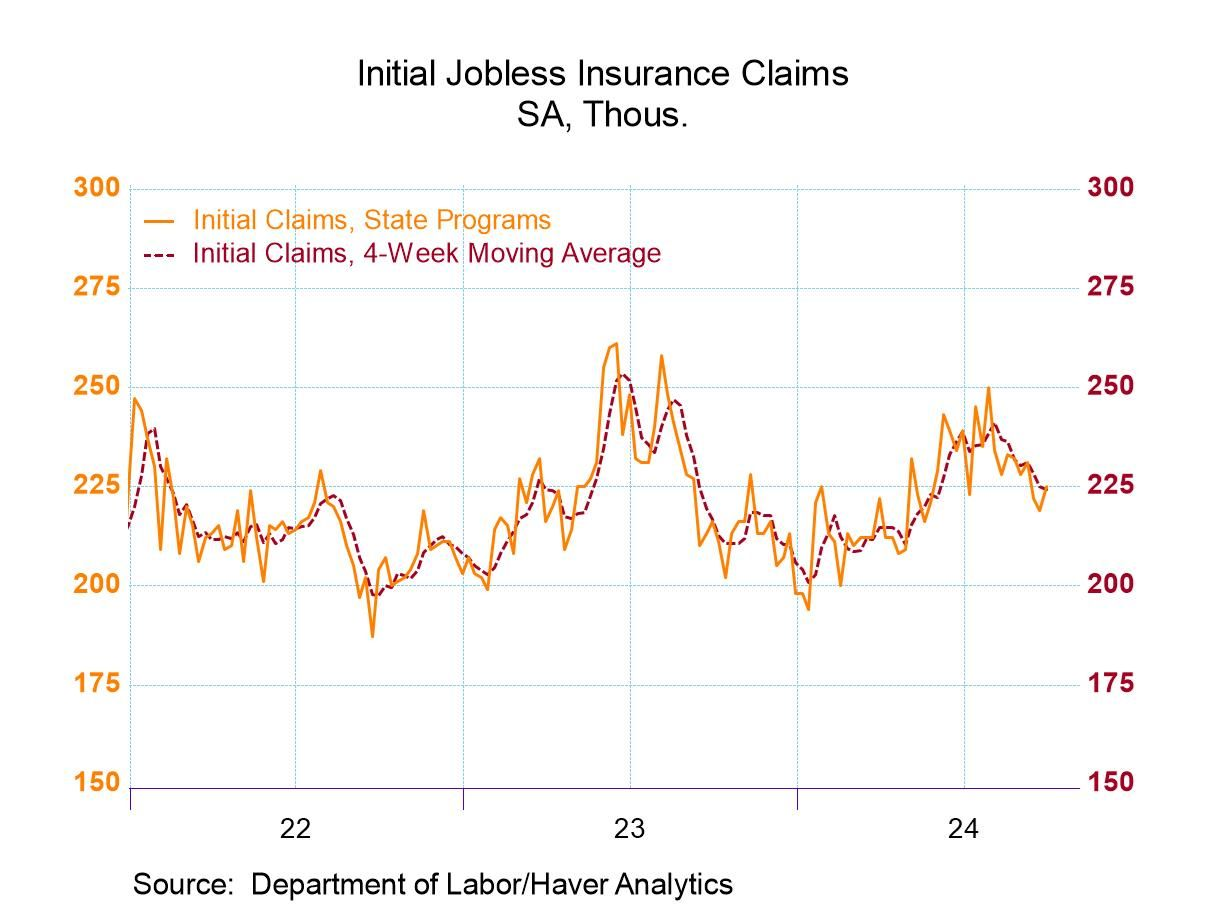

US jobless claims rose last week, but the number of new filings for unemployment benefits remains low relative to history. The 4-week average, which reduces some of the week-to-week noise, continues to trend lower. “For the moment, the labor market looks steady as a rock and the economy appears to have missed falling headlong over the cliff into the depths of recession,” says Christopher Rupkey, chief economist at FWDBONDS.

Monthly Archives: October 2024

Momentum, Large-Cap Growth Factors Still Leading This Year

Betting against momentum and large-cap growth continues to be a losing proposition, at least in relative terms, for positioning US equity portfolios in 2024, based on a set of factor ETFs. These risk premia have dominated for much of the year and it’s not obvious that the trend is set to change, based on trading through Oct. 2.

Macro Briefing: 3 October 2024

Hiring at US companies rebounded in September, according to the ADP Employment Report. “Job creation showed a widespread rebound after a five-month slowdown,” notes ADP Research. “Only one sector, information, lost jobs. Manufacturing added jobs for the first time since April.”

Total Return Forecasts: Major Asset Classes | 02 October 2024

The long-term performance forecast for the Global Market Index (GMI) continued to edge lower in September. Today’s revised estimate marks the third straight month of decline for GMI, an unmanaged benchmark that holds all the major asset classes (except cash) according to market weights via a set of ETF proxies.

Macro Briefing: 2 October 2024

Israel plans a “significant retaliation” to Tuesday’s massive missile attack from Iran that threatens to shift the Middle East to a regionwide war. “A full-scale war, or even a more limited one, could be devastating for Lebanon, Israel, and the region,” says Jonathan Panikoff, the director of the Scowcroft Middle East Security Initiative at the Atlantic Council.

Major Asset Classes | September 2024 | Performance Review

Emerging-markets stocks surged in September, delivering the lead performance for the major asset classes, based on a set of ETFs. Real estate shares were also strong performers last month, extending recent strength for these stocks. Commodities, once again, were the downside outlier.

Macro Briefing: 1 October 2024

Israel launches ground war into Lebanon. The incursion is a “limited, localized and targeted ground raids” against Hezbollah targets in southern Lebanon, the Israeli military said in a statement.

Dockworkers at ports from Maine to Gulf coast go on strike. AP reports: “Supply chain experts say consumers won’t see an immediate impact from the strike because most retailers stocked up on goods, moving ahead shipments of holiday gift items. But if it goes more than a few weeks, a work stoppage would significantly snarl the nation’s supply chain, potentially leading to higher prices and delays in goods reaching households and businesses.”

The US stock market rose on Monday, setting a new record closing price, based on the S&P 500 Index: “Everything is about the growth side of the economy, and everything is about the consumer,” says Stuart Kaiser, Citi head of US equity trading strategy. “Any data that suggests consumer spending is holding in and you’re not seeing the weakness that people are worried that the Fed is worried about, I think that’s all going to be positive for equity markets.”