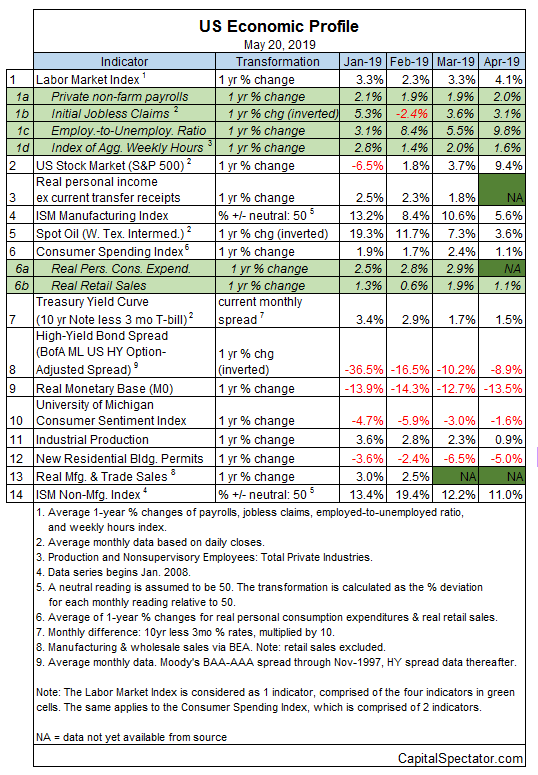

Recent economic data is clouding the outlook for the US macro trend. Although a recession hasn’t started and isn’t likely to begin in the immediate future, several key indicators suggest that output is slowing and so uncertainty is rising for the second half of the year.

Notably, industrial production’s one-year change eased to a sluggish 0.9% increase in April—the weakest gain in over two years. Meanwhile, retail spending, although still rising at a modest 3.1% year-over-year pace last month, remains subdued relative to the trend at this point in 2018.

On the plus side, the labor market’s trend remains strong. Private payrolls expanded 2.0% in April in annual terms, a healthy gain that implies that macro risk remains low. Low jobless claims, which have been near 50-year lows recently, point to ongoing strength for the labor market for the foreseeable future.

Despite the upbeat numbers for the labor market of late, the 3-month average of the Chicago Fed National Activity Index fell to a three-year low in April. Although this business-cycle benchmark remains above the -0.70 tipping point that signals recession, the current -0.32 print suggests that the economy is slowing to the point that downside surprises in the near-term future could threaten the expansion.

For the moment, however, recession risk remains low, based on The Capital Spectator’s proprietary business-cycle model. Analyzing the data in the table below through this lens reflects a low probability that an NBER-defined downturn has started. (For a more comprehensive review of the macro trend with weekly updates, see The US Business Cycle Risk Report.)

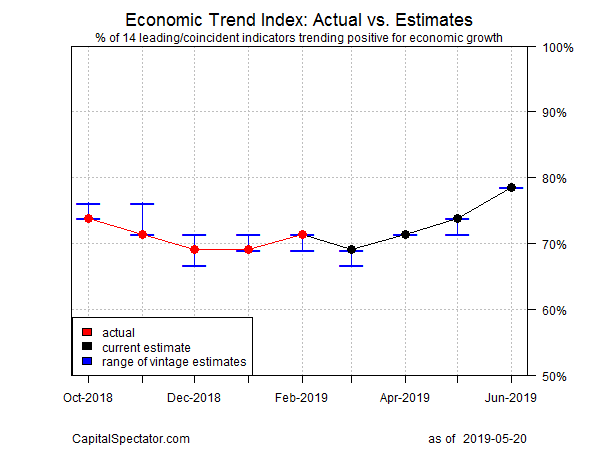

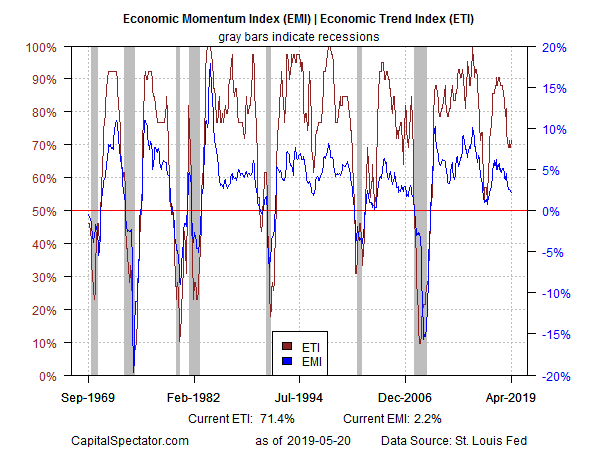

The Economic Trend Index (ETI) – a business-cycle index that tracks 14 indicators that capture a broad snapshot of US economic activity – has stabilized at roughly the 70% level in recent months (see chart below). This reading is well above the 50% tipping point–readings below this level indicate recession. Note, however, that filtering the data through another econometric lens – the Economic Momentum Index or EMI – shows that the trend is still weakening, albeit marginally. Although EMI is still comfortably above its 0% tipping point, the persistently lower values in recent history is worrisome. (For details on the design and interpretation of ETI and EMI, see my book on monitoring the business cycle.)

Translating ETI’s historical values into recession-risk probabilities via a probit model points to low business-cycle risk for the US through last month. Analyzing the data through this lens indicates that the odds remain virtually nil — roughly 1% — that NBER will declare April as the start of a new recession.

For the near-term outlook, consider how ETI may evolve as new data is published. One way to project values for this index is with an econometric technique known as an autoregressive integrated moving average (ARIMA) model, based on default calculations via the “forecast” package in R. The ARIMA model calculates the missing data points for each indicator for each month — in this case through June 2019. (Note that February 2019 is currently the latest month with a complete set of published data for ETI.) Based on today’s projections, ETI is expected to increase modestly through June. If this outlook is correct, the recent questions about the economic outlook will fade as growth picks up.

Forecasts are always suspect, but recent projections of ETI for the near-term future have proven to be reliable guesstimates vs. the full set of published numbers that followed. That’s not surprising, given ETI’s design to capture the broad trend based across multiple indicators. Predicting individual components in isolation, by contrast, is subject to greater uncertainty. The assumption here is that while any one forecast for a given indicator will likely be wrong, the errors may cancel out to some degree by aggregating a broad set of predictions. That’s a reasonable view, based on the generally accurate historical record for the ETI forecasts in recent years.

The current projections (the four black dots in the chart above) suggest that the economy will continue to expand in the immediate future, perhaps at a modestly stronger pace. The chart also shows the range of vintage ETI projections published on these pages in previous months (blue bars), which you can compare with the actual data (red dots) that followed, based on current numbers.

For more perspective on the track record of the ETI forecasts, here are the vintage projections for the past three months:

25 April 2019

28 March 2019

21 February 2019

Note: ETI is a diffusion index (i.e., an index that tracks the proportion of components with positive values) for the 14 leading/coincident indicators listed in the table above. ETI values reflect the 3-month average of the transformation rules defined in the table. EMI measures the same set of indicators/transformation rules based on the 3-month average of the median monthly percentage change for the 14 indicators. For purposes of filling in the missing data points in recent history and projecting ETI and EMI values, the missing data points are estimated with an ARIMA model.

Pingback: Economic Data Clouding Outlook for US Macro Trend - TradingGods.net

Pingback: Weighing the Week Ahead: What Should We Make of a Sputtering Economic Engine? | Dash of Insight

Pingback: Is Economic Engine Sputtering? - TradingGods.net

Pingback: Is Slowing Economy Slipping into Recession? - TradingGods.net