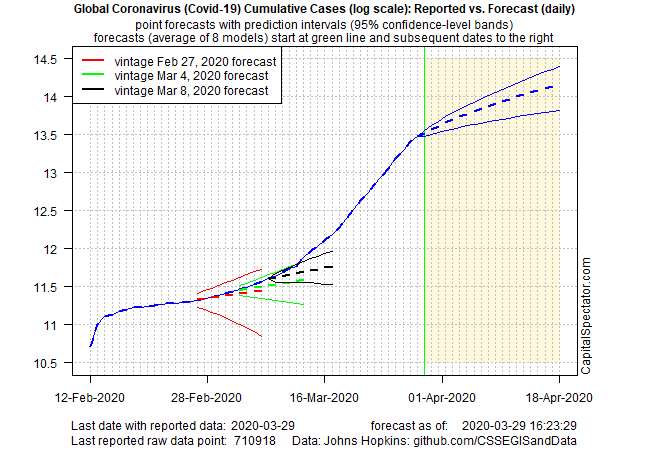

Revised data for CapitalSpectator.com’s coronavirus (Covid-19) forecast, based on an 8-model combination, still points to a rise in the number of global reported cases (via the median point forecast). At some point, when the reported cases reflect a tendency to print below the median forecast, the downside bias will be welcome news since it suggests that the trend is peaking. Unfortunately, there’s no sign of the apex yet using this framework.

Today’s projection indicates that worldwide reported cases of Covid-19 will rise further, based on analysis of data via Johns Hopkins.

Notably, previous forecasts (the Mar. 8 update, for example) have consistently underestimated future cases, based on the median combined forecast for 8 models. The actual results, on the other hand, have remained with 95% confidence-level bands… so far.

Note that as of this update the chart above is presented in log scale in the interest of visual clarity. The switch to log scale is necessary because the number of reported cases has increased dramatically in recent weeks and so effective charting is no longer practical via the raw numbers with a starting point in February or earlier.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno