US retail sales fell more than expected in January. The sharp 0.9% drop last month was partly due to cold weather that suppressed sales of new cars. The average temperature in January was the lowest since 1988, Pantheon Macroeconomics advises. The fires in Los Angeles were also a temporary factor driving sales down.

Monthly Archives: February 2025

Book Bits: 15 February 2025

● Rethinking Investing: A Very Short Guide to Very Long-Term Investing

● Rethinking Investing: A Very Short Guide to Very Long-Term Investing

Charles D. Ellis

Summary via publisher (Wiley)

In just 10 short, accessible, and inviting chapters, Rethinking Investing: A Very Short Book on Very Long-Term Investing presents straightforward steps that ordinary people can take to better invest their money. This book dispels myths about the value of investment managers, highlights emotional tendencies that can cloud our financial judgment, explains why index funds are a savvy choice, and reveals secrets like why it’s better to wait until age 70 to receive Social Security benefits—along with the calculations that make this decision crystal-clear. Written by renowned investor and popular author Charley Ellis, this must-read resource shows you how to set yourself up for investment success.

Research Review | 14 FEB 2025 | Rebalancing and Asset Allocation

The Unintended Consequences of Rebalancing

Campbell R. Harvey (Duke University), et al.

January 2025

Institutional investors engage in trillions of dollars of regular portfolio rebalancing, often based on calendar schedules or deviations from allocation targets. We document that such rebalancing has a market impact and generates predictable price patterns. When stocks are overweight, funds sell stocks and buy bonds, leading to a decrease in equity returns of 17 basis points over the next day. Our results are robust to controls for momentum, reversals, and macroeconomic information. Importantly, we estimate that current rebalancing practices cost investors about $16 billion annually-or $200 per U.S. household. Moreover, the predictability of these trades enables certain market participants to profit by front-running the orders of large institutional funds. While rebalancing remains a fundamental tool for investors, our findings highlight the costs associated with prevailing strategies and emphasize the need for innovative approaches to mitigate these costs.

Macro Briefing: 14 February 2025

A solid rise in US producer prices in January aligns with consumer price data that suggests inflation may be picking up. For the year through January, the producer price index rose 3.5%, matching December’s gain and reflecting a moderately faster increase vs. recent history.

10-Year US Treasury Yield ‘Fair Value’ Estimate: 13 February 2025

The market premium for the US 10-year Treasury yield rebounded sharply in January, rising to its highest level in nine months, based on a “fair value” estimate calculated by CapitalSpectator.com. Yesterday’s hotter-than-expected inflation data for last month suggests that the market premium will remain elevated for longer than recently expected.

Macro Briefing: 13 February 2025

US headline consumer inflation continued to accelerate, rising 3.0% in January vs. the year-ago level — the highest since last June. “The long national nightmare of inflation isn’t over yet for consumers, businesses, and investors,” writes Chris Rupkey, chief economist at FwdBonds, in a research note on Wednesday. “There could be some seasonality that pushes prices up at a faster clip in January, but today the news for [Federal Reserve] officials is all bad.” Josh Jamner, investment strategy analyst at ClearBridge Investments, notes: “The ‘wait and see’ Fed is going to be waiting longer than anticipated after a red-hot January CPI inflation report. “This report puts the final nail in the coffin for the rate cut cycle, which we believe is over.”

Desperately Seeking Yield: 12 February 2025

Yields on most assets around the world have edged higher this year. The increase reflects a range of concerns, including sticky inflation risk and greater uncertainty for global trade flows. The crowd, in other words, is demanding a higher yield premium these days, based on a set of ETFs representing the major asset classes.

Macro Briefing: 12 February 2025

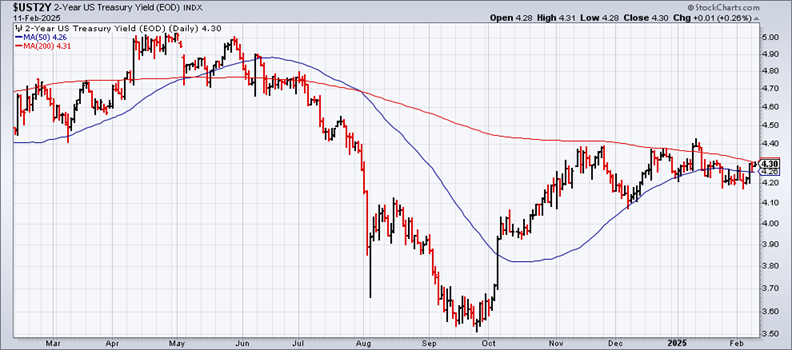

Federal Reserve Chairman Jerome Powell said the central bank doesn’t “need to be in a hurry” to cut interest rates. Testifying in the Senate yesterday, told the Banking Committee: “With our policy stance now significantly less restrictive than it had been and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance.” Meanwhile, the policy-sensitive 2-year US Treasury yield ticked up yesterday but remains in a middling range compared with recent history.

US Stock Market Is Middling Performer Amid Global Equities Rally

After two straight calendar years of red-hot performance, American shares are experiencing a run of muted results on the global stage. All the major slices of world stock markets are posting gains so far in 2025, but a notable shift from recent history is a subdued rise in US stocks vs. some its foreign competition, based on a set of ETFs through Monday’s close (Feb. 10).

Macro Briefing: 11 February 2025

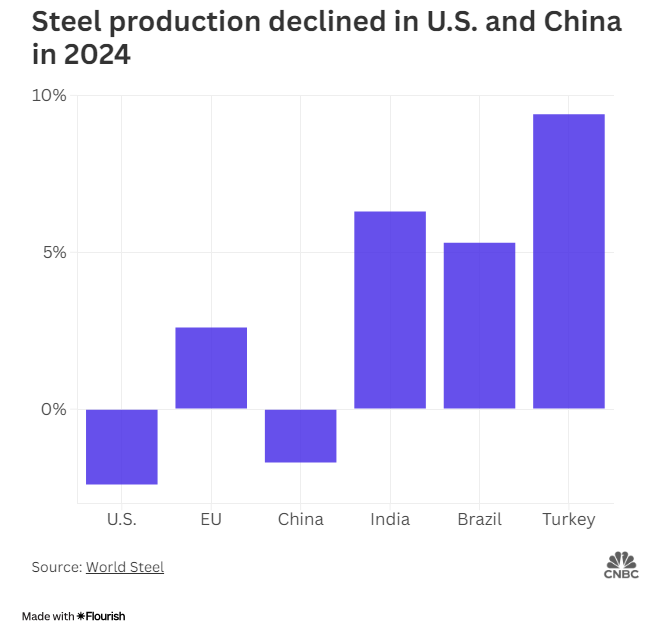

Trump announces 25% tariffs on all steel and aluminum imports. The US is the world’s largest importer of steel — the top three suppliers: Canada, Brazil and Mexico. The metals are key components in various industries, including transportation, construction and packaging. The levies will take effect on March 4.