The festival of eating, giving thanks, and breaking free of the usual routine will keep your editor off the grid for a few days. Regular programming returns on Monday, Dec. 2. Cheers!

The festival of eating, giving thanks, and breaking free of the usual routine will keep your editor off the grid for a few days. Regular programming returns on Monday, Dec. 2. Cheers!

Monthly Archives: November 2024

Revised US GDP Nowcast For Q4 Still Reflects Modest Slowdown

The US economy remains on track to end the year with a moderate increase in output, according to the median Q4 GDP estimate based on a set of nowcasts published by several sources. Recession risk, as a result, is still a low-probability risk for the near term. The question is whether a sharp change in US economic policy in 2025 will change the calculus?

Macro Briefing: 26 November 2024

Is a reflation problem brewing for the Federal Reserve in 2025? A TMC Research note highlights the potential factors aligning for 2025 that may trigger a course correction for monetary policy: “In the context of potentially reflationary factors brewing for 2025 from various sources, the outlook for ramping up money supply growth could be ill-timed for the central bank’s plans to manage inflation pressures.”

US Stocks Continue To Lead Markets By Wide Margin In 2024

As the final weeks of the trading year come into focus, American shares remain the odds-on favorite to dominate 2024 performance for the major asset classes.

Macro Briefing: 25 November 2024

US growth in business activity strengthened in November, according to PMI survey data. The US PMI Composite Output Index, a GDP proxy, rose to 55.3, a 31-month high. “The business mood has brightened in November, with confidence about the year ahead hitting a two-and-a-half year high,” says , Chris Williamson, chief business economist at S&P Global Market Intelligence. “The prospect of lower interest rates and a more probusiness approach from the incoming administration has fueled greater optimism, in turn helping drive output and order book inflows higher in November.”

Book Bits: 23 November 2024

● Tech Agnostic: How Technology Became the World’s Most Powerful Religion, and Why It Desperately Needs a Reformation

● Tech Agnostic: How Technology Became the World’s Most Powerful Religion, and Why It Desperately Needs a Reformation

Greg M. Epstein

Q&A with author via The.ink

Q: How does it help us to frame “tech” — and that’s a thing distinct from “technology” as you put it in the book — as religion, and are there ways that analytic frame might hinder our understanding?

A: It helps us to understand how far removed from reality a lot of what we’re told about tech. I want people to really look at what we’re doing when we’re interfacing with what this mythical Silicon Valley and its people are doing. When we’re creating these fantasies of a kind of technological heaven, these terrifying scenarios of a technological hell, then we’re literally in the business of creating tech gods.

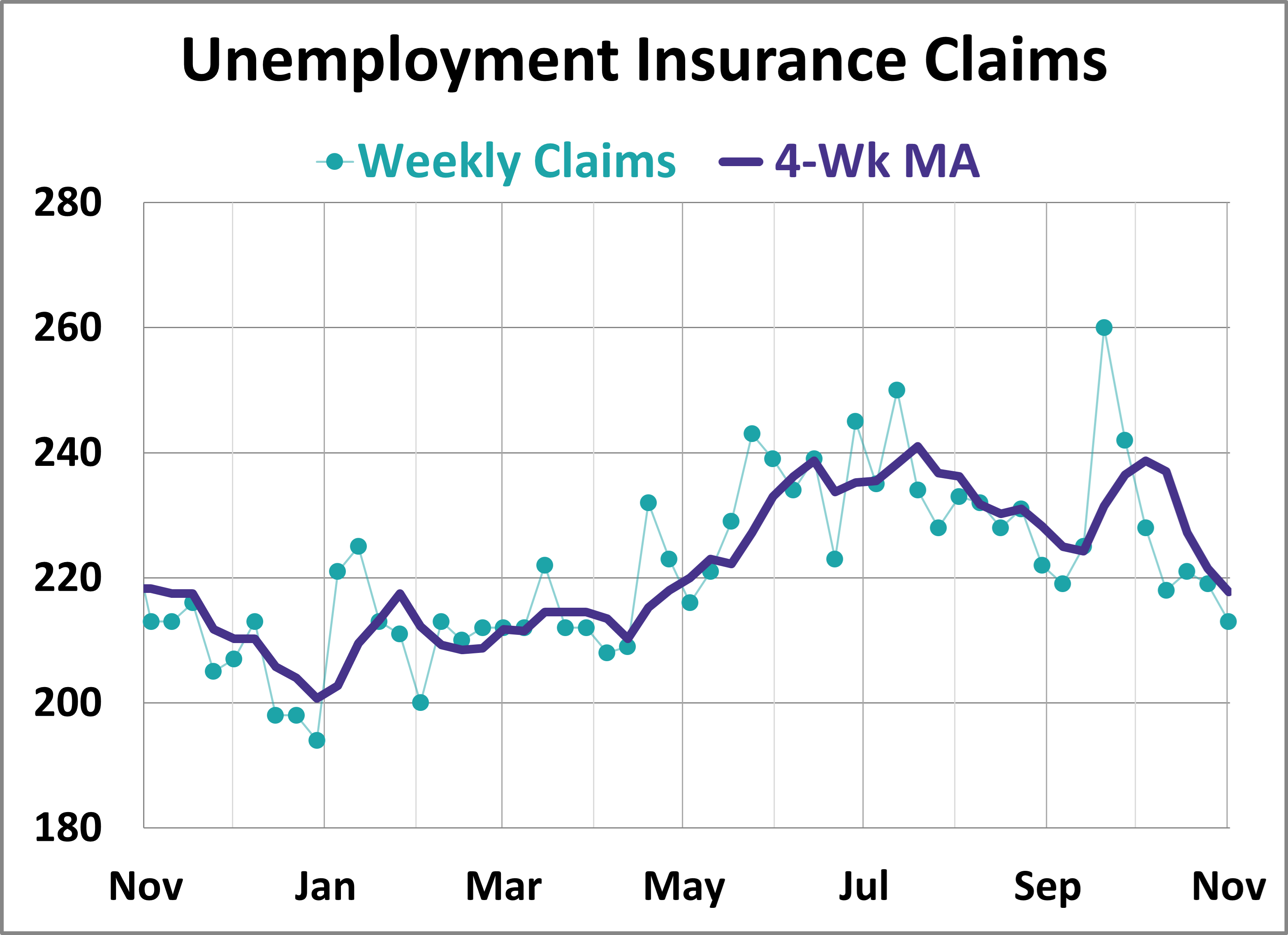

US Continuing Jobless Claims Rise To 3-Year High. Time To Worry?

The ongoing rise in continuing claims looks worrisome, but initial claims are telling a considerably more upbeat story. Which one’s the better measure? The positive spin via initial claims is probably the superior metric for assessing the near-term outlook for payrolls and, by extension, the economy. But let’s dig into this view for some perspective before signing off on the idea entirely.

Macro Briefing: 22 November 2024

US jobless claims fall to the lowest level since April. “The weekly claims report remains the best real-time monitor of labor market conditions,” Jefferies US economist Thomas Simons writes in a research note. “Right now, the data show that the labor market is trending sideways at a healthy level.”

Is The Relatively Weak Trend For US Private Payrolls A Warning?

If you could only track one economic indicator to monitor the economy the trend in payrolls would be a solid choice. Think of it as the fuel that powers consumer spending engine, which accounts for nearly 70% of economic activity. The good news is that the labor market still looks solid, based on several conventional metrics. But an alternative indicator your editor is watching introduces a degree of doubt about what may be in store for 2025.

Macro Briefing: 21 November 2024

Business inflation expectations in November remained “relatively unchanged at 2.2%, on average, according to the Atlanta Fed. The bank’s latest poll shows inflation expectations holding near the lowest level in 3-1/2 years.