A broad, equal-weighted measure of commodities topped last week’s wide-ranging gains across the major asset classes, based on a set of exchange-traded funds. In close pursuit: US and emerging markets stocks.

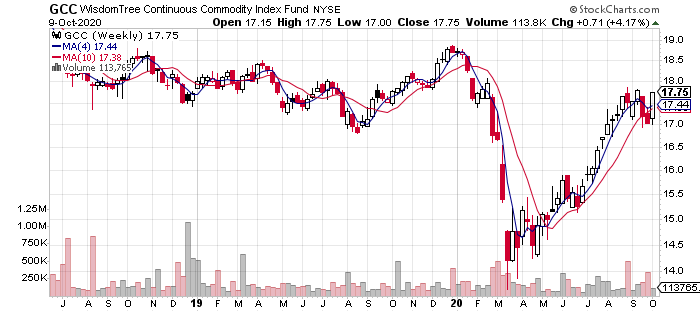

WisdomTree Continuous Commodity Index Fund (GCC) won last week’s horse race by a hair, delivering a 4.2% gain for the trading week through Oct. 9. Profiling the ETF on a weekly basis continues to show an ongoing rebound from the March coronavirus crash. But GCC may struggle to break above recent highs without a continuation of reflationary fuel in the economic data and news headlines.

Will tomorrow’s consumer inflation report (Oct. 13) offer an assist? Econoday.com’s consensus forecast sees the one-year trend for headline CPI ticking up to 1.4% for September from 1.3% in the previous month. Hardly the stuff to spark inflation worries since those gains continue to print well below the Federal Reserve’s 2% inflation target. On the other hand, core CPI (excluding energy and food) is also on track to edge higher to 1.8% year-over-year. Core measures of inflation tend to resonate more with central bankers and so this faster pace may carry more weight with inflationistas.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

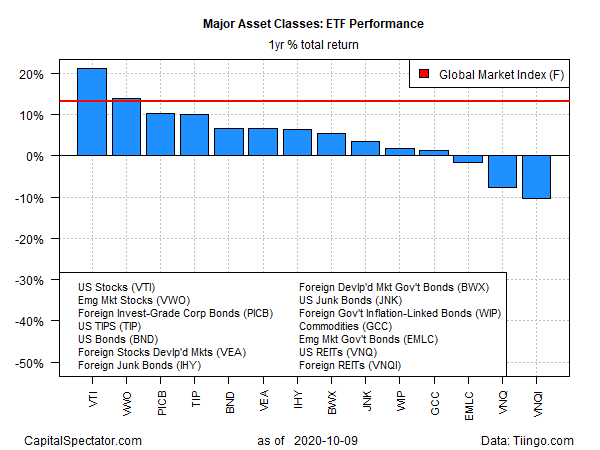

US equities also rallied last week. Vanguard Total US Stock Market (VTI) rose 4.1%, fractionally behind the gain in commodities. Shares in emerging markets also posted a similarly solid advance for the trading week: Vanguard FTSE Emerging Markets (VWO) rallied 4.0%.

Only one slice of the major asset classes lost ground last week: a broad measure of US investment-grade bonds. Vanguard Total US Bond Market (BND) slipped 0.2%, leaving the fund near its lowest close since early July.

The Global Markets Index (GMI.F) posted a strong gain last week. This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights via ETFs, rose 2.7% — the strongest weekly increase since June.

For the one-year trend, US stocks continue to lead by a wide margin. VTI is up 22.0% on a total-return basis, far ahead of the rest of the field.

Although most of the major asset classes are posting one-year gains, three are under water for the trailing 12-month period. The deepest one-year setback at the moment: foreign real estate shares via Vanguard Global ex-US Real Estate (VNQI), which is down 10.2%.

GMI.F’s one-year performance, by contrast, is a strong 13.2% at Friday’s close.

Current drawdowns for the ETF proxies tracking the major asset classes range from a trivial 0.3% peak-to-trough decline for inflation-indexed Treasuries (TIPS) to a hefty 44% tumble for broadly defined commodities (GCC).

GMI.F’s current drawdown is a slight 0.9% loss off its previous high.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report