The US Bureau of Economic Analysis is on track to report that the economy posted a strong rebound in the third quarter in Thursday’s initial GDP estimate (Oct. 29). Most economists and nowcasting models are estimating a dramatic, perhaps record-setting increase in gross domestic product (GDP). There’s still uncertainty about Q4’s outlook, but confidence is high that this week’s GDP data will confirm that the economy mounted a dramatic rebound after Q2’s record loss.

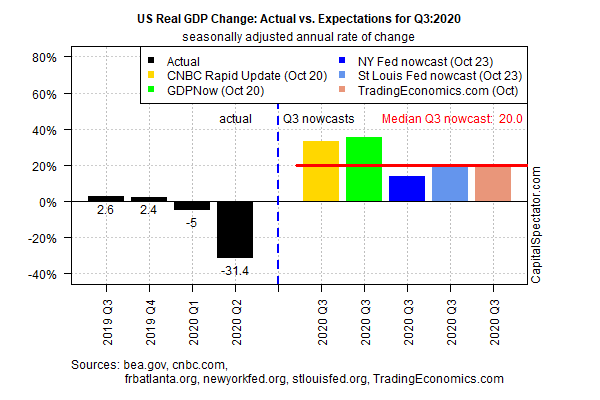

Output for Q3 is projected to increase 20.0% (seasonally adjusted annual rate), based on the median nowcast via a set of estimates compiled by CapitalSpectator.com. That’s an unusually high gain – if correct, the increase would rank as the highest quarterly increase since the dataset’s start in 1947. But even a 20% advance in GDP still pales next to the 31.4% collapse reported for Q2.

Optimists point out that two of the Q3 estimates offer substantially higher nowcasts. Notably, the Atlanta Fed’s GDPNow model is currently projecting that GDP will surge more than 35% (as of the Oct. 20 estimate) in Thursday’s release. But some nowcasts are considerably less robust. The New York Fed’s Q3 nowcast (Oct. 23), for instance, is a relatively moderate 13.8% increase and so the potential for a surprisingly soft gain can’t be ruled out.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

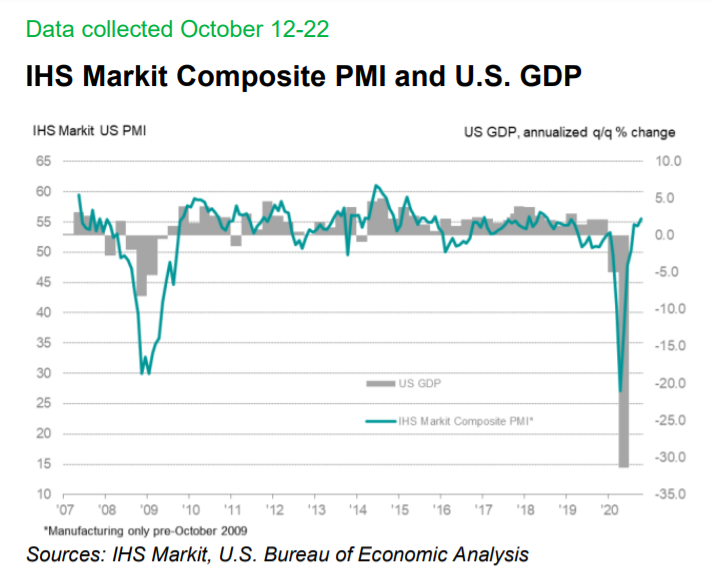

For the current quarter, recent PMI survey data paints a relatively upbeat profile. The IHS Markit US Composite PMI, a GDP proxy, rose to a 20-month high in this month’s flash estimate. “US output growth regained growth momentum in October, as business activity rose at the fastest rate for 20 months and business optimism improved markedly,” IHS Markit reported last week. The upturn was largely driven by service providers, though manufacturing firms also reported a further solid increase in production.”

Chris Williamson, chief business economist at HIS Markit, added that PMI data implies that “the US economy looks to have started the fourth quarter on a strong footing, with business activity growing at a rate not seen since early 2019.”

Bloomberg reports that “fears that a resurgence of the virus would cause the economy to lapse back into recession are fading. Economists polled by Bloomberg predict slightly stronger-than-normal GDP growth for the current [fourth] quarter and all of 2021.”

Some analysts warn, however, that it’s premature to assume that the economic danger has fully passed. “It looks like an economic recovery, but it’s really sort of a steroid kind of recovery,” says David Kelly, JP Morgan Asset Management’s chief global strategist. “As the steroid of fiscal stimulus is removed, the economy is going to grow more slowly … it’s going to grow much more slowly in the fourth quarter than it did in the third.”

Adding to uncertainty is the high probability that a new round economic stimulus will be delayed until after the election, perhaps after January if Joe Biden wins the White House. The economic risk associated with delaying stimulus could be substantial now that coronavirus infections and related hospitalizations are rising again.

″Too many countries are seeing an exponential increase in cases, and that’s now leading to hospitals and ICU running close or above capacity, and we’re still only in October,” advises Tedros Adhanom Ghebreyesus, director-general of the World Health Organization. “We are at a critical juncture in this pandemic, particularly in the Northern Hemisphere.”

How will the rebound in coronavirus infections and hospitalizations impact US economic activity? Unclear, although the potential for blowback can’t be dismissed. The good news is that economic momentum appears to be strong. The uncertainty at this stage is closely linked to what unfolds in the weeks ahead with Covid-19. For now, that appears to be a rising risk factor, which implies that the US economic rebound is still vulnerable in Q4.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Strong Rebound in Third Quarter for GDP - TradingGods.net