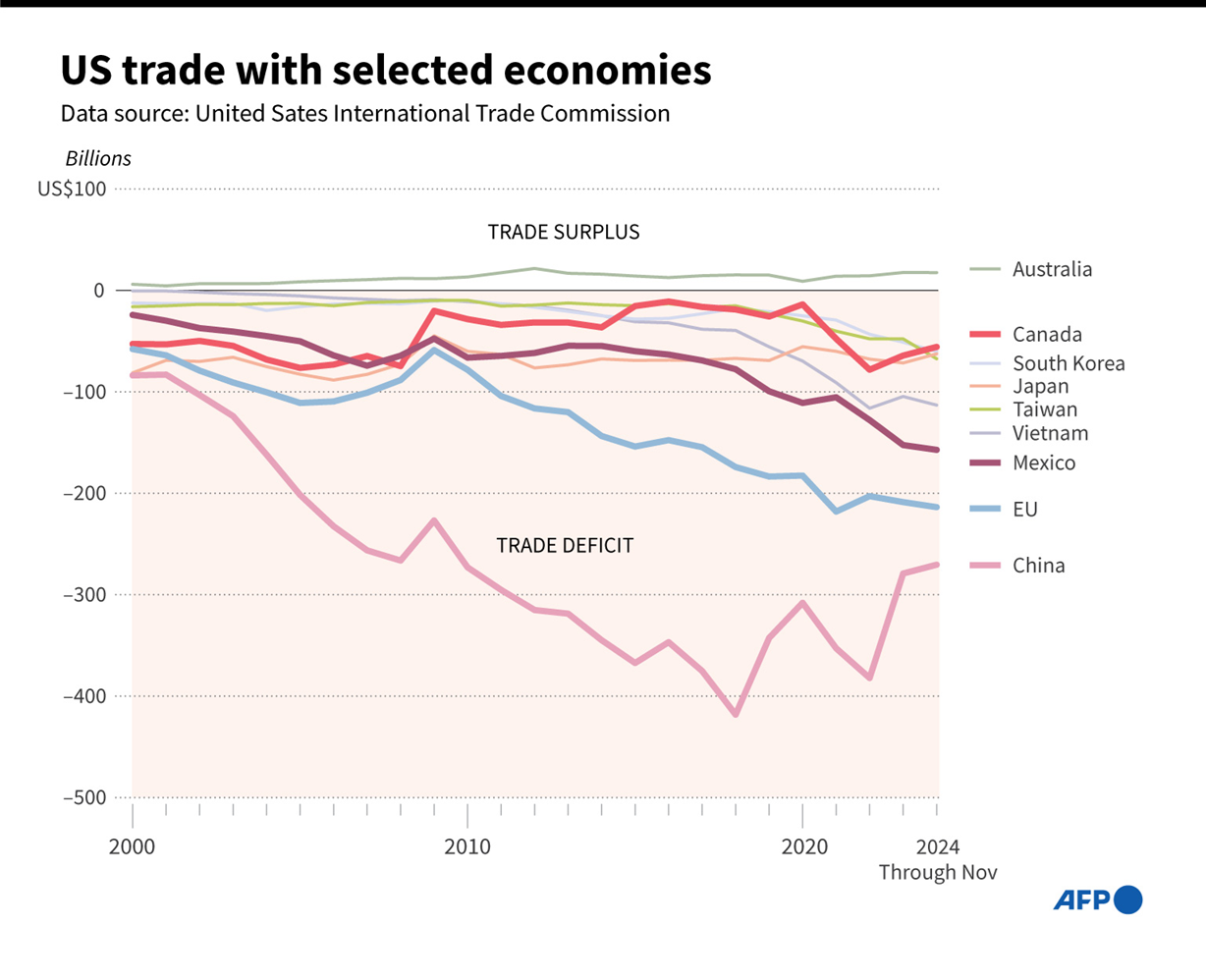

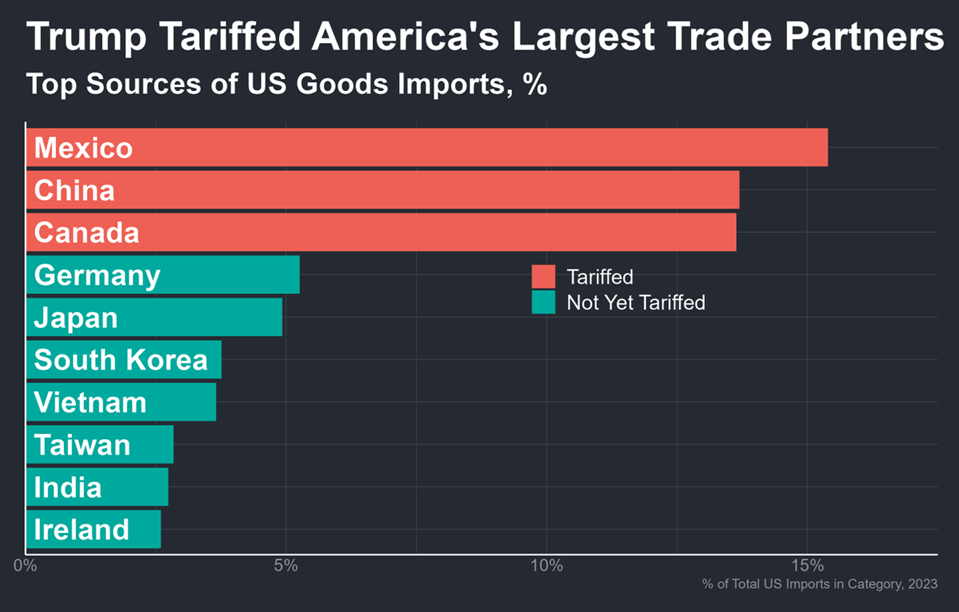

President Trump pauses tariffs on Canada and Mexico for 30 days while China announces its own duties on certain US exports. Beijing also says it is adding two American firms to its so-called unreliable entities list, saying they “violated normal market trading principles” and is investigating Google. “These moves are warnings that China intends to harm US interests if need be but still give China the option to back down,” writes Julian Evans Pritchard, head of China economics at Capital Economics in a note.

Monthly Archives: February 2025

Major Asset Classes | January 2025 | Performance Review

January was kind to the major asset classes, marking a strong rebound from a rough month in December. Across-the-board gains last month suggest the year is on a positive trajectory for markets. But the good news became irrelevant in a heartbeat after President Trump announced sweeping tariffs on Canada, Mexico and China – news that threatens to lift inflation, slow growth, upend the global trading system and roil markets.

Macro Briefing: 03 February 2025

Canada and Mexico vow to retaliate after Trump imposes sweeping tariffs on both countries. The White House also announced higher tariffs on China. The tariffs are expected to lift inflation and slow growth in the US and elsewhere. “There was some optimism in the [US Treasury] market that [tariff threats] were just for negotiation, but the market may have underestimated the determination of the Trump administration,” says Jason Lui, head of Asia-Pacific equity and derivative strategy at BNP Paribas.

Book Bits: 01 February 2025

● The New Rules of Investing: Essential Wealth Strategies for Turbulent Times

● The New Rules of Investing: Essential Wealth Strategies for Turbulent Times

Mark Haefele and Richard C. Morais

Excerpt via Barron’s

The notion that the global financial order could one day suffer or collapse under the weight of its debt has understandably given rise to a survivalist impulse to do whatever it takes to escape the financial system we have, and perhaps create a new system in the process. That impulse, for good or bad, stands behind the rise of cryptocurrency, but I am highly doubtful that cryptocurrencies will save us.

Cryptocurrencies are perceived by officials to be both a threat to the existing financial system and a facilitator of money laundering, which explains why, when Bitcoin fell 50 percent in short order, government officials went out of their way to say, “We told you so.” The U.S. secretary of the treasury pointedly warned Americans against “extremely risky” cryptocurrencies lacking “appropriate supervision and regulation.”