A second Trump administration would radically change the dynamics of world trade, The Wall Street Journal reports. The former president says if elected he would implement higher trade tariffs — tariffs that may reach their highest level since the 1930s. In that case, the change would sharply reverse decades of policy adjustments that favored a free-trade bias in the world economy.

Monthly Archives: October 2024

Tracking The Current US Business Cycle In Four Charts

The US economy continues to defy the recession forecasts that received much attention in the summer. The primary drivers of the economic resilience: strong growth in payrolls and consumer spending. By contrast, industrial production, after a strong start once the pandemic recession ended, has faltered recently. Meanwhile, the revival of personal income has suffered one of its weakest runs during economic expansions since 1970.

Macro Briefing: 16 October 2024

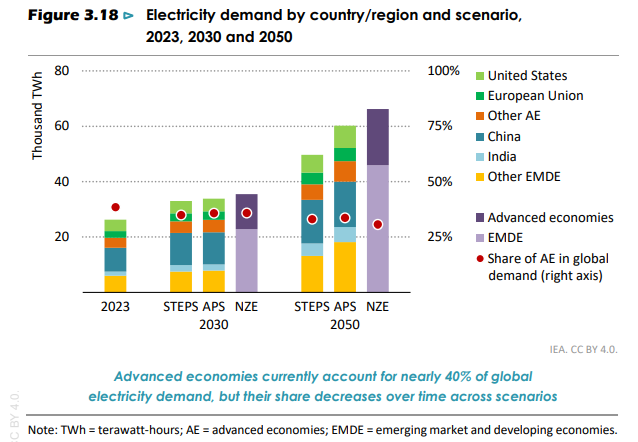

Electricity demand in the world is expected to increase much faster than overall energy demand over the next decade, predicts the IMF in the agency’s annual World Energy Outlook. Factors that are driving up demand include the rise of electric vehicles, air-conditioners and data centers.

Despite A Robust US Economy, Markets Still Pricing In Rate Cuts

Fears of a US recession in the near term have faded recently, but rate cuts are still on the agenda. The combination of a robust economy and expectations for monetary easing strike some observers as misguided, but Federal Reserve Governor Christopher Waller on Monday explained that the central bank is still anticipating that more easing is likely. The concession to the firmer economic data of late: the cuts will be softer, he noted. But if hawks looking for a sign that cuts were off the table, they were disappointed in Waller’s speech at Stanford University yesterday.

Macro Briefing: 15 October 2024

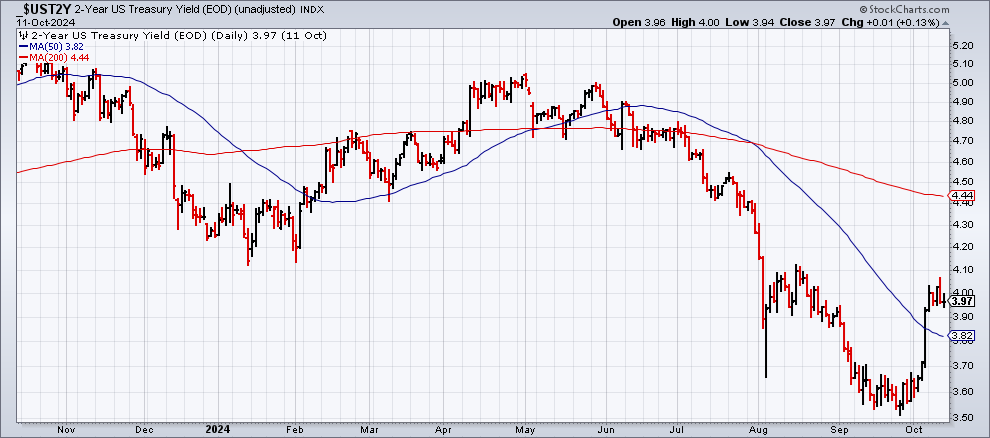

Interest rate cuts going forward will be less aggressive, says Federal Reserve Governor Christopher Waller. Referring to recent economic reports, he advises that “the data is signaling that the economy may not be slowing as much as desired… While we do not want to overreact to this data or look through it, I view the totality of the data as saying monetary policy should proceed with more caution on the pace of rate cuts than was needed at the September meeting.” Meanwhile, the policy-sensitive US 2-year Treasury yield continues to trade around the 4% mark:

2024 Shaping Up As A Bumper Year For Most Asset Classes

Generating solid returns with a globally diversified portfolio strategy has been a breeze this year. Short of making extreme bets in the handful of losers among the major asset classes, the tail wind of beta has otherwise been kind – especially for US-oriented strategies.

Macro Briefing: 14 October 2024

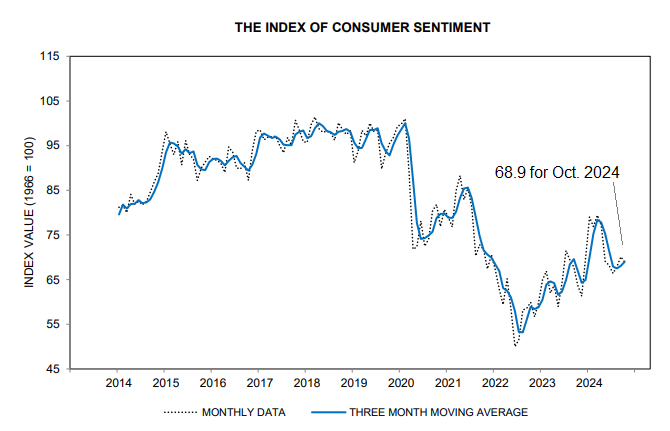

High cost of living weighs on US consumer sentiment in October. “Despite strong labor markets, high prices and inflation remain at the top of consumers’ minds,” notes Joanne Hsu, director of the University of Michigan’s Consumer Sentiment survey, in a statement. “Sentiment is currently 8% stronger than a year ago and almost 40% above the trough reached in June 2022. While inflation expectations have eased substantially since then, consumers continue to express frustration over high prices.”

Continue reading

Continue reading

Book Bits: 12 October 2024

● The Hidden Globe: How Wealth Hacks the World

● The Hidden Globe: How Wealth Hacks the World

Atossa Araxia Abrahamian

Review via The New York Times

The rise and spread of these “extraterritorial domains” is the subject of Atossa Araxia Abrahamian’s new book, “The Hidden Globe: How Wealth Hacks the World.” Abrahamian, a journalist who grew up in Geneva, a city rife with enclaves “bound by some Swiss laws, but immune from others,” traces the development of such zones, talking to some of the people who made them happen, including a few who regret their role in helping countries excise pieces of themselves in the name of allowing the already privileged to become even wealthier.

10-Year US Treasury Yield ‘Fair Value’ Estimate: 11 October 2024

The market premium for the US 10-year yield over a “fair value” estimate calculated by CapitalSpectator.com continued to narrow in September. The smaller spread extends a downside trend in recent months following a period of an extremely high market premium vs. the fair value, which is drawn from the average of three models.

Macro Briefing: 11 October 2024

US consumer inflation’s one-year trend slowed again in September, but the core rate rose. The mixed data suggests that disinflation may slow or pause in the months ahead. “September’s CPI report has good news and bad news for the Fed,” Eugenio Aleman, Raymond James’ chief economist, wrote in a note. Citing the softer housing component in the inflation report, which slowed to its lowest annual rate since February 2022, he advises: “The good news is that shelter costs slowed down to 0.2%, month-on-month, and 4.9%, year-over-year. However, it also showed that there are still plenty of upside risks for inflation going forward.” The “shelter” category accounts for more than one-third of the overall CPI.