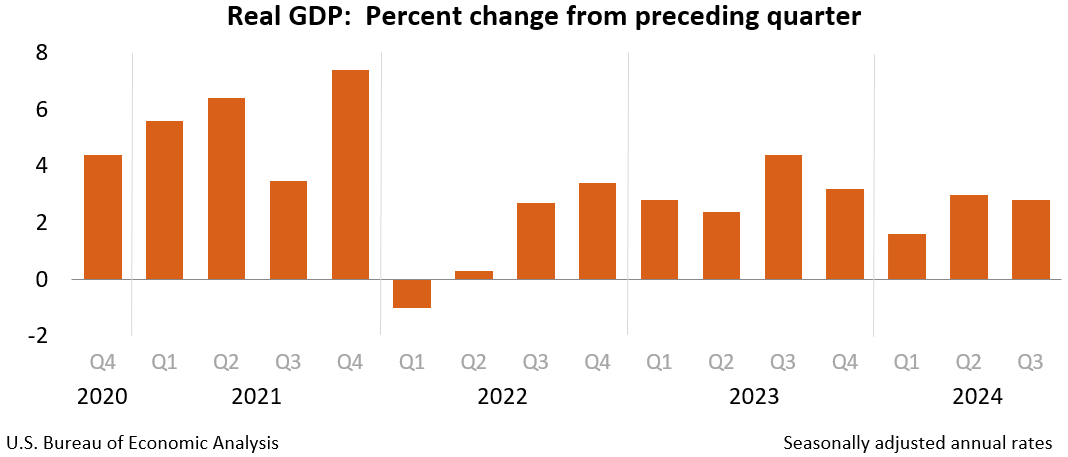

What a long, strange trip it’s been for some analysts since the summer of recession forecasts turned into yesterday’s robust 2.8% rise in third-quarter GDP. A key driver of Q3’s advance: higher consumer spending, which accounts for roughly two-thirds of GDP. Personal consumption expenditures increased 3.7% in Q3, a robust pickup from Q2’s 2.8%.

Monthly Archives: October 2024

Macro Briefing: 31 October 2024

US GDP rose 2.8% in the third quarter–a solid increase but slightly below expectations. The gain marks a slowdown from Q2’s strong 3.0% increase. A key driver of Q3’s advance: higher consumer spending, which accounts for roughly two-thirds of GDP. Personal consumption expenditures increased 3.7% in Q3, a robust pickup from Q2’s 2.8%.

Momentum, Large-Cap Growth Factors Still Top US Returns In 2024

In the competition for 2024 calendar performance there’s no competition. Momentum and large-cap growth factors continue to outperform the rest of the field by a wide margin, based on a set of ETFs through Tuesday’s close (Oct. 29).

Macro Briefing: 30 October 2024

US job openings fell in September to the lowest level since January 2021. “The low level of quits is consistent with a decline in the availability of employment opportunities,” writes Oxford Economics lead US economist Nancy Vanden Houten. “The steady decline in the quits rate is consistent with wage growth continuing to slow and easing the inflationary impulse from the labor market.”

Is The Prospect For Another Fed Rate Cut Fading?

The backup in Treasury yields may be a warning sign that the odds are slipping that the Federal Reserve will cut interest rates again at the next policy meeting on Nov. 7.

Macro Briefing: 29 October 2024

US 10-year Treasury yield rose to 4.29% on Monday, the highest since July. “If the economic data this week [especially Friday’s jobs report] is strong, then expectations for a November rate cut will fall, potentially hard, and that could inject some volatility into markets. Bottom line, Goldilocks data is important this week to keep rate cut expectations stable,” says Tom Essaye, founder of Sevens Report Research.

Busy Week Of Economic Reports Scheduled Ahead Of The Election

The last full week ahead of the US election is jam-packed with key economic reports. As a result, the potential for surprises that could sway voters is in high gear in the days to come. Here’s a quick rundown of the key releases this week.

Macro Briefing: 28 October 2024

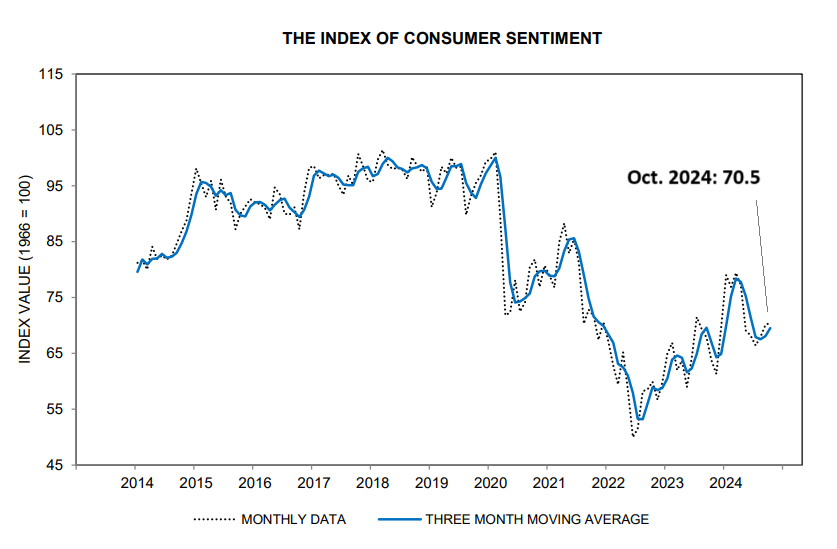

US consumer sentiment strengthened for a third straight month in October, according to survey data published by the University of Michigan. The school’s widely-read sentiment index edged higher this month to its highest reading since April. “This month’s increase was primarily due to modest improvements in buying conditions for durables, in part due to easing interest rates,” reports Joanne Hsu, surveys of consumers director at the university.

On The Road Again…

The Capital Spectator is traveling for next several days. The usual schedule resumes on Monday, Oct. 28. Cheers!

Macro Briefing: 24 October 2024

US existing home sales fell to a 14-year low in September. “The factors that would drive higher home sales —- such as mortgage rates meaningfully lower now compared to one year ago, inventory beginning to increase and, of course, jobs continuously being added to the economy —- and yet home sales are stuck at low levels,” says Lawrence Yun, the chief economist at the National Association of Realtors. In sharp contrast, sales of new homes has been trending higher in recent years.