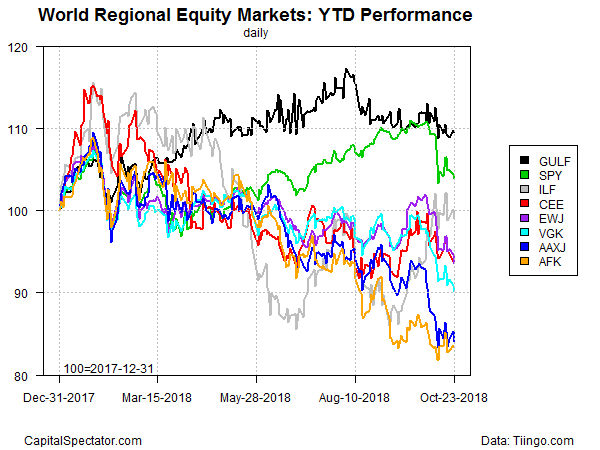

Equity markets in the Mideast remain the performance leader this year as selling takes a toll on the world’s other major stock market regions, based on a set of exchange-traded funds as of yesterday’s close (Oct. 23).

The ongoing year-to-date leadership in WisdomTree Middle East Dividend (GULF), with a roughly 25% weight in Saudi Arabia, is striking in the wake of the international crisis following revelations about the killing of Saudi writer Jamal Khashoggi. Despite the fallout that’s damaged Saudi Arabia’s reputation on the world stage, the GULF portfolio continues to hold its ground and is up a relatively strong 9.6% so far in 2018.

US equities are the second-best performer year to date. Despite the sharp selloff this month, SPDR S&P 500 (SPY) still posts a moderate 3.9% total return for 2018.

The rest of field is underwater on a year-to-date basis. The biggest loss for the major equity regions is Africa: VanEck Vectors Africa Index (AFK) is in the red by 16.7% so far in 2018.

Notably, stocks in Latin America have been strong lately, despite the headwinds blowing in most corners of the global equity markets in recent weeks. The iShares Latin America 40 (ILF) is nursing a slight 0.9% year-to-date loss, but the ETF’s recent rally has lifted the price 6.1% over the trailing one-month period.

Meanwhile, a broad measure of all the world’s stock markets is posting a modest loss this year. Vanguard Total World Stock (VT) is down 3.4% so far this year through Oct. 23.

GULF and ILF may continue to buck the trend for the bearish bias of late, but US stocks look headed for more selling today, based on futures in early trading on Wednesday. At 6:30 am ET, the broad market indexes reflected moderate losses.

By the reckoning of one columnist at Bloomberg, US stocks “are on the brink of a bear market.”

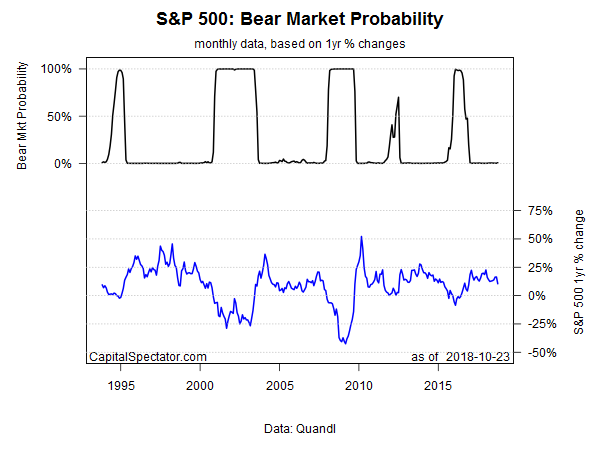

Perhaps, but an econometric estimate of bear market risk for the S&P 500 still reflects a zero probability (see here for a summary of the methodology). A key support factor is the economy, which remains comfortably in a growth mode with low recession risk.

The key question in the days ahead: Will Mr. Market forecast a darker outlook that’s not yet reflected in the macro numbers?

Interested In Learning R For Portfolio Analysis?

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Mideast Stocks Steady As Rest Of World’s Equities Fall - TradingGods.net