It’s neck and neck in the US equity sector horse this year between real estate investment trusts (REITs) and technology shares. Both slices of the stock market are leading the rest of the field by wide margins via commanding year-to-date gains, based on a set of exchange funds through yesterday’s close (Oct. 23).

Real Estate Select Sector SPDR (XLRE) is in first place, posting a fractionally higher gain over tech. XLRE is up a red-hot 32.1% so far this year after factoring in distributions. Tech is a close second-place performer via Technology Select Sector SPDR (XLK), which is ahead in 2019 by 31.6%.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Low and falling interest rates continue to support demand for the relatively high-yielding REIT sector, advises MarketWatch.com.

With the Federal Reserve cutting short-term rates twice recently and reversing its decision to shrink its balance sheet earlier this year, along with continued stimulative central bank policies in other developed economies, there’s no reason not to expect the big money flow to continue, along with plenty of support for shares of real-estate investment trusts.

Whatever the allure, it’s obvious that the crowd is charmed by REITs in no trivial degree. Indeed, a price chart of XLRE shows that this year’s rally in the ETF has been a virtually non-stop party for the real estate bulls.

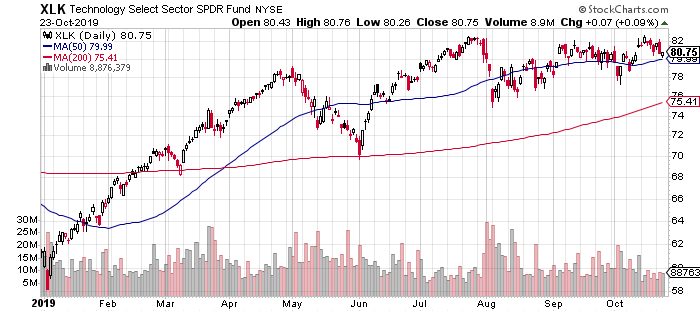

While technology’s year-to-date surge is on par with the gain in REITs in 2019, recent trading history for XLK suggests that the ETF has topped out, at least for the near term. The upward trend that prevailed in the first half of the year has given way in recent months to a sideways performance since late-August.

In any case, XLRE and XLK remain well ahead of the other sector results so far this year. Note that the third-best performer in 2019 is Utilities Select Sector SPDR (XLU). The ETF is up 24.9% — a strong year-to-date performance, albeit one that’s well behind REITs and tech.

All the major US equity sectors are enjoying year-to-date increases this year, but there’s a wide disparity between the top and bottom performances. Energy remains the laggard: Energy Select Sector SPDR (XLE) is up a relatively weak 6.1% in 2019 on a total-return basis.

Meanwhile, the US equity market overall is doing quite well, based on SPDR S&P 500 (SPY). Year to date, SPY’s total return is a strong 21.7%.

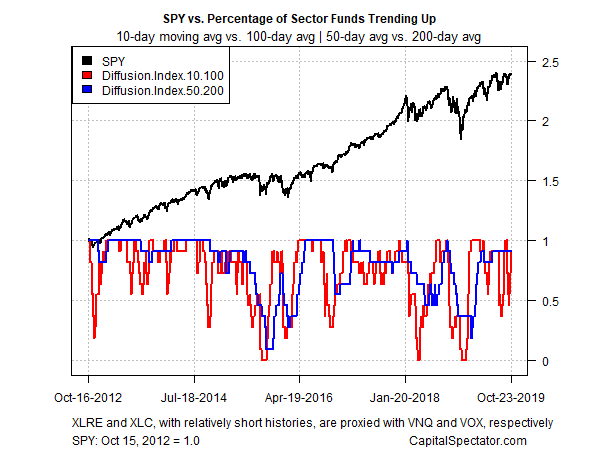

A momentum profile for all the US equity sectors continues to show a solid upside bias generally. The analysis is based on two sets of moving averages for the sector ETFs listed above. The first compares the 10-day moving average with its 100-day counterpart — a proxy for short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) represents an intermediate measure of the trend (blue line). Through yesterday’s close, the two indicators continue to reflect a wide-ranging degree of positive momentum. With the exception of energy shares (XLE), all the sector ETFs listed above are posting bullish profiles based on these two momentum metrics.

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: US Equity Sectors Lead by Real Estate and Tech - TradingGods.net