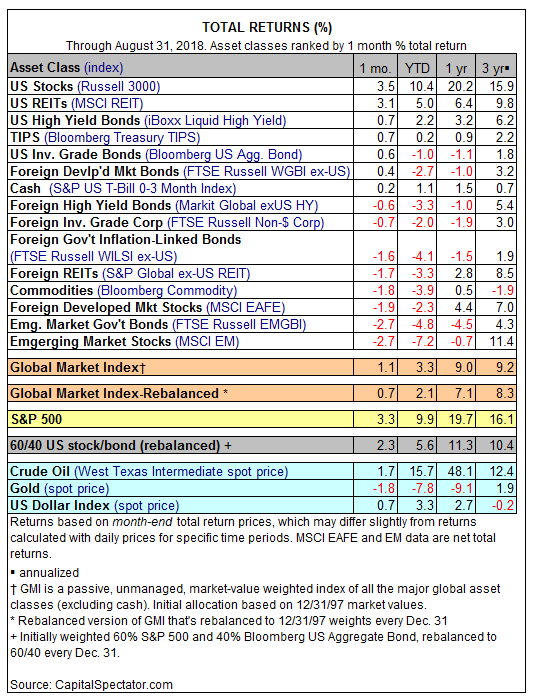

US equities topped the performance ledger for a second straight month in August for the major asset classes. The gain marked the fifth straight monthly increase and the strongest for the US stock market since January.

Russell 3000 Index, a broad measure of shares in the US, rose 3.5% last month. In close pursuit: real estate investment trusts (REITs), which posted the second-best return in August. MSCI US REIT Index jumped 3.1% last month, the sixth consecutive monthly gain for the gauge of securitiezed real estate shares.

A New Book On Using R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno

The big loser in August: emerging markets. Stocks and bonds in emerging markets are essentially tied for last place in last month’s horse race. Equities posted a fractionally bigger loss: MSCI Emerging Markets Index fell 2.7% — the sixth monthly decline in the last seven months. Posting a nearly equivalent loss: FTSE Russell Emerging Markets Government Bond Index, which has slumped in every month since April.

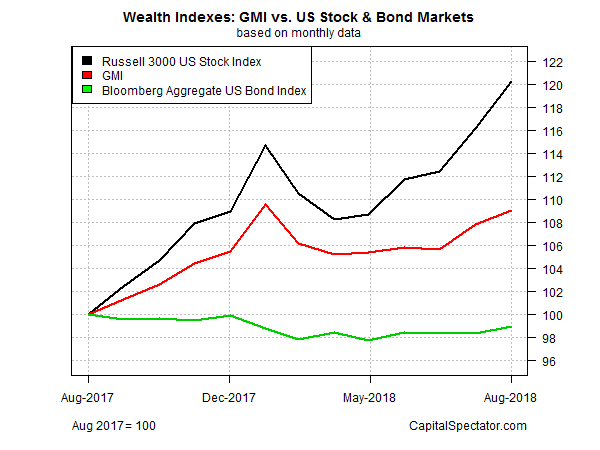

The overall trend for assets remained positive in August, based on the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. GMI advanced for a second straight month in August, posting a 1.1% gain. For the trailing one-year window, the index is up a solid 9.0%

By comparison, US equities (Russell 3000) are up a significantly stronger 20.2% over the past year while the US investment-grade bond market (Bloomberg US Aggregate Bond) slipped by 1.1% in August vs. the year-ago level.

Pingback: US Equities Top the Performance Ledger for August - TradingGods.net

Pingback: I Pick Things Up and Put Them Down: August 2018 (Savings and Investing Diary) - The CorpRaider

Pingback: Losses For Main Categories of Global Markets Last Week - TradingGods.net

Pingback: Commodities Surged Last Week - TradingGods.net