The unprecedented decline in in US economic output in the second quarter is currently on track to recover less than half the loss in Q3, according to several GDP nowcasts compiled by CapitalSpectator.com. The estimates are vulnerable to the high uncertainty related to the path of the coronavirus in the remaining weeks of Q3, but for the moment the prospects appear to favor a partial rebound.

GDP in Q3 is expected to rise 15.0% in the July-through-September quarter, based on the median estimate (see chart below). That’s a solid rise relative to quarterly increases, but it’s still mild relative to the far steeper 32.9% drop in Q2.

Another risk factor to consider: there’s more than two months to go before the Bureau of Economic Analysis publishes its initial Q3 GDP report on Oct. 29 and so today’s numbers should be viewed with extreme caution for the simple reason that a lot can happen between now and then.

Despite the potential for revision risk, many economists currently see a path for recovery unfolding for Q3. Yet there’s also widespread agreement that the outlook remains vulnerable to coronavirus-related risk.

“The economy’s climb back from the sudden and severe setback of the second quarter is fully underway, but we believe the future pace will be driven largely by the path of the novel coronavirus and how the public responds to coronavirus-related information,” says Doug Duncan, Fannie Mae Senior Vice President and Chief Economist.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

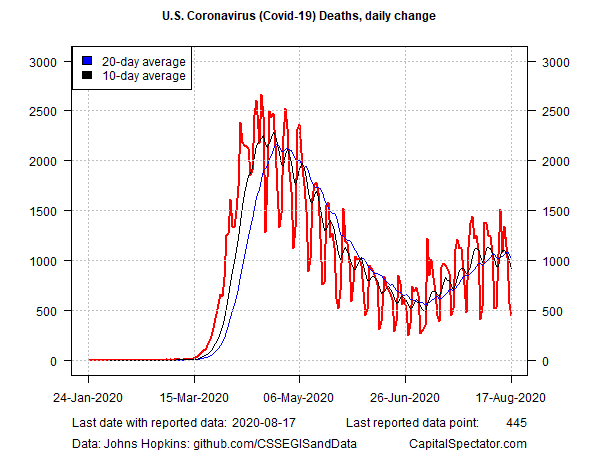

On that front, recent US Covid-19 numbers offer a basis for cautious optimism. Data through Aug. 17 suggest that the virus has peaked, based on the daily change in US cases and fatalities, according to data sets aggregated by Johns Hopkins University. New cases through yesterday fell to a two-month low of just above 35,000.

The daily change in deaths also dropped, tumbling to 445 on Monday — the lowest since Aug. 2.

There are several caveats, however, starting with questions about the reliability of the data. By some accounts, the US isn’t testing enough and so the reported data under-represents the extent of infections.

Meanwhile, assumptions about behavior is a risk factor for managing expectations. For example, IMHE’s modeling of US Covid-19 deaths for the months ahead varies widely, depending on the degree of mask use in the general population. Universal use of masks translates to a forecast of a falling/stable death rate. By contrast, if mask use declines, fatalities are on track to rise significantly for the remainder of the year.

For now, however, there are hints that the economy is recovering. The rebound’s strength and durability are open for debate, but a broad set of indicators show a bounce in economic activity following the jaw-dropping decline in Q2.

The Philly Fed’s ADS Index, for example, reflects a strong rebound in the business cycle, based on data through Aug. 8.

But for every upbeat profile, skeptics can point to a darker view in another data set. The encouraging ADS bounce, for instance, can be contrasted with the New York Fed’s spin on a high-frequency US business cycle gauge: the Weekly Economic Index. Although WEI has rebounded off its recent lows, this benchmark is still a long way from a positive trend via numbers through Aug. 8.

Perhaps the single-biggest threat to the economy is the persistence of historically high increases in weekly jobless claims. This leading indicator continues to show that unusually large numbers of workers continue to file for unemployment benefits every week.

Although new claims for the week through Aug. 8 fell below the 1-million mark for the first time since the pandemic started, the 968,000 increase (seasonally adjusted) is still a hefty gain. Until this weekly increase moves dramatically lower, the US economic outlook remains precarious.

“The labor market continues to improve, but unemployment remains a huge problem for the US economy,” notes Gus Faucher, chief economist at PNC Financial Services. “The number of people filing for unemployment insurance, both regular and PUA benefits, continues to steadily decline as layoffs abate. But job losses remain extremely elevated, far above their pre-pandemic level.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report