Economic output is still on track to decelerate to a moderately slower pace in the government’s fourth-quarter report on gross domestic product (GDP) due later this month, based on based on the median estimate for a set of nowcasts compiled by The Capital Spectator. Today’s update reflects a slightly firmer gain vs. the previous estimate published two weeks ago.

Today’s median Q4 nowcast ticked up to 2.8% (seasonally adjusted annual rate) from 2.6% in the Jan. 4 update. In other words, the upcoming GDP report from the Bureau of Economic Analysis (assuming it re-opens) that’s scheduled for Jan. 30 appears set to report that growth downshifted for a second straight quarter.

“At the end of last year, there was a particularly sharp downgrade in expectations for the US,” says Goldman Sach’s Peter Oppenheimer. “While there has been a big tightening of policy and financial conditions in the US… we don’t see a recession, but we do see a pretty sharp slowdown,” adding that markets had “got too far into pricing a deeper downturn than we expect.”

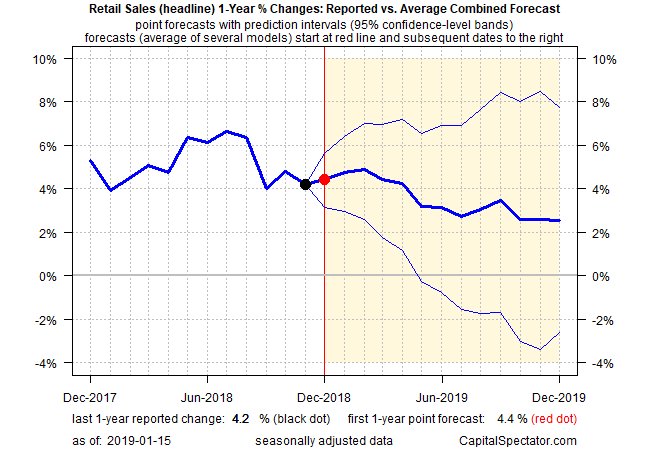

Projecting the one-year trend for GDP for the year ahead aligns with Goldman’s outlook. The chart below shows the average forecast for year-over-year changes in output, based on the average estimate via nine models. The main takeaway: US economic activity peaked last year and is set to slow in 2019 – a forecast that’s been a staple for The Capital Spectator for several months – see here, for instance.

Monitoring the US economy in the weeks and perhaps months ahead could be challenging, however, due to the partial government shutdown. There’s never a good time to go dark with economic releases, but the current environment of softer growth threatens to be especially problematic for playing the guessing games on the US macro trend. Challenging or not, there’s no sign that the shutdown will end soon, which means that several key numbers in the coming days will remain a mystery, including tomorrow’s scheduled release of retail sales figures for December.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Using the numbers published to date, however, suggests that retail spending’s trend is set to pick up. The Capital Spectator’s estimate for the annual change in December, based on the average estimate of nine models, calls for a modestly firmer increase of 4.4% from 4.2% through November.

But with the Census Bureau closed, tomorrow’s retail sales data will remain a mystery until some unknown date in the future.

Then again, perhaps the retail data (along with Thursday’s scheduled release of housing starts) will slip out. Bob Dieli, an economist who runs the No Spin Forecast consultancy, tells The Capital Spectator that “the stories that I have seen so far have made it sound as though the Census Bureau has some wiggle room. If I had to guess, I would say they would like to do retail sales because of its profile, along with housing starts and GDP.”

Meantime, the Bureau of Labor Statistics (BLS) is still open and publishing data. According to a press release on the BLS web site, “the January 2019 Employment Situation will be published as scheduled on February 1, 2019.”

Missing data is only part of the problem. A bigger issue is the self-inflicted economic damage that the partial shutdown will unleash if the political stalemate rolls on.

“How big a jolt a shutdown causes the economy depends on how long the government is closed,” S&P Global Ratings advised on Friday. “While not in our estimate, we expect that the weekly costs will widen beyond the average weekly cost of $1.2 billion as the shutdown ages.”

The longer this shutdown drags on, the more collateral damage the economy will suffer. Ironically, based on our analysis, it will only take another two weeks before the cost of the shutdown would be more than the $5.7 billion requested for the proposed southern wall.

Is Recession Risk Rising? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: Economic Output on Track to Decelerate to a Slower Pace - TradingGods.net