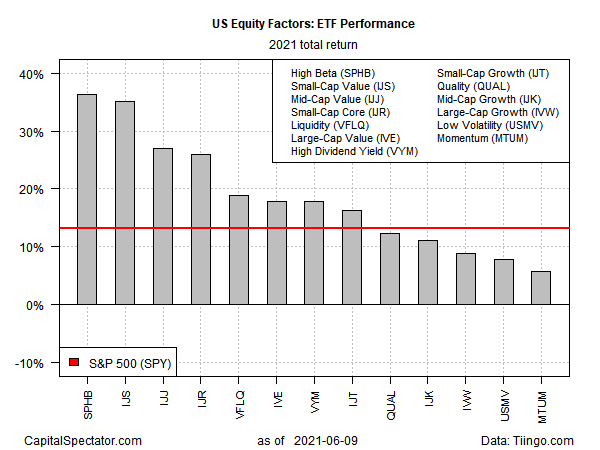

US equity factor strategies targeting high-beta and small-cap value shares continue to post the strongest performances so far in 2021, based on a set of exchange-traded funds through June 9.

Invesco S&P 500 High Beta (SPHB) is in the lead with a 36.3% return year to date. The ETF, which holds the 100 highest beta stocks in the S&P 500, has earned more than twice the return of the broad market, based on SPDR S&P 500 (SPY), which is up 13.2% this year.

A close second-place factor performer this year: small-cap value stocks. The iShares S&P Small-Cap 600 Value ETF (IJS) posted a 35.2% return in 2021 through yesterday’s close.

The rest of the factor field is trailing the two fund leaders by sizable margins. All the factor funds on our list are posting gains so far this year and the majority are beating the overall stock market (SPY). The weakest performer is struggling: iShares MSCI USA Momentum Factor ETF (MTUM) is ahead in 2021 by a relatively modest 5.6%. For much of the year so far, MTUM has been churning in a trading range and at the moment shows no sign of breaking free.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: High-Beta and Small-Cap Value Shares Post Strong Performance in 2021 - TradingGods.net