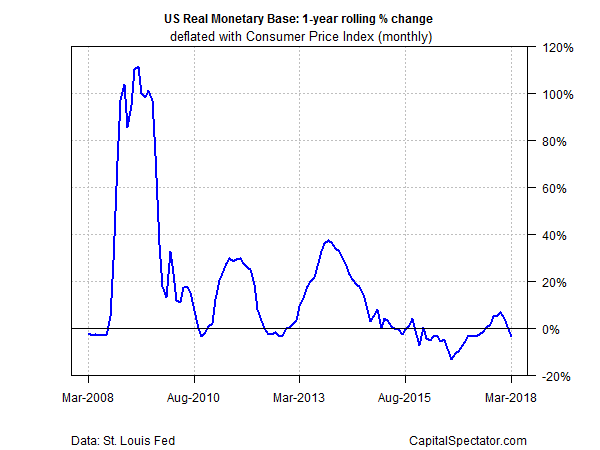

For the first time in eight months, inflation-adjusted base money (aka M0) in the US contracted in March, slipping 3.7% vs. the year-ago level. The slide comes at a time when Fed Chairman Jerome Powell is emphasizing that markets should be expecting gradual interest rate increases in the months ahead.

“Markets should not be surprised by our actions if the economy evolves in line with expectations,” Powell said in a speech in Zurich on Tuesday. He also noted:

I do not dismiss the prospective risks emanating from global policy normalization. Some investors and institutions may not be well positioned for a rise in interest rates, even one that markets broadly anticipate… risk sentiment will bear close watching as normalization proceeds around the world.

Meanwhile, the return of a negative trend in real M0’s year-over-year change suggests that the central bank’s monetary tightening program is accelerating, if only slightly. The dip marks a break after seven straight months of annual increases. The latest downturn may signal a new phase in the Fed’s policy for squeezing the money supply.

Recall that real annual trend for the Fed’s narrowest gauge of money supply — also known as base money or high-powered money — offered an early sign in 2015 that the Fed was moving toward hiking interest rates for the first time in nearly a decade. Later that year, in December, the central bank announced that it was raising the target range for the federal funds rate. The central bank has increased rates several times since then.

The latest slide in M0’s real year-over-over change coincides with Fed funds futures pricing in a 95% probability for a rate hike at next month’s policy meeting, based on CME data in early trading for Tuesday, March 8. In the context of the futures-based forecast, the return of a negative M0 trend implies that the Fed’s commitment to raising rates is strengthening.

Meantime, keep your eye on the daily effective Fed funds (EFF) rate for a possible early hint of the central bank’s policy decision next month. For example, EFF inched up ahead of the March 21 announcement to raise the target range for the federal funds rate to 1.50% to 1.75%. EFF remained at or below 1.42% throughout 2018 until ticking up to 1.43% for the first time this year on March 15, followed by another fractional increase to 1.44% on March 20 — ahead of the March 21 rate hike.

EFF doesn’t always rise before a Fed rate hike. Even when it does that’s no guarantee that another increase is fate. Nonetheless, watching EFF is useful in context with monitoring Fed funds futures, M0 and other data for developing insight into where Fed policy may be headed. As such, the latest numbers suggest that the central bank remains on track to squeeze policy again at the June 12-13 FOMC meeting.

When will the next recession strike? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Pingback: Inflation-Adjusted Money Contracted in March - TradingGods.net

Pingback: Softer Inflation Data For April Doesn't Change Fed's Policy Outlook | Growth Investing Research