Sticky inflation risk is still a threat for the bond market, but concern that the US economy is slowing has become the main factor driving Treasury yields lower recently.

Monthly Archives: February 2025

Macro Briefing: 28 February 2025

US jobless claims rose more than expected last week, rising to highest level since December. Although the rise leaves claims far below a level that suggests elevated recession risk, some economists see the increase as a sign that the labor market is slowing.

US Sector Leadership Shifts, Favoring Healthcare Stocks

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens. Using a set of ETFs as proxies, healthcare is now the leading sector performer year to date, taking the lead from financials, based on prices through Wednesday’s close (Feb. 26).

Macro Briefing: 27 February 2025

New US home sales fell sharply in January. “New home sales will continue to struggle with fewer homes coming to market due to tepid buying activity,” says CoreLogic chief economist Selma Hepp. “Even though homebuilders continue to offer buyer incentives, high mortgage rates, mixed with continued price appreciation, keep the eligible pool of homebuyers restricted to higher income individuals.”

Are Markets Rethinking The Prospects For Trump 2.0?

Recent headlines appear to have shaken investor sentiment. It’s premature to read too much into a few days of weaker-than-expected survey numbers. More importantly, the latest data indicate that the economy is still growing, businesses continue to hire, and the near-term outlook for consumer spending remains positive. But the White House would do well to consider the implications of the recent slide in Main Street’s sentiment. The financial markets seem to be doing just that.

Macro Briefing: 26 February 2025

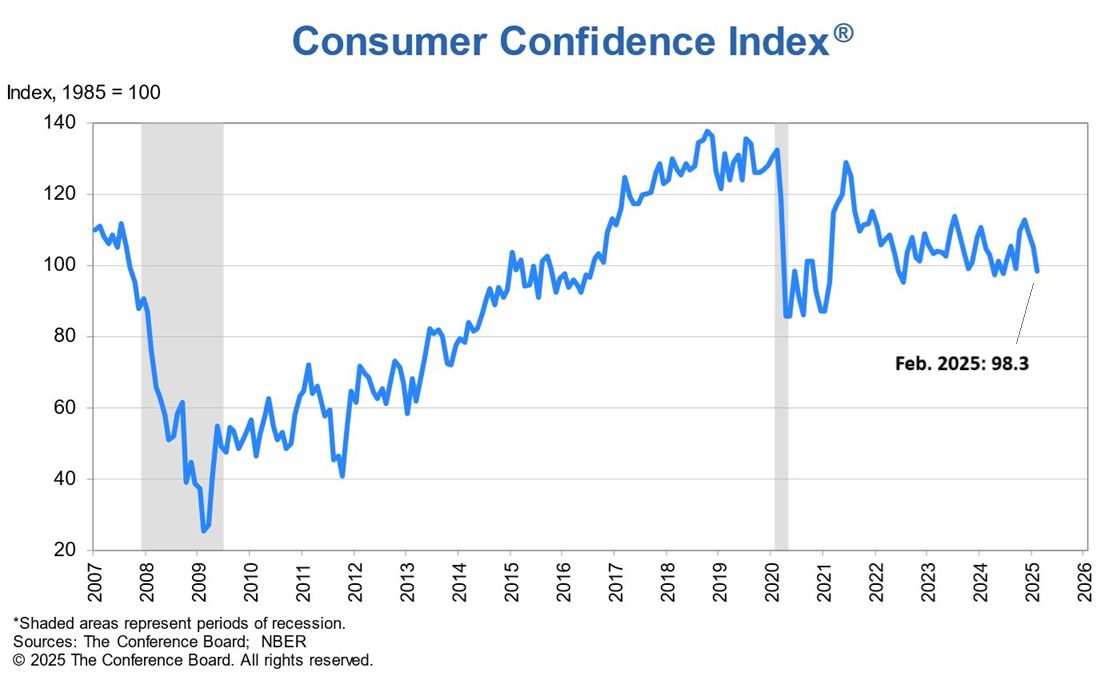

US Consumer Confidence Index fell sharply in February, marking the biggest monthly decline since 2021. “This is the third consecutive month on month decline, bringing the Index to the bottom of the range that has prevailed since 2022,” said Stephanie Guichard, a senior economist at The Conference Board. “Average 12-month inflation expectations surged from 5.2% to 6% in February.”

Politics And Policy Clouds Path Ahead For Fed

The central bank’s job is never easier, but in the current climate it’s unusually tricky.

In addition to the usual challenges that complicate real-time monetary-policy decisions, the Federal Reserve must weigh the potential economic implications from a blizzard of edicts from the White House. It’s unclear how President Trump’s plans have altered the Fed’s expectations, but private sector economists are weighing in on the outlook.

Macro Briefing: 25 February 2025

US economic activity slowed in January, according to the Chicago Fed National Activity Index. Two of the index’s four broad categories decreased from December, and one category made a negative contribution in January.

Foreign Stocks, Commodities Lead Major Asset Classes This Year

The year so far is shaping up to be quite different from 2024 in terms of leaders and laggards for the major asset classes. Global equities ex-US are the leaders, along with a broad measure of commodities, based on a set of ETFs through Friday’s close. The formerly high-flying US equities market, by comparison, is posting relatively modest results year to date.

Macro Briefing: 24 February 2025

US economic activity “falters and payrolls decline in February, as optimism slumps and costs rise,” according to the latest update of the US PMI Composite Output Index, a survey-based GDP proxy. This month’s initial estimate for the index is 50.4, a 17-month low that’s just slightly above the neutral 50 mark that separates growth from contraction.