US consumer inflation edges up to 2.6%, marking first pickup in pricing pressure since March. The core reading of inflation (excluding energy and food) held steady at a 3.3% pace. “Progress on inflation has started to stall,” says Michael Pugliese, a senior economist at Wells Fargo. “The time is fast approaching when the Fed will signal that the pace of rate cuts will slow further, perhaps to an every-other-meeting pace starting in 2025.”

Monthly Archives: November 2024

Rising Treasury Yields Raise Doubts About Another Fed Rate Cut

Fed funds futures are still leaning into expectations that the Federal Reserve will reduce its target rate next by a quarter point, but the related confidence of the forecast is slipping.

Macro Briefing: 13 November 2024

The US dollar index rose to a six-month high on Tuesday, fueled by expectations for rising inflation risk during a second Donald Trump presidency. The reasoning is related to the possibility that the Federal Reserve may curtail or perhaps reverse rate-cutting plans if inflation rebounds due to potentially reflationary policies driven by higher tariffs and other policy plans outlined by the president-elect. Higher interest rates tend to support a higher dollar relative to other currencies. The Fed would “continue to take a cautious tone going forward, especially in light of what we view as heightened inflation risks in a second Trump term,” predicts Win Thin, global head of markets strategy at Brown Brothers Harriman.

Communications, Financials Take Lead As Top Sector Performers

Defensives are out, animal spirits are in… again. Or so the latest rotation among US equity sectors suggests, based on a set of ETFs through Monday’s close (Nov. 11).

Macro Briefing: 12 November 2024

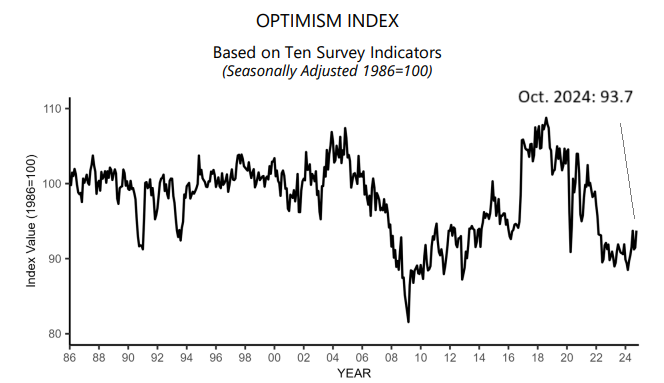

US small business optimism edges up to three-month high in October, but remains far below pre-pandemic levels. “With the election over, small business owners will begin to feel less uncertain about future business conditions,” predicts NFIB Chief Economist Bill Dunkelberg. “Although optimism is on the rise on Main Street, small business owners are still facing unprecedented economic adversity.”

Will Reflation End The US Bond Market’s Recovery?

In mid-September, the bond market looked set to coast to a second year of recovery after a bruising run of back-to-back losses in 2021 and 2023. Since then, the market has lost altitude. Although a modest year-to-date gain is holding for the moment, the headwinds may be strengthening for fixed-income securities as the market grapples with a changing outlook for inflation.

Macro Briefing: 11 November 2024

US consumer sentiment continued to improve in early November, rising for a fourth straight month to a six-month high. “While current conditions were little changed, the expectations index surged across all dimensions, reaching its highest reading since July 2021,” says Joanne Hsu, surveys of consumers director at University of Michigan, which publishes the data. The results reflect sentiment before the Nov. 5 election.

Book Bits: 9 November 2024

● Is the Chinese Economy a Miracle or a Bubble?

● Is the Chinese Economy a Miracle or a Bubble?

Lawrence J. Lau

Summary via publisher (The Chinese University of Hong Kong Press)

Since China undertook economic reform and opened its economy to the world in the late 1970s, its economy has been growing at an average annual rate of over 9 percent for more than four decades. No other economy in recorded history has grown at such a high rate and for such a long period as China has done. The questions that naturally arise are: Was the Chinese economy a miracle? Or was it a mere bubble? Will the Chinese economy begin to stagnate like the Japanese economy did in the 1990s, and perhaps decline? Will it be able to escape the “middle-income trap”? If it is not a miracle, can the Chinese development experience be replicated elsewhere?

Research Review | 7 November 2024 | Market Analytics

Climate Risk and Predictability of Global Stock Market Volatility

Mingtao Zhou and Yong Ma (Hunan University)

March 2024

Our study investigates the informative role of climate risk in improving the predictability of global stock market volatility. By extracting the composite component from the four individual climate risk proxies of Faccini et al. (2023), we show that aggregate climate risk is a significantly positive predictor of stock volatility across 32 international markets. This predictability persists in out-of-sample tests and cannot be subsumed by relevant economic and financial uncertainty measures. However, the predictive power of aggregate climate risk exhibits noteworthy variations over time and across regions; it weakens when economic conditions deteriorate, while it strengthens in regions with advanced financial development, high energy dependence, and strong climate change readiness. Moreover, by dissecting the multi-facets of climate risk, we demonstrate that physical risks, especially natural disasters, have much stronger predictability than transition risks.

Macro Briefing: 8 November 2024

The policy-sensitive US 2-year Treasury yield fell on Wednesday as the Federal Reserve announced a widely-expected 1/4-point cut in its target rate. Despite the slide in the 2-year yield, it’s unclear if the upside trend will pause or reverse. The 2-year yield is widely followed as a proxy for near-term policy expectations. As of yesterday’s close, the 2-year yield, at 4.20%, remains modestly below the 4.50%-4.75%, which implies a forecast for another rate cut. Fed funds target range. Fed funds futures are pricing in a 71% probability for a 1/4 rate cut at next month’s FOMC meeting.