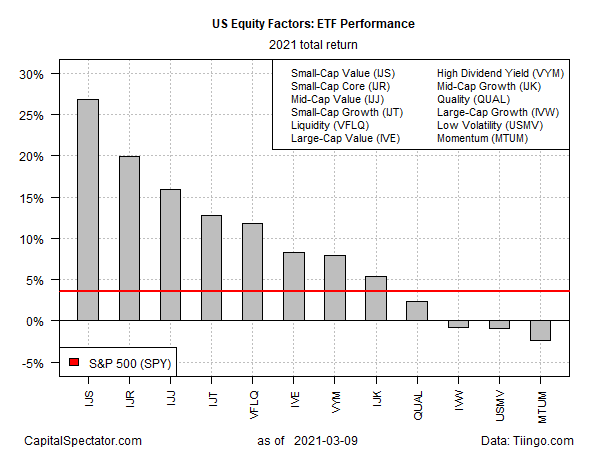

Small-cap value is back. This slice of US equity factor risk is leading the wide-ranging field of US equity risk factors by a wide margin so far in 2021, based on a set of ETF returns through Mar. 9.

After a tepid gain in 2020 (+3.0), iShares S&P Small-Cap 600 Value (IJS) is roaring in the first quarter with a 26.9% return year to date. The fund’s strong technical profile suggests that the rally has room to run, based on the expanding spread in the 50-day moving average over its 200-day counterpart.

Small cap stocks in general are running hot this year. The second-strongest US equity factor performance in 2021 is a core portfolio in the small-cap space (IJR) while the fourth-best year-to-date gain is held by small-cap growth (IJT).

The rally is no garden variety advance, notes market analyst Mark Hulbert. Writing in The Wall Street Journal a few days ago, he notes that “small stocks so far this year have beaten their large-capitalization brethren by a wider margin than they have in more than two decades….”

Indeed, the iShares S&P Small-Cap 600 Value’s +26.9% run so far this year is far above the broad market’s 3.6% year-to-date gain via SPDR S&P 500 (SPY).

It’s also notable that several flavors of equity factor risk premia are having a rough 2021 as the first quarter moves into its final weeks. Of the dozen factor funds tracked here, three (large-cap growth, low volatility and momentum) are mildly in the red year to date. The deepest loss at the moment: iShares MSCI USA Momentum Factor (MTUM), which is in the hole with a 2.4% decline so far in 2021.

What’s driving the small-cap rally? One popular narrative: the increasingly bullish expectations for the US economic rebound. The reasoning is that smaller companies tend to be more directly tied to the national economy vs. their large-cap counterparts and os the small-cap factor stands to reap a greater share of the macro benefits in relative terms.

This storyline is top of mind this week as the House is set to approve the Biden administration’s $1.9 trillion stimulus/relief bill. The expected rush of fiscal spending in the months ahead prompted economists to raise 2021 economic growth projections, according to a new survey. The average forecast for 2021 economic growth jumped to nearly 6%, up from last month’s 4.9% growth estimate for the year, based on polling by The Wall Street Journal.

If the forecast is correct, small-cap shares will be in the sweet spot from a macro perspective for the foreseeable future.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Small-Cap Value Stocks Continue to Outperform the Rest of the Factor Field - TradingGods.net