● Gambling Man: The Secret Story of the World’s Greatest Disruptor, Masayoshi Son

● Gambling Man: The Secret Story of the World’s Greatest Disruptor, Masayoshi Son

Lionel Barber

Essay by author via Harvard Business Review

Few characters are more enigmatic or misunderstood than Masayoshi Son, the billionaire founder and CEO of SoftBank, the Japanese media technology conglomerate. In Japan and in western media, he is cast as a dreamer, financial engineer, and speculator — an object of suspicion who has risked financial ruin more than once in a five-decade career.

His life story is a Forrest Gump-like journey through all the key moments in recent business history: from the launch of the personal computer to the birth of the internet, the dotcom boom and bust, the rise of China, the global financial crisis, and the advent of artificial intelligence. As the British writer Simon Nixon observed in a review of Gambling Man, my biography of Son, “He seems to have known everyone and owned everything, or at least tried to buy it.”

Monthly Archives: January 2025

Trump Says He’ll ‘Demand That Interest Rates Drop Immediately’

In President Trump’s first week in office he issued a blitz of executive orders, but perhaps his most ambitious statement to date is his claim yesterday that he would order the Federal Reserve to cut interest rates.

Macro Briefing: 24 January 2025

US jobless claims edged higher last week but remain low, suggesting that hiring will remain robust for the near term. Continuing claims, however, rose to the highest level in more than three years. The uptrend in continuing claims is considered a sign that more workers are struggling to find new jobs.

Bond Market Awaits News On Inflation, Tariffs And The Deficit

Is this the calm before the storm? Or has the danger passed? The bond market is focused on news and data in the days and weeks ahead that will provide context for answering these key questions. Meanwhile, Treasury yields have taken a break from the sharp upswing that’s dominated trading in recent months. In short, a wary calm prevails.

Macro Briefing: 23 January 2025

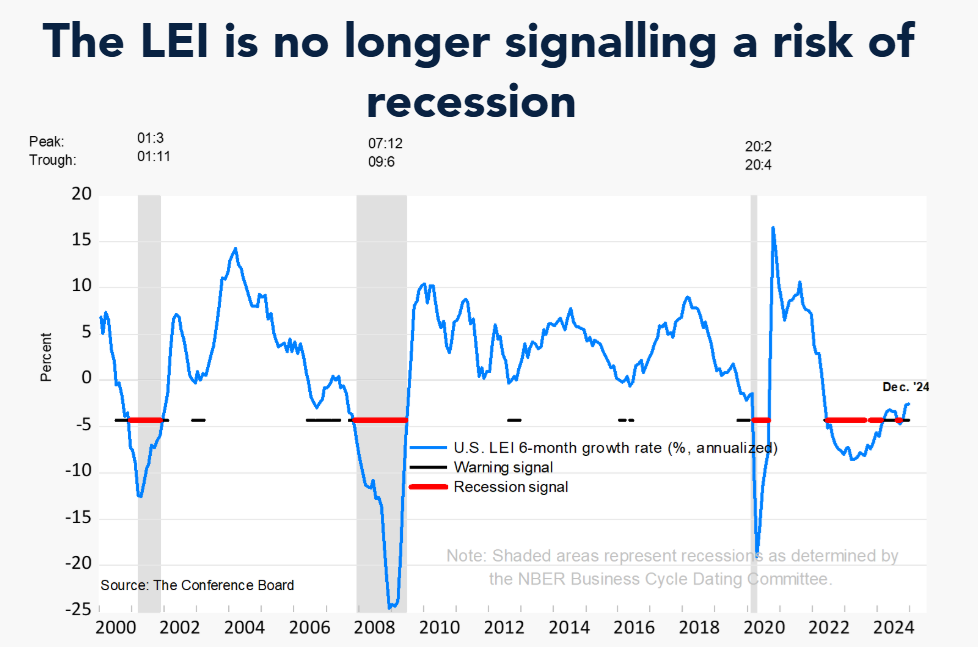

The US Leading Economic Index edged lower in December, but the 6- and 12-month growth rates “were less negative, signaling fewer headwinds to US economic activity ahead,” reports the Conference Board. “Nonetheless, we expect growth momentum to remain strong to start the year and US real GDP to expand by 2.3% in 2025.”

Commodities Take Early Lead For Asset Classes So Far In 2025

Is this the year of commodities? It’s a plausible narrative, based on the early days of trading in 2025 for a set of ETFs that track the major asset classes through Tuesday’s close (Jan. 21). Although these are early days for evaluating the calendar year, the initial results show a broad measure of commodities with a solid lead.

Macro Briefing: 22 January 2025

US equities rose for a second day, lifting the S&P 500 Index closer to its record-high close posted in December. “President Trump’s Inauguration Day policy announcements on tariffs were more benign than expected,” wrote Alec Phillips, chief US political economist at Goldman Sachs, in a note to clients yesterday. Jamie Cox, managing partner at Harris Financial Group, says the market “seems to have overcome its tariff tantrum.”

Will Trump’s Tariffs Help Or Hurt The Effort To Tame Inflation?

On his first day as president, Donald Trump announced bold plans to reshape economic policy. His ideas for revising US priorities are as brash and audacious as they are controversial and contested in some quarters.

Macro Briefing: 21 January 2025

On his first day as president, Trump says he’s considering imposing tariffs on Canada and Mexico that could start as early as February: “We’re thinking in terms of 25% (levies) on Mexico and Canada…” The US trade deficit with Canada is largely due to US purchases of oil. Mexico also runs a trade surplus with the US and for the first 11 months of 2024 was the top exporter to the world’s largest economy.

US Economy Humming As Trump Returns To White House Today

Donald Trump will be sworn in as the 47th president of the United States at 12 noon eastern. When he takes the oath office for a second time at least one thing will be clear: He will enter the White House with an economy that’s in dramatically better shape than when he left four years ago.