The manufacturing sector continues to be a drag on economic growth in the US and around the world. Consumer spending and the services sector have been counterweights. But new survey data for August suggests that services may be vulnerable. Weakness in manufacturing and services appears to be creating the biggest threat to the economy since the expansion started ten years ago.

The US Composite Output Index, a proxy for GDP, slipped this month to 50.9, just above the neutral 50 mark that separates growth from contraction. The initial reading for August is a warning that output has slowed to a crawl and is vulnerable to contraction in the months ahead.

“August’s survey data provides a clear signal that economic growth has continued to soften in the third quarter,” says Tim Moore, economics associate director at IHS Markit, which publishes the PMI numbers. “The PMIs for manufacturing and services remain much weaker than at the beginning of 2019 and collectively point to annualized GDP growth of around 1.5%.”

Survey data isn’t the final word on economic conditions, of course, and so this data should be viewed cautiously at this point. Nonetheless, it’s a reminder that risks are bubbling.

Nonetheless, the US still looks set to skirt an outright contraction in the near term, but that’s largely if not completely due to the consumer and the services sector. But services activity appears to be giving way, or so the latest survey figures suggest.

The initial data for the US Services PMI shows a drop to 50.9 this month, down from 53.0 in July. That’s an uncomfortably small margin of comfort for this critical sector–all the more since manufacturing is now contracting, slightly, according to the sector’s PMI. As a result, if services activity slips further in September and beyond, it would seem that the US economy will succumb to the dark side for the first time in a decade. The best you can say about services, as IHS Markit does, is that economic activity is “subdued.”

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

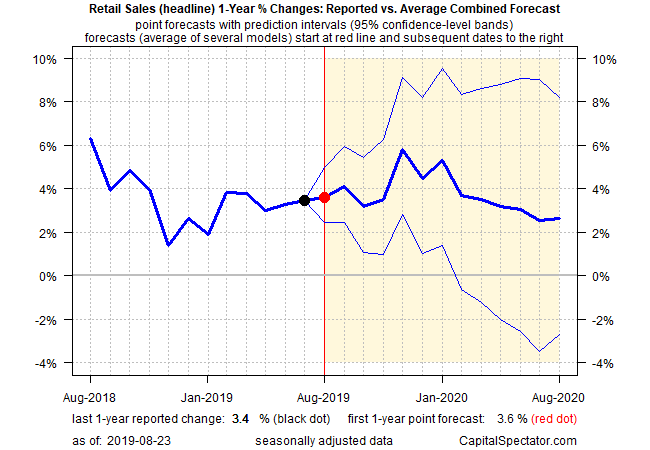

That leaves most if not all of the recession risk in the hands of consumers. Last week’s release of retail sales data for July paints a moderately upbeat profile. Spending ticked up to a solid 0.7% monthly gain, a four-month high, lifting the one-year trend to a 3.4% increase—a middling pace relative to recent history.

The near-term outlook for the retail trend looks encouraging in the sense that the moderate one-year gain last month remains on track to more or less hold. For example, the point forecast for spending in August is projected to tick up to a 3.6% gain, based on The Capital Spectator’s combination forecasting model.

The labor market continues to trend positively, too, which is no trivial factor for keeping consumer spending bubbly. Yesterday’s update on jobless claims, for instance, still point to a solid expansion for payrolls.

So, yes, the hard data still looks encouraging, but official economic numbers arrive with a lag. The more recent sentiment profile for US consumers in August, by contrast, offers a more up-to-date snapshot of Main Street. Unfortunately, the mood took a hit this month via the University of Michigan’s Consumer Sentiment Index, which fell to the lowest level since the start of the year.

“Consumers strongly reacted to the proposed September increase in tariffs on Chinese imports, spontaneously cited by 33% of all consumers in early August, barely below the recent peak of 37%,” a press release notes. “Although the announced delay until Christmas postpones its negative impact on consumer prices, it still raises concerns about future price increases.”

Uncertainty in general is weighing on the US economy. Although the headwinds from the US-China trade war have been modest to date, the pressure is building. The manufacturing sector has taken the biggest hit so far.

“The hope is that the consumer side stays strong enough to offset the weakness,” says Liz Ann Sonders, chief investment strategist at Charles Schwab.

By some accounts, the outlook remains bright on this front. “The underlying US consumer is doing well, making more money, they’re employed and, more importantly, they’re spending more money,” advises Bank of America CEO Brian Moynihan. “The US consumer continues to spend, and that will keep the US economy in good shape.”

The question is whether the near-term rear-view mirror will continue to hold up as signs of trouble mount. Notably, the services sector looks headed for rough patch, according to the latest PMI survey results. “Business expectations among service providers for the next 12 months eased in August and were the lowest since this index began nearly a decade ago,” IHS Markit noted in yesterday’s report.

The main risk factor at the moment is the US-China trade war. With no sign that a resolution is near, the conflict will continue to pinch economic activity, if only on the margins. But a much bigger front on trade risk may be approaching. As CNBC reports,

The United States has more to lose from a full-blown trade war with the EU than it does with its current conflict with China, experts have told CNBC.

President Donald Trump has kept up his tough rhetoric against the European Union despite focusing on Chinese tariffs in recent months. But his administration is due to decide in November whether to impose duties on one of most important industries in Europe: autos.

For now, forward momentum on the US economy remains positive and the immediate risk of recession remains low. Third-quarter nowcasts for GDP growth still look modestly upbeat. The Atlanta Fed’s GDPNow model, for instance, is currently projecting that output will 2.2%, a touch better than Q2’s 2.1% gain. Both increases represent hefty slowdowns from Q1, but a 2% advance, give or take, is enough to keep the decade-long expansion alive.

But depending on how the Trump administration manages its trade war from here on out, including the decision to expand the conflict to Europe, or not, will cast a long shadow on how the economy performs for the rest of the year into 2020. Political risk, in short, remains the biggest threat to the longest US expansion on record.

“The China trade war is causing most of this [uncertainty and economic strain],” says Republican Sen. Lindsey Graham, a Trump ally. “It’s just the world economy is affected when China has a problem.”

How this plays out is anyone’s guess. What’s clear is that economic risk is rising for the US, largely for self-inflicted reasons. It could all disappear tomorrow, but it could just as easily simmer for months. As bouts of economic uncertainty go, it doesn’t get much cloudier than it is right now.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Manufacturing Sector Drag on Economic Growth - TradingGods.net