Several risk factors that could end the bond market’s party, but for the moment US fixed-income markets are having a good year so far, based on prices through Thursday’s close (Jan. 30).

Monthly Archives: January 2025

Macro Briefing: 31 January 2025

US fourth-quarter GDP increased less than expected. Output rose 2.3% (annualized), marking a slowdown from Q3’s 3.1%. Consumer spending accelerated in Q4, rising 4.2%, the fastest pace in nearly two years. “Holding back growth was a decline in business investment, flat reading in net exports, and sharp decline in inventories,” advises Nationwide chief economist Kathy Bostjancic. “The drawdown in inventories, especially at the wholesale level indicates that retailers also scurried to stock up before possible tariffs. This could continue into early 2025.”

Momentum Leading US Equity Factors For 2025’s Kickoff

It’s been a good year so far for the momentum factor. That’s hardly surprising given that momentum was red hot in 2024. Momentum, it seems, still has momentum.

Macro Briefing: 30 January 2025

The Federal Reserve left its target rate unchanged at a 4.25%-4.50% range in yesterday’s policy announcement. Following the decision, Fed funds futures are pricing in an 82% probability that the central bank will continue to leave rates unchanged at the next FOMC meeting on March 19. Meanwhile, President Trump on Wednesday said the central bank “failed to stop the problem they created with inflation” and have done a “terrible job on bank regulation.”

US Q4 GDP Growth Nowcast Rises Ahead Of Thursday’s Report

Economic output in the fourth quarter is expected to increase at a solid rate in this week’s initial GDP estimate from the Bureau of Economic Analysis. Thursday’s report from the government (Jan. 29) is on track to rise 2.7%, based on the median estimate from several sources compiled by CapitalSpectator.com.

Macro Briefing: 29 January 2025

US Consumer Confidence Index fell in January, but “has been moving sideways in a relatively stable, narrow range since 2022. January was no exception,” writes the chief economist at The Conference Board. “All five components of the Index deteriorated but consumers’ assessments of the present situation experienced the largest decline. Notably, views of current labor market conditions fell for the first time since September, while assessments of business conditions weakened for the second month in a row.”

Does China AI Threaten US Tech Dominance?

And just like that, the formerly high-flying US tech sector is on the defensive. If you blinked, you missed it.

Anxiety about the competitive threat from Chinese artificial intelligence lab DeepSeek triggered a sharp selloff in US equities on Monday, with the worst of the decline centered in tech. Chipmaker Nvidia was especially hard hit, suffering a near-$600 billion loss of market cap in one day.

Macro Briefing: 28 January 2025

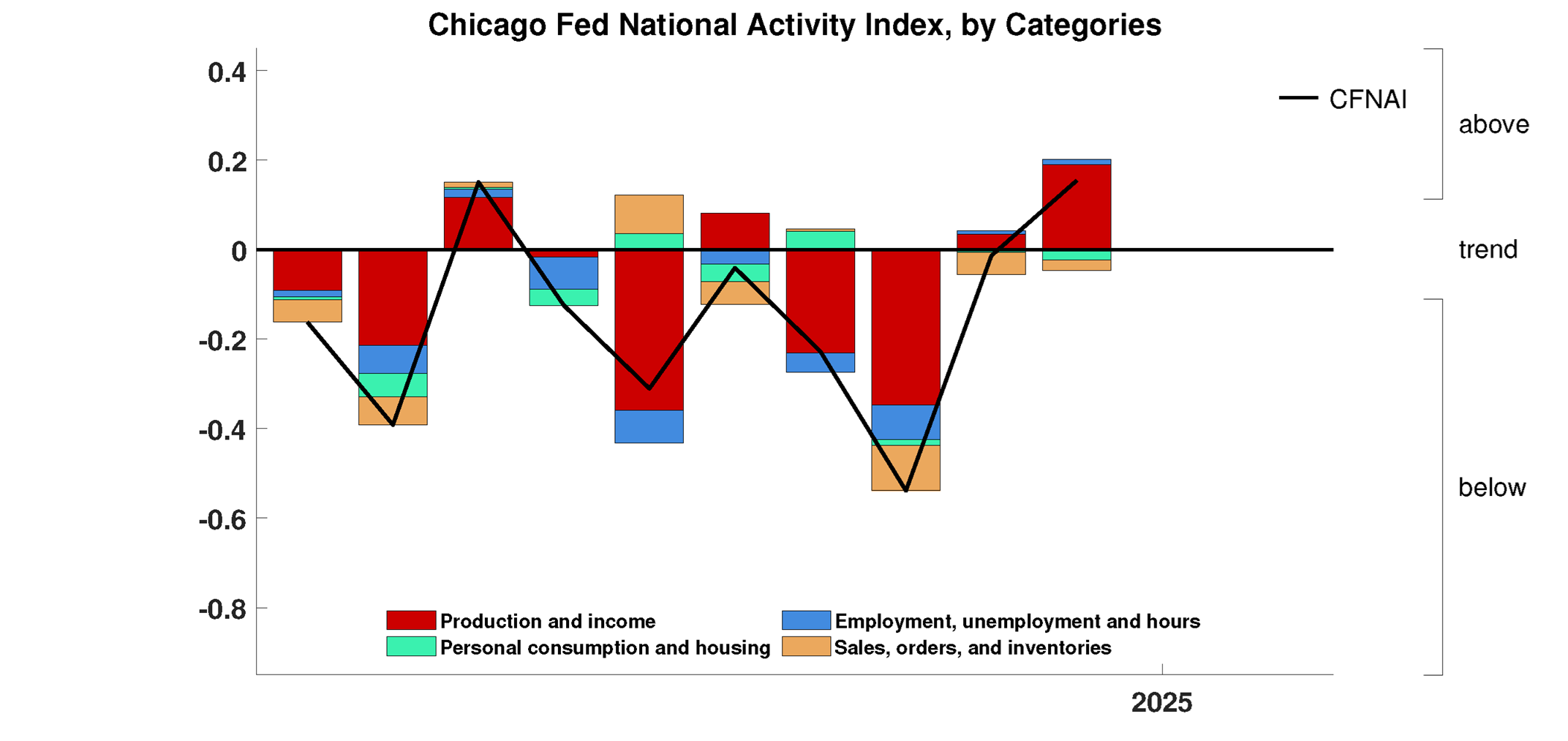

US economic activity strengthened in December, according to the Chicago Fed National Activity Index. This benchmark rose to the strongest reading last month since May, reflecting a firmer pace of growth at 2024’s close.

Will The Trump Factor Influence Markets And The Fed This Week?

Investors this week will be keenly watching how or if the Federal Reserve and the bond market cooperate with Donald Trump’s order for lower interest rates. Although the central bank is unlikely to make decisions based on directives from the White House, the Trump 2.0 policy agenda will surely be a factor, one way or another.

Macro Briefing: 27 January 2025

US Composite Output Index, a survey-based GDP proxy, posted slower growth in January, S&P Global reports. Business activity expansion downshifted from December’s 32-month high to a softer pace. “Although output growth slowed slightly in January, sustained confidence suggests that this slowdown might be short-lived,” says Chris Williamson, chief business cconomist at S&P Global Market Intelligence. “Especially encouraging is the upturn in hiring that has been fueled by the improved business outlook, with jobs being created at a rate not seen for two-and-a-half years.”