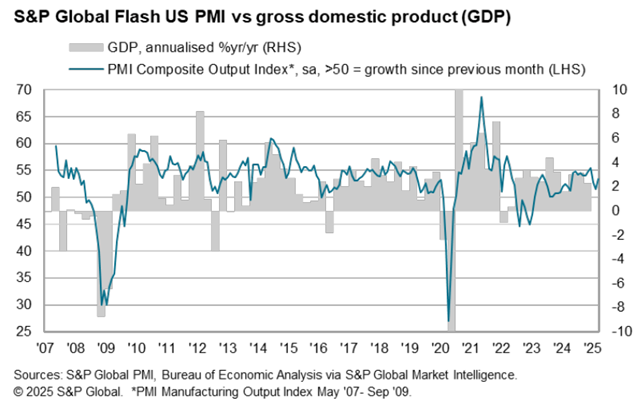

US business activity growth strengthened in March, rising to a 3-month high, according to US PMI Composite Output Index, a survey-based GDP proxy. A pickup up in growth for the services industry drove the improvement as activity in the manufacturing sector weakened. “A welcome upturn in service sector activity in March has helped propel stronger economic growth at the end of the first quarter,” says the chief business economist at S&P Global Market Intelligence. “However, the survey data are indicative of the economy growing at an annualized 1.9% rate in March and just 1.5% over the quarter as a whole, pointing to a slowing of GDP growth compared to the end of 2024.”

Monthly Archives: March 2025

Energy And Healthcare Stocks Are Big Winners This Year

It’s been a rough year for the US stock market so far, but you wouldn’t know it by looking at year-to-date returns for energy and healthcare shares, based on a set of ETFs through Friday’s close (Mar. 21). Both equity sectors are posting strong gains in 2025, marking them as standout winners when the market overall is nursing a moderate loss.

Macro Briefing: 24 March 2025

The US Treasury yield curve has inverted again, based on the 10-year less 3-month spread. The difference between maturities was a slightly negative -0.03. Historically, a negative spread implies that recession risk is elevated for the near term, although this widely followed indicator doesn’t have a perfect record. The only blemishes on its record are the 1998 and mid-2022 inversions, which produced no subsequent economic recessions. Most recently, the curve inverted in 2022 and 2023 without leading to a recession.

Book Bits: 22 March 2025

● King Dollar: The Past and Future of the World’s Dominant Currency

● King Dollar: The Past and Future of the World’s Dominant Currency

Paul Blustein

Review via Financial Times

Dollar hegemony has long enraged governments around the world. In the 1960s the French complained of America’s “exorbitant privilege”. Forty years later, as the global financial crisis wreaked havoc, China called for a shift away from the dollar… Blustein believes that the forces supporting the dollar are quite durable and the potential alternatives weak, making its dominance “almost impregnable”. Even if the dollar’s role attenuates, he is not too concerned. Financial stability might actually increase with more international currencies, he writes, because “a multipolar currency regime would create more safe havens to flee to during crises.”

Research Review | 21 MAR 2025 | Models and Forecasts

ChatGPT and Deepseek: Can They Predict the Stock Market and Macroeconomy?

Jian Chen (Xiamen University), et al.

February 2025

We study whether ChatGPT and DeepSeek can extract information from the Wall Street Journal to predict the stock market and the macroeconomy. We find that ChatGPT has predictive power. DeepSeek underperforms ChatGPT, which is trained more extensively in English. Other large language models also underperform. Consistent with financial theories, the predictability is driven by investors’ underreaction to positive news, especially during periods of economic downturn and high information uncertainty. Negative news correlates with returns but lacks predictive value. At present, ChatGPT appears to be the only model capable of capturing economic news that links to the market risk premium.

Macro Briefing: 21 March 2025

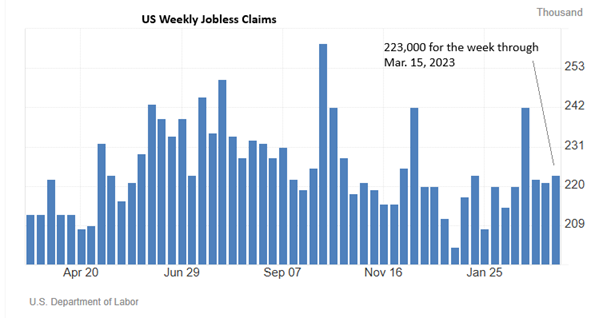

US jobless claims rose modestly last week, but remain low, suggesting the near-term outlook for the labor market remains positive. Claims rose 2,000 to a seasonally adjusted level of 223,000, a middling level relative to recent history.

US Stocks Remain 2025’s Only Loser For The Major Asset Classes

Investing in just about anything other than US stocks has been a winning strategy this year. Using a set of ETF proxies shows that American shares are still the only source of red ink among the major asset classes year to date, based on trading through Mar. 19.

Macro Briefing: 20 March 2025

Federal Reserve keeps its target interest rate steady and lifts its forecast for US inflation and lowers growth estimate for 2025. Most Fed officials continue to expect that the central bank will lower interest rates this year, despite higher inflation expectations. In a press conference yesterday, Fed Chairman Powell said: “Inflation has started to move up now, we think, partly in response to tariffs, and there may be a delay in further progress in the course of this year.”

A Fed Rate Cut May Be Near, But Not Today

The surge in macro uncertainty related to tariffs, including the possibility of a global trade war, has complicated the Fed’s already difficult task of setting interest rates to accommodate an unknown future. The added complication of factoring in how White House policy will evolve, and how that will influence future inflation and economic activity, is about as challenging as it gets when the main tool is the blunt instrument of adjusting interest rates.

Macro Briefing: 19 March 2025

US housing starts rebounded in February, but newly issued building permits — a leading indicator for residential construction — eased for a second month and fell 6.8% vs. the year-ago level. “January’s dramatic drop in housing starts, largely driven by exceptionally cold weather, reversed in February, but a decline in housing permits tempered the optimism. Looming tariffs are creating considerable uncertainty about construction costs, limiting activity,” advises Bloomberg Economics.