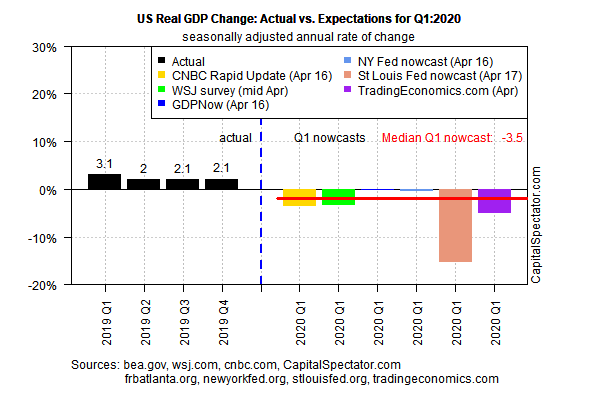

There had been hope that the coronavirus-triggered recession that’s now roiling the US economy wouldn’t show up in the data until the second quarter. But recent updates for March have smashed that idea and so next week’s initial estimate of Q1 GDP is on track to post a loss, based on several nowcasting models and survey results compiled by CapitalSpectator.com.

The negative outlook for Q1 economic activity is striking because the brunt of the coronavirus blowback didn’t bite in the US until March. But the depth and speed of the economic decline last month is now expected to overwhelm the moderate growth in January and February and pull Q1 GDP down–sharply.

There’s still a lot of uncertainty about what we’ll see in the Q1 report that the Bureau of Economic Analysis is scheduled to release on Apr. 29. Judging by several nowcasting models, however, the outlook is grim. The median Q1 estimate for six models is -3.5%, a dramatic decline from Q4’s 2.1% increase.

The negative outlier in the Q1 nowcasts is the St. Louis Fed’s estimate, which is currently projecting an astonishing -15.4% collapse in output. Throwing that estimate out, the median for the remaining estimates is a softer-but-still-painful 3.3% slide.

Any way you slice it, Q1 GDP looks set to confirm that the recession started early—before the worst of the coronavirus blowback. Whatever the pain that’s due in the official data for the first three months of the year, it will pale next to the Q2 results, which will reflect the full breadth and depth of the economic shutdown that’s now in progress.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

For a taste of what’s coming, consider The Wall Street Journal’s survey of economists for April. The average Q1 estimate is a deeply negative 3.3% decline but that’s mild next to Q2’s sobering -25.3% forecast.

“The U.S. economy is hemorrhaging jobs at a pace and scale never before recorded. It compares to a natural disaster on a national scale,” says Scott Anderson, chief economist at Bank of the West.

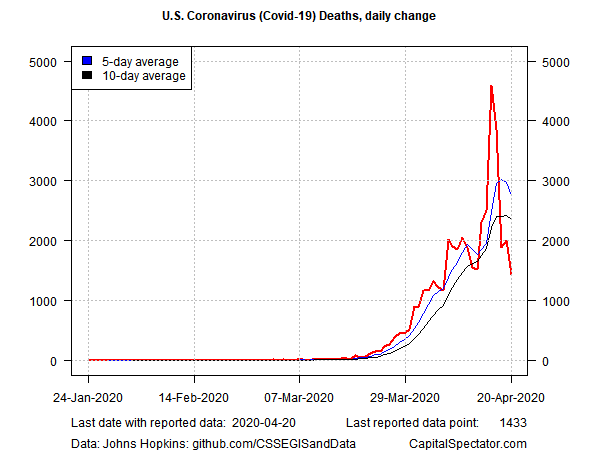

Growth will return, of course—but when? The timing is dependent on progress (or the lack thereof) in managing coronavirus infections and fatalities. On that note, there’s a glimmer of hope that maybe the worst has passed for the US. The daily pace of increase in US deaths continued to fall yesterday (Apr. 20), dropping to a two-week low, based on data from Johns Hopkins. It’s unclear if this is a reliable sign that the peak is behind us, but for the moment it serves as a ray of optimism.

In any case, Dr. Anthony Fauci — the top US government official on infectious diseases – reminded the nation of a simple but basic fact: “Unless we get the virus under control, the real recovery economically is not gonna happen.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: Economic Decline Expected to Pull Q1 GDP Down - TradingGods.net