Small-capitalization equities in the US have been on a tear this year, but investors are wondering if the headwinds in recent weeks are a sign that the strong upside momentum has run its course.

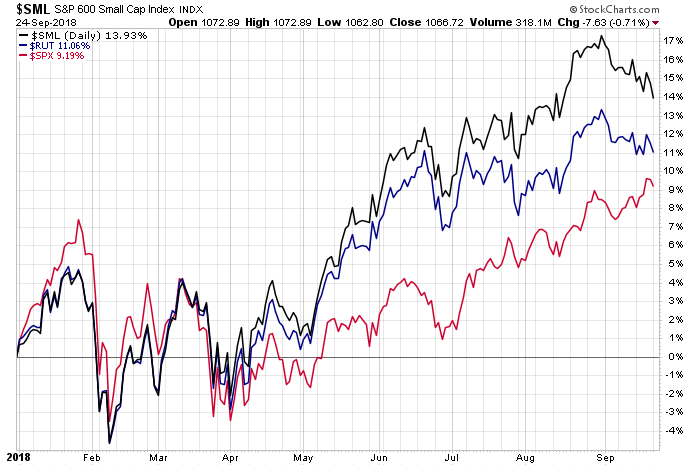

Small caps are still comfortably in the lead over large caps year to date, but trading in September has witnessed a reversal of fortunes for this formerly red-hot slice of the US equity market. For a closer look, let’s start by recognizing that two widely followed small-cap benchmarks continue to beat the broad market via the S&P 500 ($SPX) for 2018 through yesterday’s close (Sep. 24). The Russell 2000 Index ($RUT) is up a solid 11.1% this year and the S&P 600 ($SML) is doing even better with a 13.9% total return year to date. In both cases, the performances represent healthy premiums over the S&P 500’s 9.2% gain so far this year.

It’s premature to read too much into recent history, but it’s hard not to wonder if the small-cap rally’s low- hanging fruit has now been picked. Consider how performances stack up for the past month. While the broad market via the S&P 500 remains in positive terrain, the two small-cap indexes have stumbled are now in the red over the trailing one-month period.

Another worrisome sign for small-cap bulls is the partial deterioration in the technical profile for $SML. For the first time since May, the S&P 600 fell below its 50-day moving average yesterday. That alone is hardly a definitive sign that a bear market in small caps is now destiny. Perhaps it’s merely a healthy consolidation after a strong run.

Whatever the future holds for small caps, investors will be mindful that headwinds from macro factors may be lurking. The escalating US-China trade war in particular is front and center these days for looking ahead. Small-cap stocks have been widely hailed this year as a port in the storm for rising international tensions, courtesy of a relatively high domestic focus for many of these firms. But it remains to be seen how much of a moat that focus will be if the blowback from a trade war pinches the US economy.

For the moment, trade risk is still increasing. On Monday, each country imposed the biggest tariffs on each other so far. By some accounts, further deterioration is in the cards.

William Zarit, chairman of the American Chamber of Commerce in China, predicts the conflict is “going to get worse.”

If Zarit’s outlook is accurate, what does that imply for small caps and US equities in general? At the very least, a further escalation in the trade war will test theory that small stocks are relative havens compared with the broader market a la the S&P 500, which has greater exposure to foreign markets and therefore troubles linked to a trade war. Based on the last month, however, it’s not obvious that’s a distinction that still resonates with the crowd.

A New Book On Using R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

Pingback: Small Caps Facing Headwinds - TradingGods.net