The US stock market was the clear performance leader for the major asset classes in November. The strong gain in American shares was all the more striking in a month that was otherwise skewed to the downside.

US companies, however, roared higher last month. The Russell 3000 Index jumped 3.8%, delivering its best gain since June. Year to date, the index is up 27.3%, which is also the leading performance for the major asset classes so far in 2019.

The second-best performer in November: foreign stocks in developed markets. The MSCI EAFE gained 1.1%, marking its third straight monthly increase.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Most of the major asset classes lost ground last month. The biggest loser: broadly defined commodities. The Bloomberg Commodity Index shed 2.6%. Despite the latest loss, commodities are holding on to a mild 2.5% year-to-date gain.

Although most markets backtracked in November, the Global Market Index (GMI) posted a monthly gain. This unmanaged benchmark that holds all the major asset classes (except cash) in market-value weights rose 1.7% last month, thanks to gains in its US and developed-market equity components.

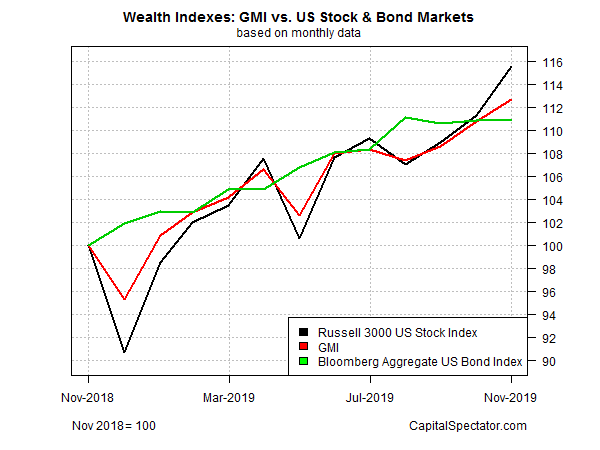

For the trailing one-year window, GMI is up a strong 12.7% (red line in chart below), modestly behind US equities (Russell 3000) and ahead of US investment-grade fixed income (Bloomberg Aggregate US Bond Index).

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: US Stock Market Performance Leader for Major Asset Classes in November - TradingGods.net

Pingback: Commodities Top Last Week's Returns - TradingGods.net

Pingback: Last Week's Top Gainers - TradingGods.net