The beginning of the end for the current run of peak yields looks set to start tomorrow (Wed., Sep. 18) as the Federal Reserve is expected to roll out its first interest rate cut. On the eve of regime shift it’s timely to take stock of where we are with trailing payout rates across the major asset classes, based on a set of ETFs.

Monthly Archives: September 2024

Macro Briefing: 17 September 2024

US economy is at an “important turning point,” says the top economic advisor in the White House. “Inflation is now back down close to pre-pandemic levels, and that means the focus needs to be on safeguarding the gains — the important gains — we’ve made in the labor market,” observes White House National Economic Advisor Lael Brainard.

New York Fed Manufacturing Index indicates a strong rebound in business activity for September. “Business activity grew in New York State for the first time in nearly a year, according to firms responding to the September 2024 Empire State Manufacturing Survey,” the bank reports. “New orders climbed, and shipments grew significantly.”

Bond Market Enjoys Solid Tailwind Ahead Of Fed Meeting

The Federal Reserve is expected to cut interest rates this week. The question is whether the bond market has fully priced in the start of policy easing?

Macro Briefing: 16 September 2024

A busy week of central bank decisions awaits in the days ahead, including the Federal Reserve’s expected announcement of a rate cut on Wed., Sep. 18. Central banks in Brazil, England, Norway and South Africa are also set to hold policy meetings this week. “We’re entering a cutting phase,” says John Bilton, global head of multi-asset strategy at JP Morgan Asset Management.

The US 10-year Treasury yield closed last week at 3.66%, near the lowest level since June 2023. The recent slide in the benchmark rate comes amid the consensus view that the Federal Reserve will cut interest rates on Wednesday (Sep. 18). Fed funds futures are estimating a coin toss between a 1/4-point vs. a 1/2-point reduction in the target rate.

Book Bits: 14 September 2024

● Punishing Putin: Inside the Global Economic War to Bring Down Russia

● Punishing Putin: Inside the Global Economic War to Bring Down Russia

Stephanie Baker

Interview with author via Marketplace.org

Since the invasion of Ukraine, Russia has been cut off from much of the global economy, with over 20,000 sanctions and other restrictions in place, according to Stephanie Baker, an investigative reporter at Bloomberg News. Companies like McDonald’s and Starbucks have pulled out. A coalition of countries have agreed to a price cap for Russian oil in the hopes of reducing the country’s energy revenue. Never before has an economy the size of Russia’s been targeted by so many sanctions, but are those sanctions working? Baker, author of the new book “Punishing Putin: Inside the Global Economic War to Bring Down Russia,” says it depends on your definition of success.

US Q3 GDP Data Still Expected To Post Solid Growth

Today’s revised estimate of US economic activity for the upcoming third-quarter GDP report continues to point to a slower-but-still solid growth rate, based on the median nowcast for several estimates compiled by CapitalSpectator.com.

Macro Briefing: 13 September 2024

US jobless claims edged higher last week but remain at a middling level compared with the range over the past two years. This leading indicator continues to reflect a relatively upbeat outlook for the labor market. “After some noise earlier in the summer, initial jobless claims have settled into a tight range over the last several weeks,” says Nancy Vanden Houten, lead US economist at Oxford Economics. On a longer-term basis, claims layoffs remain near historically low levels.

10-Year US Treasury Yield ‘Fair Value’ Estimate: 12 September 2024

The premium for the US 10-year Treasury yield continued to fall in August relative to the “fair value” estimate based on a model developed by CapitalSpectator.com. The market rate remains moderately above the model’s estimate, but as expected in previous months (see the analysis from March, for instance) the unusually high premium is finally starting to normalize.

Macro Briefing: 12 September 2024

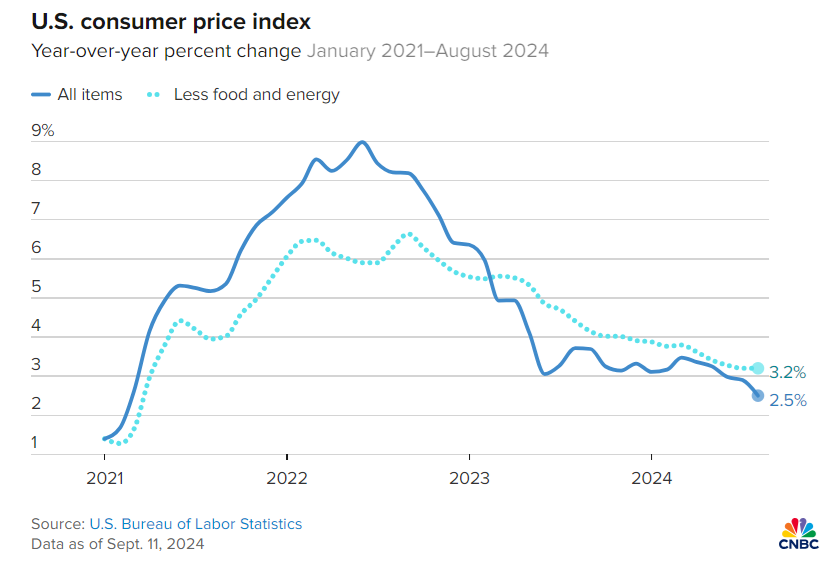

US consumer price inflation at the headline level eased to a 2.5% year-over-year pace in August, the slowest in 3-1/2 years. Core CPI, however, remained sticky at 3.2%, unchanged from the previous month. “This isn’t the CPI report the market wanted to see. With core inflation coming in higher than expected, the Fed’s path to a 50 basis point cut has become more complicated,” says Seema Shah, chief global strategist at Principal Asset Management. Sarah House, senior economist at Wells Fargo, advises: “Inflation continues to decelerate on tend, but we’re seeing it take longer for some of the impact of the pandemic to fully unwind.”

Utilities Stocks Are Now Top-Performing US Equity Sector In 2024

Market sentiment has recently shifted to prioritize defensive equity sectors. The attitude adjustment has lifted utilities shares, which are now outperforming the rest of the field as the top-performer, based on a set of sector ETFs through Tuesday’s close (Sep. 10).