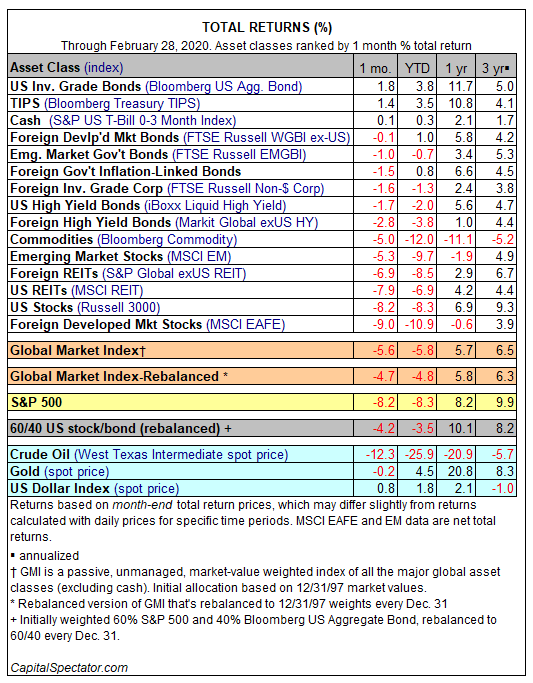

Nearly every corner of the major asset classes took a beating in February, courtesy of coronavirus-related worries. Only investment-grade US bonds, US inflation-indexed government bonds and cash bucked the risk-off sentiment. Otherwise, red ink swept across markets near and far.

The biggest loss last month: foreign stocks in developed markets. MSCI EAFE Index tumbled 9.0% on a net basis – the deepest monthly loss in eight years for this slice of equities. US stocks suffered almost as deeply: Russell 3000 Index crumbled 8.2% in February.

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

US government bonds were the main source of salvation last month. With nearly half of the Bloomberg US Aggregate Bond Index holding Treasuries, the safe-haven trade lifted the benchmark for a second month. The 1.8% total return follows January’s 1.9% gain, providing the best year-to-date rally (+3.8%) so far for the major asset classes.

The de-risking that’s dominating sentiment of late is driven by concerns that the coronavirus will create substantial economic headwinds as nations around the world focus on containment. The potential for economic blowback is the biggest threat to the global economy since the 2008-2009 financial crisis, warns the OECD.

“Growth was weak but stabilizing until the coronavirus Covid-19 hit,” the OECD notes in a new economic outlook published today (March 2). “Restrictions on movement of people, goods and services, and containment measures such as factory closures have cut manufacturing and domestic demand sharply in China. The impact on the rest of the world through business travel and tourism, supply chains, commodities and lower confidence is growing.”

February losses were too extensive to spare the Global Markets Index (GMI) from red ink. This unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights fell 5.6% in February, a substantially deeper loss vs. January’s mild 0.2% decline for GMI.

For the trailing one-year period, GMI continues to hold on to a moderate 5.7% advance. US stocks (Russell 3000) are still posting a somewhat higher 6.9% one-year gain through last month’s close. US bonds, however, are now decisively in the lead (vs. all the major asset classes) for the trailing one-year window with an 11.7% total return for Bloomberg US Aggregate Bond Index.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Coronavirus Cut into Every Facet of the Major Asset Classes Last Week - TradingGods.net

Pingback: Major Asset Classes Have Moved into the Red - TradingGods.net

Pingback: Major Asset Classes Posted Gains Last Week - TradingGods.net