The future’s unclear, especially when it comes to anticipating the trend for inflation. Or so it appears based on comparing the Treasury market’s implied forecast vs. recent estimates from several prominent investment and consultancy shops.

Let’s start with the Treasury market, which continues to price in a rebound in US inflation expectations. Consider the 5-year Note’s implied estimate, based on the yield spread for the nominal rate less its inflation-indexed counterpart. After diving in March, threatening to reach zero and perhaps go negative, the forecast has bounced sharply in recent weeks. At yesterday’s close, the 5-year spread ticked up to 1.14% (June 23)—the highest since March 6—the early days of the coronavirus crash in global markets.

One theory is that the rebound is simply rethinking the extreme estimate of disinflation/deflation risk. As economies have reopened after the shutdown, and economic activity has partially recovered, the crowd is revising inflation expectations to the formerly modest-but-still-positive outlook and that’s about as far as it will go, for now.

The next several weeks will be closely watched for clues on whether the market is inclined to extend the reflationary outlook that’s prevailed lately.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

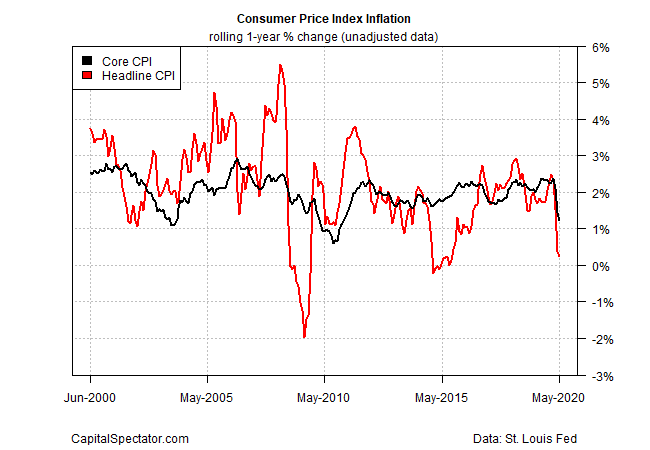

Meanwhile, official inflation gauges still reflect weak pricing pressure. The headline measure of the Consumer Price Index in May fell sharply, approaching zero for the one-year change.

By some accounts, the recent surge in monetary and fiscal stimulus to fight the economic blowback from the coronavirus will eventually lead to higher inflation, perhaps substantially higher.

“What worries me is that at the moment it seems that there is no limit to fiscal stimulus,” says Klaus Kaldemorgen, a portfolio manager at asset manager DWS.

Many economists see a different future. “The outlook for core inflation in both the US and the eurozone is likely to remain subdued over the medium term, necessitating the ongoing support of current unconventional monetary policies,” predicts Robert Sierra, director of Fitch Rating’s economics team.

We expect Eurozone core inflation to end 2021 below 0.5% while in the US we see core PCE ending next year at below 1% from a recent average of 1.5% in the three months to April. This will leave core inflation in both the US and the eurozone well below their inflation targets.

Manny Roman, chief executive officer of the bond shop Pacific Investment Management Co., agrees and forecasts that “the days of inflation we remember are gone.” Although he expects inflation will gradually rise from current levels, the return to a low-2% pace is about as far it will go for the near term.

A critical factor for the inflation’s trend in the months and years ahead is the path of economic recovery. A new survey of economists by FiveThirtyEight.com anticipates that the dramatic decline in US output will be followed with a sharp but partial recovery and an extended period of relatively slow growth, according to 73% of respondents. “There is nothing standard or smooth about this recovery,” advises Lisa Cook, professor of economics and international relations at Michigan State University.

The upcoming second-quarter GDP report is expected to be unusually ugly. The Atlanta Fed’s GDPNow model, for example, is nowcasting a dramatic 45.7% crash in economic US activity in Q2, based on the current estimate for the annualized rate (as of June 17).

Growth will likely bounce back later in the year in some degree, but the main event that will influence the macro trend and inflation for the foreseeable future: the arrival of widely distributed coronavirus vaccine, or not.

Representing the leading front for optimism, Dr. Anthony Fauci, the top infectious disease expert in the US government, told Congress yesterday that he’s “cautiously optimistic” that a vaccine could be ready as early as the end of this year.

If accurate, the outlook for inflation may turn out to be closer to the Treasury’s market’s estimate. Alternatively, if a vaccine arrives later than expected (or is only partially effective), inflation could remain unusually subdued for years.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: Unclear Future for Anticipating the Trend for Inflation - TradingGods.net