Investors can’t get enough of bond-market risk this year. Sure, the bull run in US stocks is a sight to behold, but the animal spirits in fixed income are no less impressive. Demand for bonds has lifted all the major slices of US fixed income so far in 2019, based on a set of exchange-traded funds.

Animating this year’s bond rally: expectations that the Federal Reserve has shelved its plans for more interest-rate hikes and is now pondering rate cuts to combat a slowing economy. Fed funds futures are currently pricing in a virtual certainty of a rate cut at next month’s policy meeting, according to CME data.

The possibility that the yields will fall (and bond prices will rise) has fueled a powerful rally in fixed-income risk this year. Notably, the long-end of the curve for corporate bonds is soaring. This year’s top performer by far: Vanguard Long-Term Corporate Bond (VCLT), which has surged 14.9% on a total-return basis through yesterday’s close (June 26).

VCLT’s high-flying performance in 2019 is well ahead of the second-best year-to-date return in US fixed income via junk bonds. SPDR Bloomberg Barclays High Yield Bond ETF (JNK) is currently up 10.4% this year.

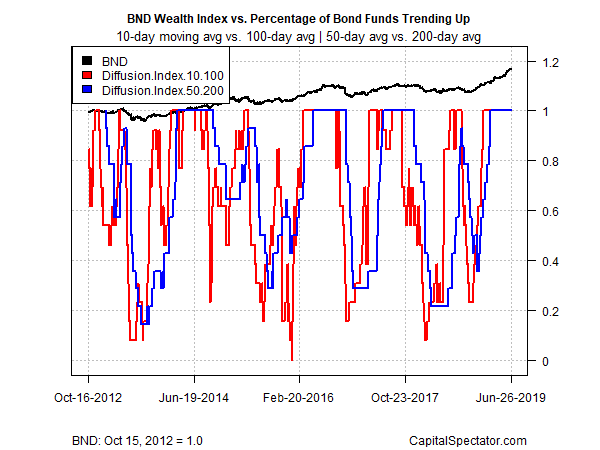

US bonds overall are enjoying a strong run, based on the fixed-income benchmark via Vanguard Total Bond Market (BND). This fund, which holds a representative sample of all US investment-grade debt, is higher by 5.7% year to date (red line in chart above).

Not surprisingly, companies are rushing to float new debt to take advantage of the crowd’s eagerness to buy just about anything offered in bond-land regardless of the yield. The appetite is such that the market has bid up bond prices to the point that the world is now awash in negative-yielding debt (prices and yields move inversely in the bond market). According to Bloomberg, the world’s supply of sub-zero-yielding bonds has recently hit a record $13 trillion.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

The benchmark US Treasury yield, by contrast, is still comfortably positive, although this bellwether rate has fallen sharply this year and is currently trading at 2.05%, as of June 26. That’s down from more than 3.2% as recently as November.

The outlook for softer economic growth and subdued inflation has kept hope alive that the US bond market will continue to deliver healthy capital gains in the face of dwindling current yields. The macro data has been cooperative so far, although it’s unclear how long the party can last. Clearer signs that US recession risk is rising would do the trick. Economic headwinds have strengthened, but for now the odds are still low that a new downturn is imminent.

The bond market thinks otherwise and perhaps the crowd is right. Maybe the answer of what happens next lies in upcoming tweets from President Trump, who’s set to meet with China’s President Xi at the G20 summit that started today. By some accounts, the leaders will agree to a ceasefire in the US-China trade war, which would give a boost to the economic outlook. In turn, a softer, kinder run with trade tensions could take the edge off the bond-market rally. By contrast, a disappointing tête-à-tête could unleash a new phase of a bull run in bonds.

In any case, fixed-income traders are already pricing in a perfect storm of slower economic growth (or worse) and disinflation. Measuring momentum in the bond market certainly reflects this outlook in the extreme, based on two measures of the price trend. The first metric is a set of moving that compares each ETF’s 10-day moving average with the 100-day average — short-term trending behavior (red line in chart below). A second set of moving averages (50 and 200 days) offers an intermediate measure of the trend (blue line). The indexes range from 0 (all funds trending down) to 1.0 (all funds trending up).

Using prices as of yesterday’s close shows that all the bond ETFs are posting a bullish posture in no uncertain terms. As fixed-income nirvana goes, this is as good as it gets. The only mystery: how long will the bliss in everything last?

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: Demand for Bonds Brings Rally for Bond-Market - TradingGods.net