US household income rebounded in 2023, posting the first annual increase since the pandemic, according to new data published by the Census Bureau. Inflation-adjusted median household income rose 4% to $80,610 in 2023 vs. $77,540 in the 2022. Despite the statistical improvement, “For many households, they still don’t feel it,” says Beth Ann Bovino, chief economist at US Bank, in a reference to the lingering effects of inflation that spiked in 2022 but has been sliding ever since. While income rose in 2023, so did the poverty rate, which increased for a second year after pandemic aid provided by the government expired. The share of Americans living in poverty (defined by the Census Bureau) rose to 12.9% last year, up from 12.4 percent in 2022.

Monthly Archives: September 2024

US Core Consumer Inflation Trend Set To Hold Steady In August

Tomorrow’s update on US consumer inflation for August isn’t expected to derail expectations that the Federal Reserve will cut interest rates next week, but the disinflation trend of late looks set to stall. The estimate is based on CapitalSpectator.com’s ensemble model for the year-over-year change in core CPI.

Macro Briefing: 10 September 2024

The threat of a US government shutdown on Sep. 30 is in focus after House Republicans unveiled a spending plan that’s expected to be a non-starter with Democrats. Even if the GOP bill passes the House, it will likely fail in the Democratic-led Senate. The odds of that the House will approve the legislation, however, are looking shaky.

Consumer inflation expectations are “largely stable” in August, reports the New York Federal Reserve. The median one-year ahead inflation outlook is unchanged at 3.0%, according to the latest survey by the regional Fed bank.

US Stocks Continue To Top Global Markets In 2024

American shares suffered their deepest weekly decline in more than a year last week, but the setback wasn’t enough to dethrone US stocks as the world’s top-performing asset class in 2024. Based on a set of ETFs tracks the major asset classes through Friday’s close (Sep. 6), US equities are still leading the field by a wide margin.

Macro Briefing: 9 September 2024

US payrolls rebounded in August, but the 142,000 increase in new jobs was less than forecast. “The labor market is cooling at a measured pace,” notes Jeffrey Roach, chief economist at LPL Financial. “Businesses are still adding to payrolls but not as indiscriminately. The Fed will likely cut by 25 basis points and reserve the right to be more aggressive in the last two meetings of the year.” The unemployment rate dipped to 4.2% from 4.3% previously. Although that’s modest relative to the history, the recent increase has triggered recession warnings, according to some analysts. “The increased unemployment rate is in a range where we have historically been in recessions,” says economist Claudia Sahm. “But that’s a history, that’s a past. We’re not in a recession right now, but we do have a weakening labor market.”

Book Bits: 7 September 2024

● The Greatest of All Plagues: How Economic Inequality Shaped Political Thought from Plato to Marx

● The Greatest of All Plagues: How Economic Inequality Shaped Political Thought from Plato to Marx

David Lay Williams

Summary via publisher (Princeton U. Press)

Economic inequality is one of the most daunting challenges of our time, with public debate often turning to questions of whether it is an inevitable outcome of economic systems and what, if anything, can be done about it. But why, exactly, should inequality worry us? The Greatest of All Plagues demonstrates that this underlying question has been a central preoccupation of some of the most eminent political thinkers of the Western intellectual tradition.

Research Review | 6 September 2024 | Portfolio Risk Management

Semivolatility-managed portfolios

Daniel Batista da Silva (U. of Geneva) and M. Fernandes (Getulio Vargas Fnd.)

July 2024

There is ample evidence that volatility management helps improve the risk-adjusted performance of momentum portfolios. However, it is less clear that it works for other factors and anomaly portfolios. We show that controlling by the upside and downside components of volatility yields more robust risk-adjusted performances across a broad set of factors and anomaly portfolios, as well as exchange-traded funds. In particular, we propose semivolatility-managed portfolios that, apart from deleveraging when downside volatility is high, also exploit the higher expected returns in times of good volatility. We find that our semivolatility-managed portfolios that control for both skewness and downside volatility perform better than the original portfolios and extant (semi)volatility management proposals.

Macro Briefing: 6 September 2024

US hiring at companies slowed again in August, dipping to a rise of 99,000 over the previous month, according to the ADP Employment Report. The downshift marks the softest pace since January 2021. “The job market’s downward drift brought us to slower-than-normal hiring after two years of outsized growth,” says Nela Richardson, chief economist, ADP. “The next indicator to watch is wage growth, which is stabilizing after a dramatic post-pandemic slowdown.”

Will Friday’s Jobs Report Alter The Upbeat Q3 GDP Nowcast?

The current lineup of US GDP nowcasts for the third quarter continue to indicate a softer but still solid growth rate. Wall Street is wondering if the upcoming payrolls report for August will change the calculus.

Macro Briefing: 5 September 2024

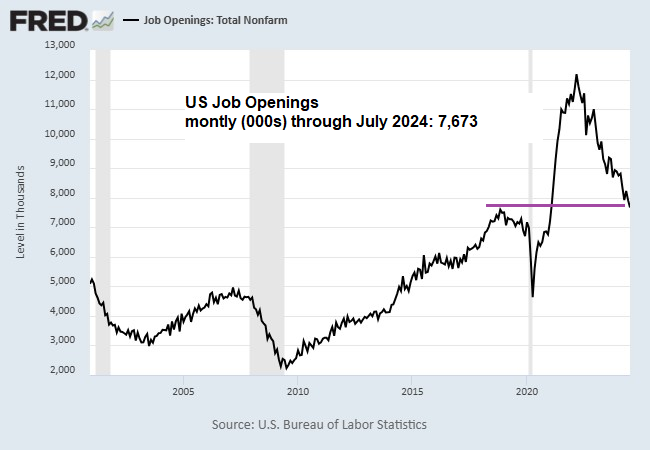

US job openings in July fell to the lowest level since January 2021, the Labor Department reports. The slide highlights concerns that the labor market’s recent slowdown will continue. The report also strengthens the view that the Federal Reserve will cut interest rates at next week’s policy meeting (Sep. 18). “The labor market is no longer cooling down to its pre-pandemic temperature, it’s dropped past it,” says Nick Bunker, head of economic research at the Indeed Hiring Lab. “Nobody, and certainly not policymakers at the Federal Reserve, should want the labor market to get any cooler at this point.”