Several updated nowcasts for US economic activity in the fourth quarter have been revised sharply higher recently, but the median estimate barely changed, based on the several data points from a range of sources compiled by CapitalSpectator.com. The US economy still, as a result, still looks set to slow in the final quarter of the year via the median nowcast.

Monthly Archives: December 2024

Macro Briefing: 17 December 2024

US economic activity accelerated to a 33-month high in December, according to the US Composite, a survey-based GDP proxy. “Business is booming in the US services economy, where output is growing at the sharpest rate since the reopening of the economy from COVID lockdowns in 2021,” says Chris Williamson, chief business economist at S&P Global Market Intelligence. “The service sector expansion is helping drive overall growth in the economy to its fastest for nearly three years, consistent with GDP rising at an annualized rate of just over 3% in December.”

Best Of Book Bits 2024: Part II

Here’s the follow-up to the first installment of our year-end review of Book Bits columns published in 2024. Happy reading!

● Shocks, Crises, and False Alarms: How to Assess True Macroeconomic Risk

● Shocks, Crises, and False Alarms: How to Assess True Macroeconomic Risk

Philipp Carlsson-Szlezak and Paul Swartz

Excerpt via Harvard Business Review

In 2022, when U.S. interest rates climbed, a cascade of emerging-market defaults were predicted—but they didn’t materialize. Also in 2022, and again in 2023, public discourse cast an imminent recession as “inevitable.” Instead a resilient U.S. economy not only defied the doomsayers but delivered strong growth.

For executives and investors such whiplash comes with two types of costs: financial and organizational. Consider the financial cost to automakers that reduced their semiconductor orders in 2020 because they misread the Covid-19 recession as a protracted economic depression. That meant they missed out on sales during the roaring recovery. And leaders can lose the trust of their organizations if they overreact to false alarms with abrupt reversals in strategy, operations, and communications. Clearly, getting the macro call right really matters.

Boston Bound…

10-Year US Treasury Yield ‘Fair Value’ Estimate: 12 December 2024

The market premium for the US 10-year Treasury yield continued to rebound in November vs. a “fair value” estimate calculated by CapitalSpectator.com. The increase marks the second straight monthly increase in the premium, which is now at the highest level since May.

Macro Briefing: 12 December 2024

US consumer inflation edged higher to a 2.7% year-over-year pace in November, marking a second straight month of slightly higher increases. Core CPI, which strips out volatile food and energy prices, held steady at a 3.3% rate. “In-line core inflation clears the way for a rate cut at next week’s [Federal Open Market Committee] meeting,” says Whitney Watson, global co-head and co-CIO for fixed income at Goldman Sachs Asset Management. “Following today’s data the Fed will depart for the holiday break still confident in the disinflation process and we think it remains on course for further gradual easing in the new year.”

Communications Services Leads US Equity Sectors In 2024

The neck-and-neck horse race for first place among equity sectors has recently given way to a decisive lead for communications services stocks year to date, based on a set of ETFs through Tuesday’s close (Dec. 10).

Macro Briefing: 11 December 2024

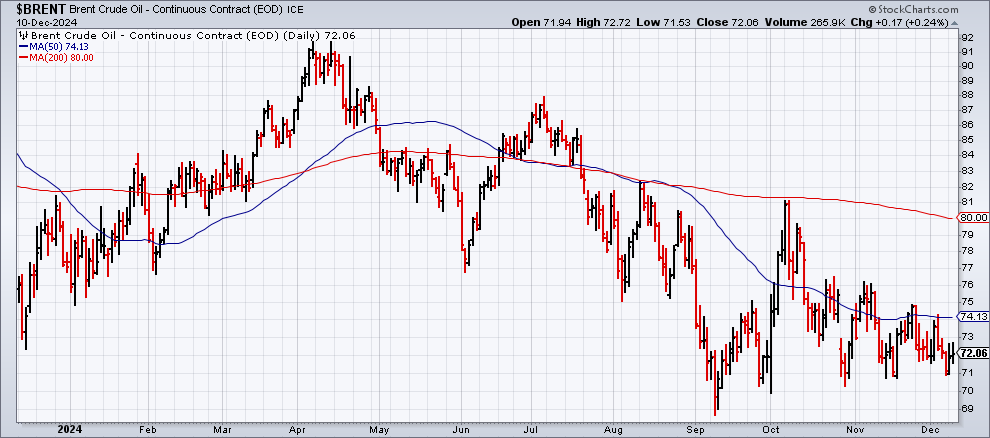

Saudi Arabia is struggling with its plan to keep crude oil prices elevated. “Rising US production and internal OPEC+ pressure limit the kingdom’s sway over prices,” reports The Wall Street Journal. Trump is a new source of uncertainty as US-based shale drillers may be embolded to lift output amid a push for deregulation. Meanwhile, the International Energy Agency estimates global supply will exceed demand by more than one million barrels a day next year without a production cut. Brent, the international oil benchmark, is down 6.5% this year.

Is The Downshift In US Inflation Stalling?

Disinflation has stalled recently, but economists are debating if this is a temporary blip that will soon give way to a softer trend. Tomorrow’s consumer price report for November will be widely read for an update.

Macro Briefing: 10 December 2024

US small business optimism rose sharply in November, according to NFIB’s survey. “The election results signal a major shift in economic policy, leading to a surge in optimism among small business owners,” says NFIB chief economist Bill Dunkelberg. “Main Street also became more certain about future business conditions following the election, breaking a nearly three-year streak of record high uncertainty.”