Concerns over Saudi Arabia’s supply of crude oil drove commodities prices higher last week, delivering the strongest gain for the major asset classes, based on a set of exchange traded funds.

The iShares S&P GSCI Commodity-Indexed Trust (GSG), which is dominated by crude oil, surged 3.5% for the trading week ended Sep. 20. The increase lifted the fund to its highest weekly close since early July.

The jump in oil prices was the primary source of GSG’s gain, thanks to a severe supply disruption after attacks on Saudi Arabia’s production facilities. The kingdom has vowed to repair the damage quickly and resume oil exports, but new doubts persist about the reliability of Saudi supply. Meantime, Reuters today reports that Saudi Arabia has restored roughly 75% of output and plans to return to full volumes in a week or so.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

The US oil benchmark (West Texas Intermediate) is trading below $60 a barrel this morning, well below last week’s high, based on the November 2019 futures contract.

Most markets posted gains last week. The second-strongest performer among the major asset classes: US real estate investment trusts (REITs). Vanguard Real Estate (VNQ) rose a strong 2.0%, closing last week near a record high.

Last week’s biggest loss among the major asset classes: emerging markets stocks. Vanguard FTSE Emerging Markets (VWO) fell 1.6% during the trading week ended Sep. 20. The slide marks the ETF’s first weekly decline in a month.

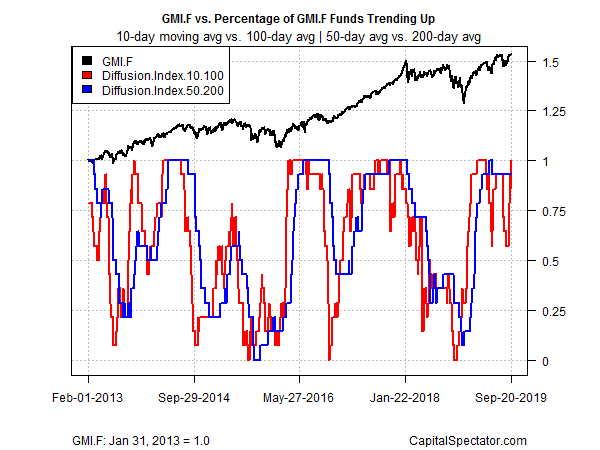

An ETF-based version of the Global Market Index (GMI.F) was essentially flat last week. This unmanaged benchmark, which holds all the major asset classes (except cash) in market-value weights, posted a fractional loss after three straight weekly gains.

For the one-year trend, US REITs continue to lead the field by a wide margin. VNQ is up 18.9% on a total return basis for the past year – well ahead of the second-strongest one-year performer: investment-grade US bonds via Vanguard Total Bond Market (BND), which is ahead by 10.4%.

In contrast with last week’s winning performance, broadly defined commodities remain dead last for the one-year change. GSG fell 11.4% as of last week’s close vs. the year-earlier price.

GMI.F is up a moderate 4.1% on a total-return basis for the trailing one-year window.

Profiling the major asset classes via momentum indicators paints an upbeat profile. Although markets have stumbled recently, last week’s trading delivered a rebound in the momentum profile overall. The analysis is based on two sets of moving averages for the ETFs listed above. The first compares the 10-day moving average with its 100-day counterpart — a proxy for short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) represent an intermediate measure of the trend (blue line). At last week’s close, short-term momentum revived to a perfect score (all funds reflect a 10-day moving average above the 100-day average). Medium-term momentum is almost as strong. There’s no shortage of potential risks lurking in the global economy, but at last week’s close most markets have climbed a wall of worry.

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report