The appetite for US equity risk has wobbled in recent months, but on the first trading day after Trump’s election victory the bullish signaling revived on several fronts, based on numerous sets of ETF pairs through Wednesday’s close (Nov. 6). The main exception: bonds, which are wilting anew.

Daily Archives: November 7, 2024

Macro Briefing: 7 November 2024

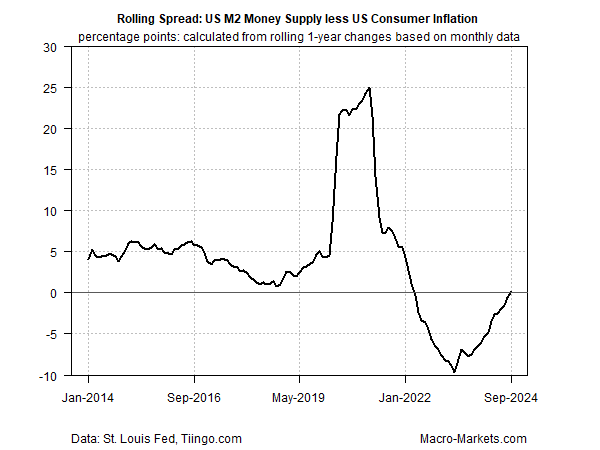

The Federal Reserve is expected to reduce its target rate today, but the wisdom of rate cuts is in doubt after Tuesday’s election. A research note from TMC Research advises that the central bank should pause rate cuts until the potentially inflationary consequences of Donald Trump’s policy plans become clearer. “Donald Trump’s election victory appears to have altered the assumptions about what’s prudent for monetary policy in the near term,” the report recommends. “Although the general outline of the president-elect’s agenda are well known, there’s debate about the details and, more importantly, how hard he’ll push on his policy positions re: taxes, tariffs, immigration and other macro topics. “Note, too, that broadly defined money supply (M2) in real terms is rising again after 2-1/2 years of contracting. The shift suggests that the policy bias is once more inflationary, albeit trivially so through September. But with the Fed poised to continue easing policy further, the central bank may find itself in an awkward position in next year’s first half if fiscal policy changes create a stronger tailwind for reflation.”