The long-run performance outlook for the Global Market Index (GMI) ticked higher in October. Today’s revised forecast marks the first higher estimate in the past four months for GMI, an unmanaged benchmark that holds all the major asset classes (except cash), based on market weights via a set of ETF proxies.

Daily Archives: November 4, 2024

Macro Briefing: 4 November 2024

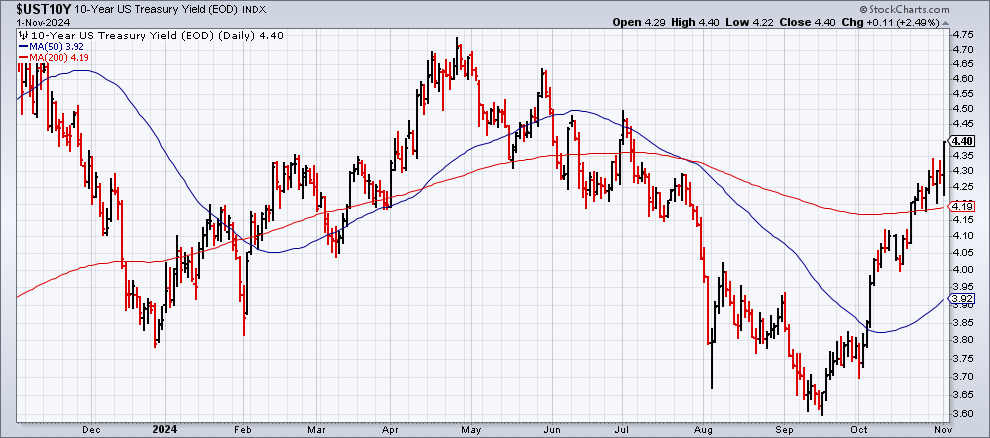

The US 10-year Treasury yield rose to 4.40% on Friday, a four-month high. The head of rates strategy at TD Securities, Gennadiy Goldberg, says the 10-year could approch 5% if Trump wins the election and the Republicans sweep in Congress. Reuters reports: “If Republicans take both houses of Congress and the U.S. presidency, it likely would bring higher tariffs, and consequently higher interest rates, especially at the back end of the yield curve, due to inflation. Increased U.S. Treasury debt supply to finance a huge fiscal deficit also lifts longer-end yields.” If Democrats win: “it could bring higher taxes on corporations and higher-income households that could weigh on economic growth. Disinflation is likely and as such, more aggressive easing by the Federal Reserve would be possible. Interest rates are likely to decline in this environment, led by the front end of the curve.”