● Why Nothing Works: Who Killed Progress―and How to Bring It Back

● Why Nothing Works: Who Killed Progress―and How to Bring It Back

Marc J. Dunkelman

Interview with author via NPR

Q: When New York City built its subway system in the first part of the 1900s, it took about three years to build the first subway line through Manhattan. It’s impossible to do anything in three years in the United States today, certainly anything of that scale. What do you make of that comparison?

A: I think that’s exactly right. We had a long period in our history where we gave centralized power to certain authority figures to make big decisions that were designed to help everybody. And often they weren’t beneficial. Sometimes they were abusive. There are lots of stories where we awoke to that in the 1960s and seventies.

Monthly Archives: February 2025

Real (Inflation-Adjusted) Treasury Yields Remain Elevated

At a time of increased uncertainty about inflation, the relatively elevated real yields available in inflation-indexed Treasuries offer a partial antidote of certainty for anxious investors.

Macro Briefing: 21 February 2025

US jobless claims edged higher last week, but remain at a level that prevailed prior to the pandemic. “New claims have trended lower since last August as the 13-week moving average touched 218,000 after peaking at 235,000, a sign that the labor market remains strong,” writes an analyst at RSM.

Despite Inflation Risk, Bond Market Holds On To Gains In 2025

Inflation concerns continue to lurk, but the US bond market is holding on to its rally so far this year, based on a set of ETFs through Wednesday’s close (Feb. 19).

Macro Briefing: 20 February 2025

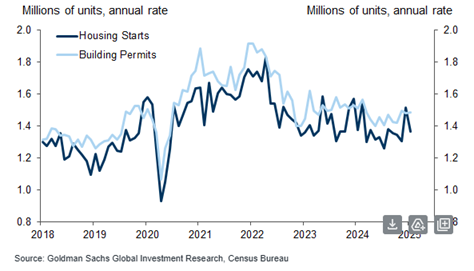

US housing starts fell more than expected in January, in part due to disruptions from snowstorms and freezing temperatures. “The outlook for more homebuilding is cloudy and gray as import tariffs are likely to push up building costs in the months to come, and homebuyers report the higher cost of borrowing is holding them back from being able to afford and purchase a new home,” says Christopher Rupkey, chief economist at FWDBONDS.

Foreign Stocks Lead Major Asset Classes In 2025

After two straight years of performance dominance by US equities, foreign stocks in developed markets are leading the major asset classes by a wide margin so far in 2025, based on a set of ETFs through Tuesday’s close (Feb. 18). It’s anyone’s guess if the leadership for equities ex-US continues, but at the moment the change in fortunes is a striking reshuffling of recent history.

Macro Briefing: 19 February 2025

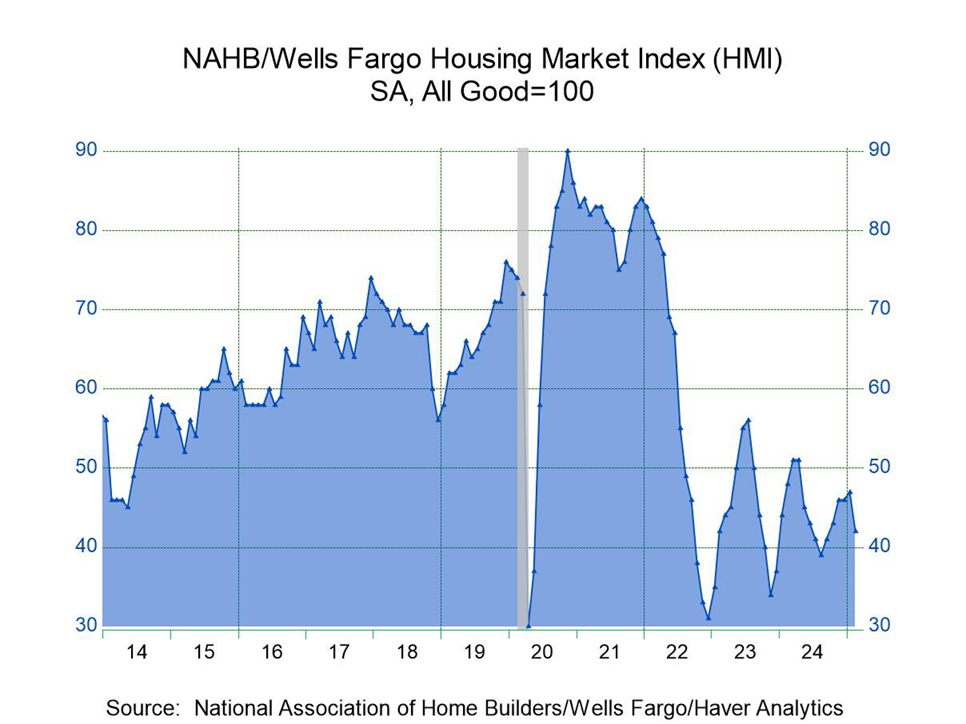

The US Housing Market Index, a survey-based measure of home builder sentiment, fell further below the neutral 50 mark in February. The index has been been below 50 since May and reflects a cautious outlook among US home builders for the near-term outlook.

Momentum Leaves Other Equity Factors In The Dust So Far In 2025

The momentum factor is crushing the competition year to date, based on a set of ETF proxies through Friday’s close (Feb. 14). After a strong run last year, momentum is roaring higher in 2025 in relative and absolute terms.

Macro Briefing: 18 February 2025

China’s trade surplus in goods continues to rise and now dwarfs the heights for Germany and Japan during their exporting heydays in the 1990s. “Over the past six years, China’s imports of such goods increased by an average of only $15 billion a year, essentially no change at all when inflation is taken into account,” writes Brad Setser, a senior fellow at the Council on Foreign Relations. “Its manufactured exports, on the other hand, have grown more than 10 times as fast, by over $150 billion a year. When it comes to manufactured goods, trade with China is virtually a one-way street.”

Moderate, Steady Growth Expected For US Q1 GDP

US economic activity is on track to maintain a moderate growth rate in 2025’s first quarter, according to the median for several nowcasts compiled by CapitalSpectator.com. Today’s initial Q1 estimate projects that the 2%-plus pace reported for Q4 by the Bureau of Economic Analysis (BEA) will continue in the current quarter.